Introduction

Systematic factor investing has been widely adopted by both institutional and individual market participants, especially after the Global Financial Crisis of 2007-2008. This investment approach seeks to provide systematic exposure to various risk factors, such as quality, momentum, growth, value, dividend, low volatility and size. By leveraging these factors, market participants seek to achieve more diversified portfolios in order to enhance overall risk-adjusted returns over the long term.

When considering factor investing, however, it is important to recognize that empirical evidence indicates that the performance can vary significantly depending on the prevailing economic environment. In this paper, we examine the influence of different economic regimes—characterized by levels of economic growth and inflation—on the performance of various S&P 500® Factor Indices. Our findings may offer valuable insights for market participants interested in allocating to factor investments.

Macroeconomic Framework

To examine performance across different economic regimes, we must first establish a framework to categorize them. Our framework creates four possible regimes based on two key metrics: growth and inflation. To minimize the influence of noisy data, these economic conditions must persist for a minimum of three months before they are recognized as a regime.

The Growth Regime

The growth regime, whether rising or falling, is assessed by analyzing the month-to-month change in the U.S. Composite Leading Indicator (CLI). Developed by the Organization for Economic Co-operation and Development (OECD), the CLI is an index that provides early indications of turning points in business cycles, reflecting the fluctuations in economic activity around its long-term potential level. This indicator is measured as an amplitude-adjusted index with a long-term average value of 100.

A positive monthly change in the CLI compared to the previous month indicates that the CLI is increasing, suggesting that the economy grew over that month. Conversely, a negative change indicates a decline in economic growth.

The Inflation Regime

The inflation regime, categorized as either rising or falling, is determined by comparing the three-month average of the all-items U.S. Consumer Price Index (CPI) with the three-year moving average. If the three-month average exceeds the three-year average, it indicates rising inflation; if it falls below, it suggests falling inflation.

Four Macroeconomic Regimes

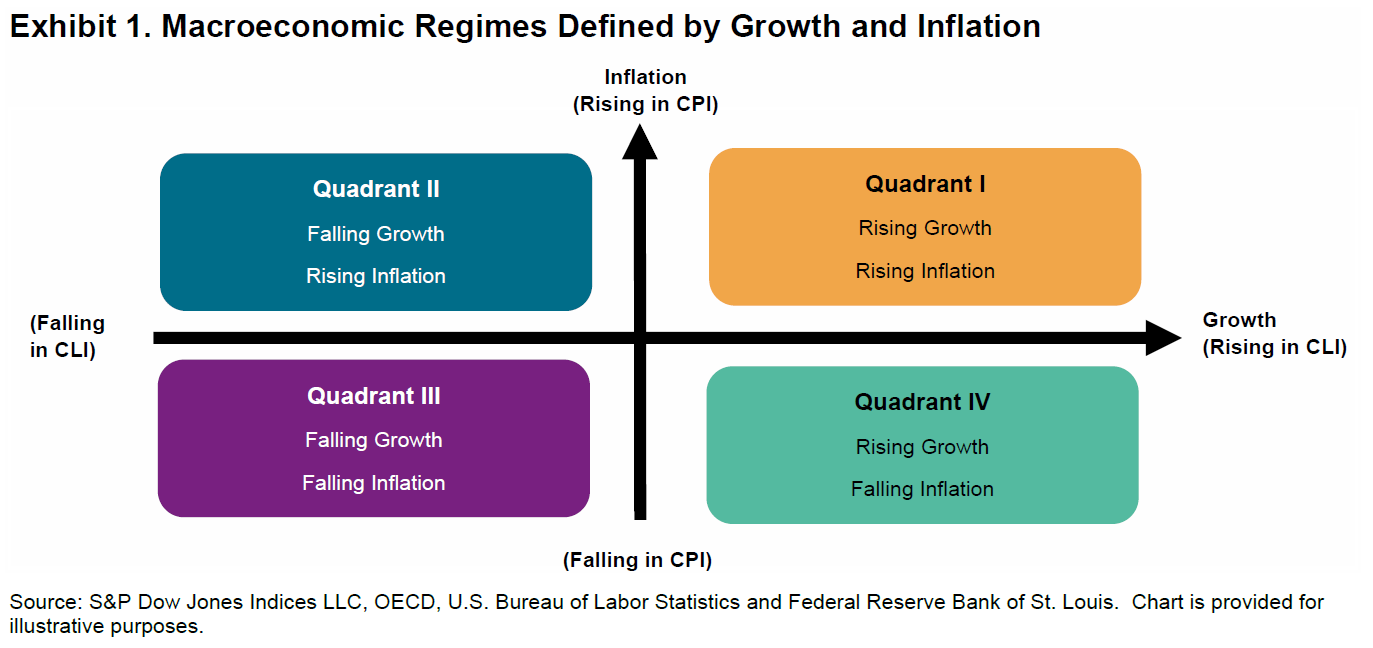

These growth and inflation metrics allow us to categorize historical economic conditions into four regimes as illustrated in Exhibit 1. The four quadrants below represent each of the four regimes.

- Quadrant I: Rising growth and rising inflation

- Quadrant II: Falling growth and rising inflation

- Quadrant III: Falling growth and falling inflation

- Quadrant IV: Rising growth and falling inflation