Hard currency emerging market (EM) bonds present market participants with access to distinct sources of credit beyond developed economies. EM country risk is distinct and has historically been associated with relatively higher yields. The USD Liquid EM Sovg & Sub-Sovg serves as a focused benchmark for the hard currency EM credit market, offering a transparent and replicable measure (please see the Appendix at the end of this document for a guide to the abbreviated index names). The index measures the performance of USD-denominated sovereign and sub-sovereign liquid bonds issued by emerging market economies.

The USD Liquid EM Sovg & Sub-Sovg combines broad market representation with stringent liquidity criteria, effectively balancing the spectrum of benchmark tracking and liquid replicability. Bonds must have a minimum amount outstanding of USD 1 billion and a remaining time to maturity of at least one year at the rebalancing date. The index uses a unique capping methodology based on the number of countries represented in the composition. The average country weight is defined as 1 divided by the number of countries in the index. Weight-based capping is applied as 3 times the average country weight, rounded to the nearest 2.5%. Detailed methodology rules can be found here. This capping is applied to prevent overweighting one country of risk over the others to maximize returns, while reflecting the most liquid securities in the market.

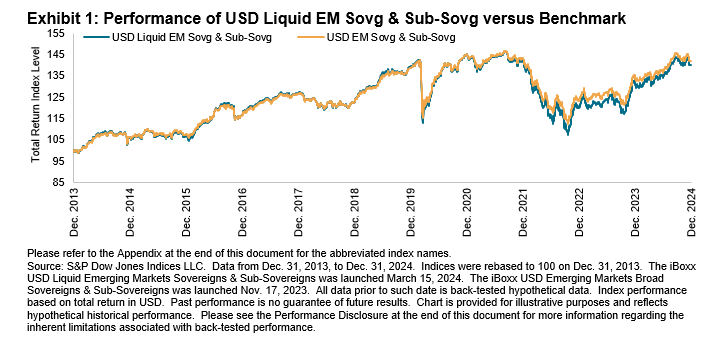

A performance comparison illustrates how closely the USD Liquid EM Sovg & Sub-Sovg tracks a similar broad-based benchmark, the USD EM Sovg & Sub-Sovg. From Dec. 31, 2013, to Dec. 31, 2024, the correlation between the USD Liquid EM Sovg & Sub-Sovg and the benchmark was 99.12%, while the five-year correlation reached an even higher 99.68%. These figures underscore the USD Liquid EM Sovg & Sub-Sovg’s historical ability to reflect overall market trends.

Further analysis shows the consistency of risk analytics between the liquid and benchmark indices. Duration, yield and spread were only 0.7 years, 0.1% and 16 bps, respectively, while the number of bonds in the liquid index was reduced by nearly half (-419 bonds) and the amount outstanding decreased by approximately USD 388 billion.