Key Highlights

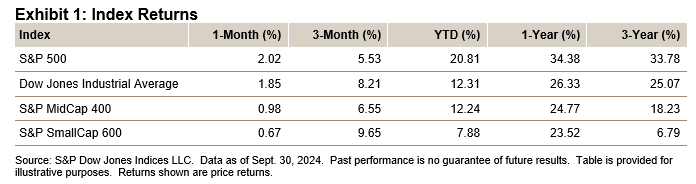

- The S&P 500® was up 2.02% in September, bringing its YTD return to 20.81%.

- The Dow Jones Industrial Average® increased 1.85% for the month and was up 12.31% YTD.

- The S&P MidCap 400® returned 0.98% for the month, bringing its YTD return to 12.24%.

- The S&P SmallCap 600® moved up 0.67% in September and was up 7.88% YTD.

Market Snapshot

Expectations were low for September, as the month with the worst track record (averaging -1.16% per month since 1926 for the S&P 500) started off with the worst week, down 4.25%, since March 2023 (-4.55%). The Street’s motto for September then became “plan for the worst and pray that it won’t be that bad.” But a funny thing happened on the way to the bear—nothing. The economy continued on, inflation was under control, the Fed delivered a 0.50% rate decrease, with two 0.25% decreases expected later this year, and the feared yen carry trade issue was not spoken of again. Additionally, Q2 2024 earnings officially set a record (while sales fell 0.3% short of one), with more earnings records expected for Q3 and Q4, and even China chipped in at the end of the month (and will need to continue to do so to achieve its goals of supporting real estate and encouraging consumer spending), which also helps to ensure low-cost U.S. supplies. The result was five new closing highs (43 YTD), with the index closing at one of those highs (5,762.48), with The Dow® posting seven new closing highs (33 YTD), and also closing at one of them (42,330.15). The S&P 500’s year-end target price rose (6,000; 4.1% away), along with gold, and both gasoline and energy stocks fell. For the month, the index posted a satisfying 2.02% gain (2.14% with dividends) and was up 20.81% YTD (22.08%). All was well at Broad and Wall, as brokers sent out quarterly statements showing the S&P 500 was up 34.38% (36.35%) over the past year. Optimism was alive and well on the Street, and no one wanted to talk about any potential gloom and doom ahead.

The S&P 500’s market value increased USD 1.263 trillion for the month (up USD 1.059 trillion last month) to USD 48.701 trillion and was up USD 8.662 trillion YTD; it was up USD 7.906 trillion for 2023 and down USD 8.224 trillion in 2022.

The Dow Jones Industrial Average set seven new closing highs in September (33 YTD), as it traded (and closed) above 42,000 (42,330.15 closing high and 42,628.32 intraday high), after setting four new closing highs in August and three in July. For the month, The Dow closed at 42,313.00, up 1.85% (1.96% with dividends) from last month’s close of 41,563.08, when it was up 1.76% (2.03%) from the prior month’s close of 40,842.79 (4.41%, 4.51%). For the three-month period, The Dow was up 8.21% (8.72%), as the YTD period was up 12.31% (13.93%). The one-year return was 26.33% (28.85%), 2023 was up 13.70% (16.18%) and 2022 posted a decline of 8.78% (-6.86% with dividends).

Target prices continued up, as the S&P 500’s one-year Street consensus target price increased for the 10th consecutive month to 6,265, an 8.7% gain (10.4% last month) from the current price and up from last month’s 6,238 (6,119 the month before that), after declining for 2 consecutive months, which followed 11 consecutive months of gains (which was after 9 consecutive months of declines). The Dow target price also increased for the 10th consecutive month to USD 44,468, a 5.1% gain (6.5% last month) from now (44,282, 44,097), after two consecutive months of declines, which was after three consecutive months of gains.

The second U.S. presidential debate, this time between Vice President Kamala Harris and Republican nominee Donald Trump (the prior one was between President Joe Biden and Trump) produced no clear victor, but the consensus was that Harris won the debate. No additional debates between Harris and Trump have been arranged; the Harris campaign wanted one but the Trump campaign didn’t. A second assassination plan on Trump was stopped prior to the attempt, with no incident. Congress passed (both the House, 341-82, and Senate, 78-18) and the president signed a short-term government funding bill, avoiding a potential shutdown starting Sept. 30, 2024; the funding is through Dec. 20, 2024.