U.S. mega-caps have become increasingly important in driving equity returns in recent years amid outperformance from some of the largest companies. Given the elevated importance of U.S. mega-caps in recent years, this paper provides an overview of the S&P 500 Top 50®, which seeks to measure the performance of mega-cap U.S. equities by selecting the largest 50 companies in the S&P 500, annually. Specifically, this paper:

• Highlights the potential relevance of U.S. mega-caps;

• Outlines the S&P 500 Top 50's construction, and analyzes the index's historical risk/return characteristics, and;

• Shows how incorporating U.S. mega-caps could help investors alleviate domestic sector biases.

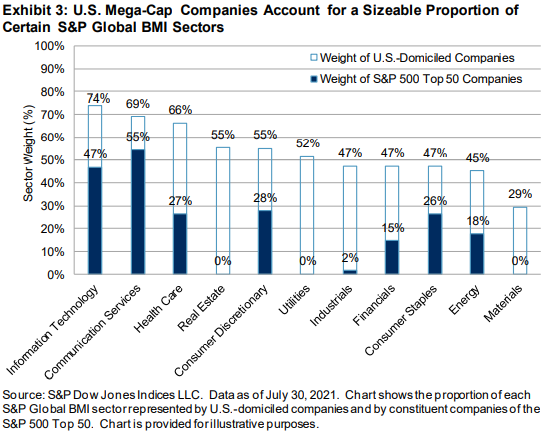

Exhibit 1 shows that S&P 500 Top 50 constituents accounted for around 45% of the U.S. equity market, as represented by the S&P Total Market Index (TMI), at the end of July 2021. This figure ranked in the top 5% of month-end readings since June 2005 and was far above the long-term average of 40%.

POTENTIAL RELEVANCE OF U.S. MEGA-CAP COMPANIES TO GLOBAL INVESTORS

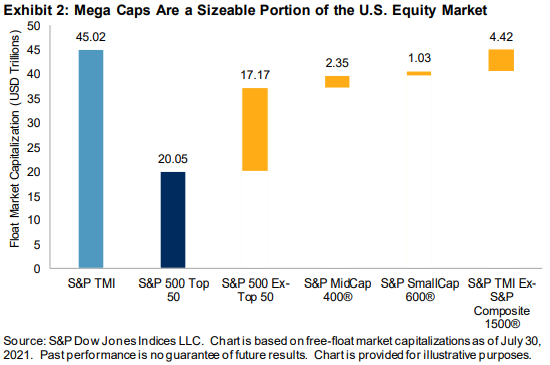

The breadth and depth of the U.S. equity market means that trends affecting U.S. companies will be relatively important in driving global equity returns. For example, U.S.-domiciled companies accounted for 57% of the weight of the S&P Global BMI as of July 30, 2021, nearly 8.5 times larger than the index's second-largest country, Japan.

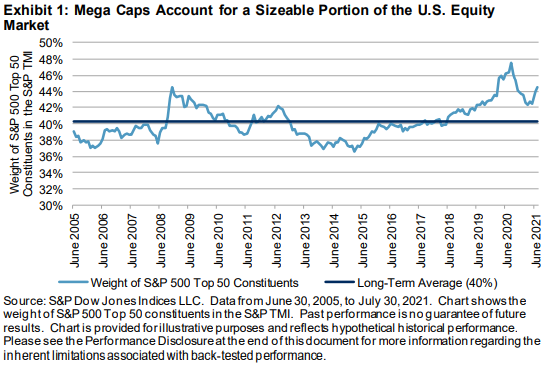

Exhibit 1 showed that mega-cap companies represent a sizeable portion of the U.S. equity market. Exhibit 2 reinforces this point by comparing the float market capitalization of the S&P TMI and its component indices, as of July 30, 2021. While smaller U.S. equity indices are as large as certain S&P Global BMI countries, S&P 500 Top 50 constituents are an order of magnitude larger.

Perhaps unsurprisingly, U.S. mega-cap companies can have an outsized impact on global equity returns and measuring their performance may help to identify prevailing market narratives. This is especially the case for certain global equity sectors: Exhibit 3 shows that U.S. companies account for the majority of the float market capitalization in most S&P Global BMI sectors, and U.S. mega-cap companies account for a sizeable proportion of this weight.