Bank Card Default Rate Falls to Lowest Level Since 2015

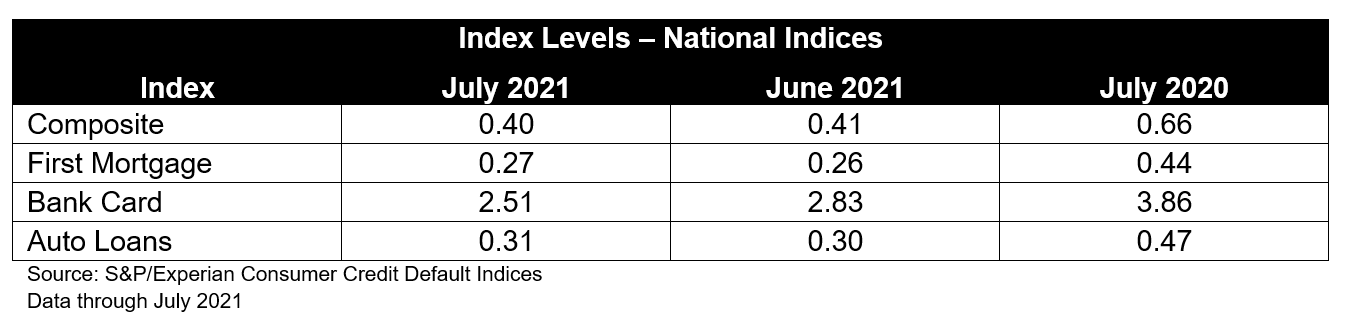

NEW YORK, AUGUST 17, 2021: S&P Dow Jones Indices and Experian released today data through July 2021 for the S&P/Experian Consumer Credit Default Indices. The indices represent a comprehensive measure of changes in consumer credit defaults and show that the composite rate was one basis point lower at 0.40%. The bank card default rate fell 32 basis points to 2.51%. The auto loan default rate was up one basis points to 0.31% and the first mortgage default rate increased one basis point to 0.27%.

Three of the five major metropolitan statistical areas (“MSAs”) showed lower default rates compared to last month. Dallas decreased two basis points to 0.40% while New York and Los Angeles each dropped one basis point, to 0.42% and 0.36% respectively. Miami was nine basis points higher, at 0.51%, while Chiacago increased one basis point to 0.39%.

The table below summarizes the July 2021 results for the S&P/Experian Consumer Credit Default Indices. These data are not seasonally adjusted and are not subject to revision.

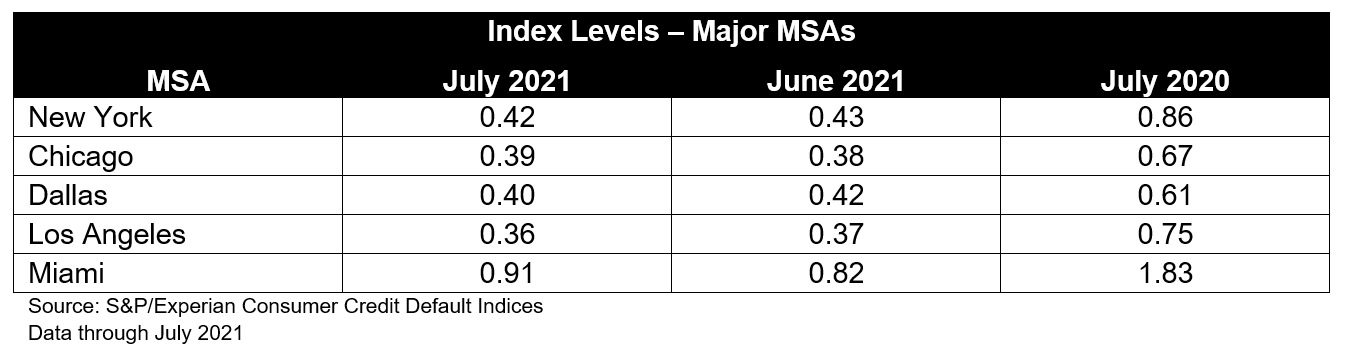

The table below provides the index levels for the five major MSAs tracked by the S&P/Experian Consumer Credit Default Indices.