Introduction

Commodities have largely remained outside the purview of environmental investment frameworks, creating a gap in investing across all asset classes. The global investment landscape is witnessing a transformative shift toward sustainability, in part driven by increasing awareness of the environmental impact of commodity production and the clean energy transition. According to the latest S&P GSCI® world production average, over 25 billion barrels of oil are produced each year. Combining that with the S&P Global Trucost estimate that one barrel of oil produces over 400 kilograms of CO2 equivalent (kgCO2e), the total carbon emissions for oil are over 10 trillion kgCO2e.

Investors in commodities primarily access the market through derivatives, such as oil futures. These derivatives serve as vital tools for commodity producers, consumers and investors. This paper explores how index-based commodity investing could be seen through a sustainable investing lens and examines the challenges and opportunities in integrating environmental considerations across asset classes. It also delves into the role of commodity derivatives in financial markets and outlines a framework for carbon accounting to measure environmental impact. Additionally, it highlights how the S&P Global Commodity Environmental dataset can be leveraged to measure carbon intensity for commodity indices.

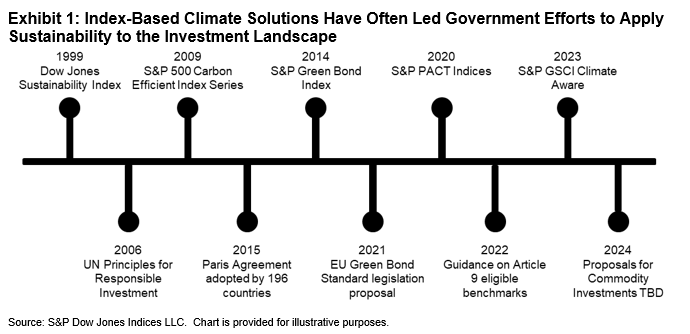

Finally, this paper highlights the significance of benchmarks for environmental investing, offering an introduction to the S&P GSCI Climate Aware as a forward-thinking approach to climate-focused commodity investments. The S&P GSCI Climate Aware is a prominent example in the past quarter century of incorporating environmental, social and governance (ESG) considerations into leading benchmarks before policy makers and regulators adopt similar rules into investment practices (see Exhibit 1).

Looking at Commodities through a Sustainable Investing Lens

The paradox in sustainable commodity investing lies in the fact that while there are extensive proposals affecting sustainable investments in stocks and bonds, commodities—one of the largest contributors to environmental degradation—remain largely untouched. Governments around the world have introduced several regulatory measures to enhance sustainable investing practices, but the scope of these regulations has mainly focused on equity and fixed income investment products. The European Union (EU) has led the march toward transparency and accountability for investors, asset managers and companies.

Commodity production and consumption is considered one of the leading causes of environmental degradation. While the physical production of a commodity can have a direct impact on the environment, investing in commodity derivatives could be viewed in the same light as investing in equities and bonds. Buying stock in a company that emits carbon isn’t the same as emitting the carbon oneself, but there is an association. While such a throughline exists for stocks and bonds, financial instruments associated with commodities, like commodity derivatives, are not subject to specific sustainability regulations. We will discuss two elements used to create sustainability metrics in a commodity index. First, we look at the use of transparent data to measure the impact of commodity production, and second, the connection with the physical production of commodities and the financial instruments that support the commodities market.