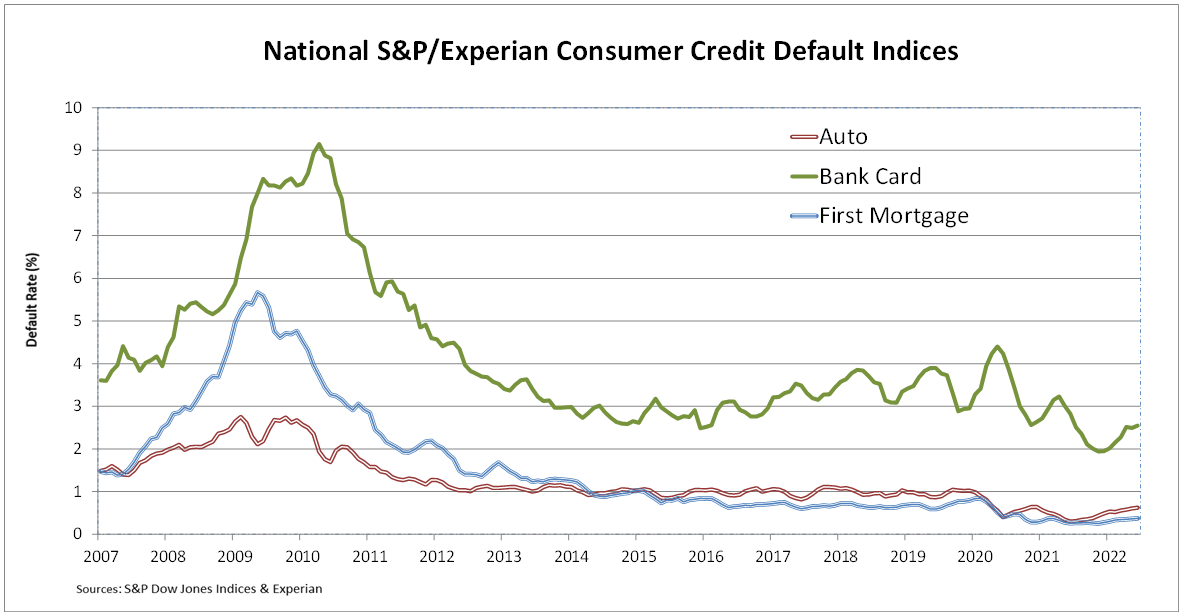

First Mortgage Default Rate at Highest Since September 2020

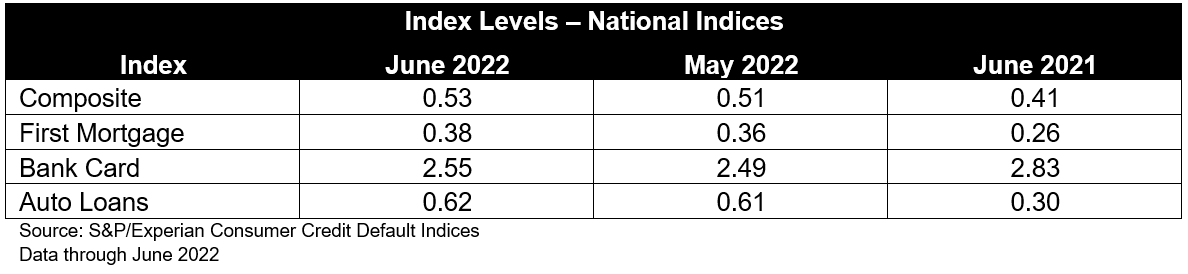

NEW YORK, JULY 19, 2022: S&P Dow Jones Indices and Experian released today data through June 2022 for the S&P/Experian Consumer Credit Default Indices. The indices represent a comprehensive measure of changes in consumer credit defaults and show that the composite rate rose two basis points to 0.53%. The bank card default rate climbed six basis points to 2.55%. The auto loan default rate was one basis point higher at 0.62% while the first mortgage default rate was up two basis points to 0.38%.

Four of the five major metropolitan statistical areas ("MSAs") showed higher default rates compared to last month. Miami had the largest increase, up 15 basis points to 0.99%. Chicago and Dallas each rose five basis points, to 0.58% and 0.57% respectively. Los Angeles was one basis point higher at 0.46%. New York dropped six basis points to 0.71%.

The table below summarizes the June 2022 results for the S&P/Experian Consumer Credit Default Indices. These data are not seasonally adjusted and are not subject to revision.

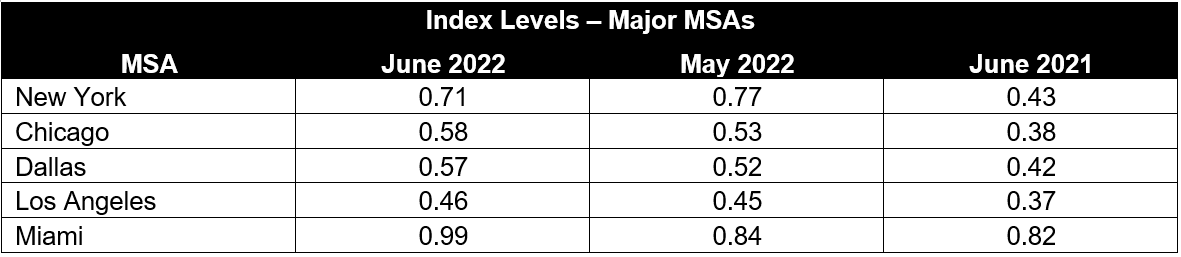

The table below provides the index levels for the five major MSAs tracked by the S&P/Experian Consumer Credit Default Indices.