Volatility-controlled indices (VCIs) are widely used crediting options within index-linked annuities and life insurance products. However, the nomenclature sounds more complex than what the indices aim to achieve.

Here we will demystify what VCIs are, their general mechanics, and the potential benefits they provide to the insurance ecosystem.

What Is a Volatility-Controlled Index?

A VCI is one that is designed to manage to a target volatility level, typically measured by the realized volatility of the underlying index.

The most common components of a VCI are an equity component and a theoretical cash component. While equity indices seem to be the most frequently used indices in the insurance industry, multi-asset indices, such as the S&P MARC 5% Index, have also increased in usage in recent years.

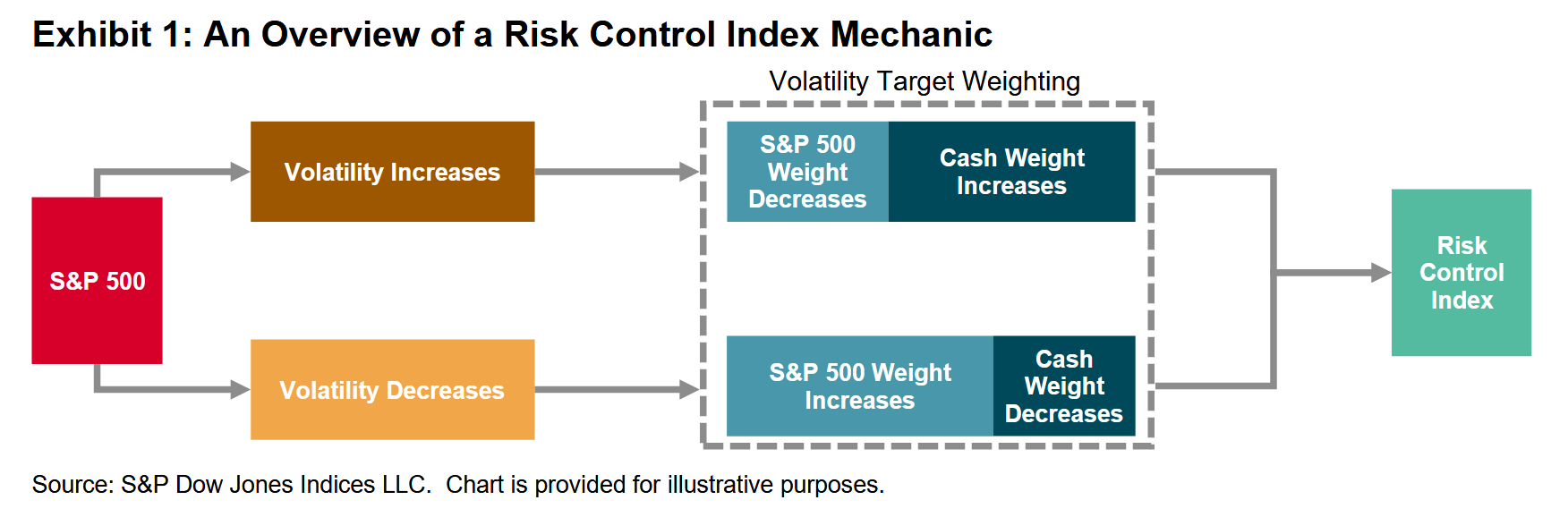

As a general principle, when market volatility is higher than the target volatility level of the index, the index will allocate away from equity to the cash component to dampen volatility. On the other hand, when market volatility is lower than the target, the index may allocate more than 100% weight to the underlying index component. Allocation in a VCI context refers to the weight attributed to each asset class (as previously mentioned, most commonly an equity component and a theoretical cash component) in the index.

The ability to either move index component weighting to cash or increase exposure above 100% helps the index as it seeks to maintain a target volatility level.

What Are the Potential Benefits of VCIs?

- Increased Stability: When an index is managed to a volatility target, it typically realizes a more consistent volatility level than an index without a risk overlay.

- Simplicity: A volatility-controlled index provides a simple, transparent methodology based on the underlying index’s historical volatility.

- Hedging Efficiencies: The more stable volatility experience may improve hedging efficiencies for insurance products based on the index, which may in turn lead to cost savings.

It is important to note that certain potential benefits of VCIs work in tandem with the specific features of insurance products, which are entirely within the control of the insurance carrier.

Insurance carriers may consider the combination of a VCI and the insurance product implementing to look to provide an improved outcome for the carrier’s customers.