Key Highlights

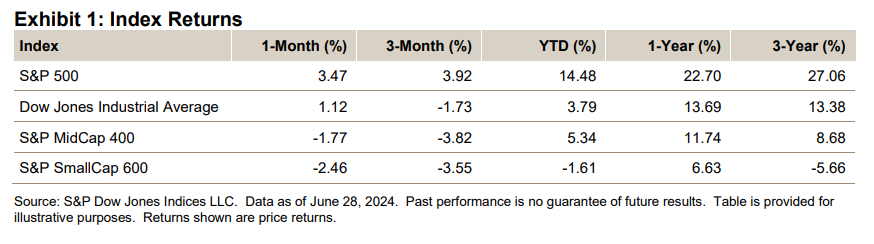

- The S&P 500® was up 3.47% in June, bringing its YTD return to 14.48%.

- The Dow Jones Industrial Average® increased 1.12% for the month and was up 3.79% YTD.

- The S&P MidCap 400® lost 1.77% for the month, bringing its YTD return to 5.34%.

- The S&P SmallCap 600® was down 2.46% in June and down 1.61% YTD.

Market Snapshot

June continued the S&P 500’s 2024 gains, with the index posting 7 new closing highs and bringing its YTD total to 31. The index was up 3.47% for the month (3.59% with dividends) on negative breadth (201 up and 301 down). This came after May’s broad gain of 4.80% (4.96%) and April’s broad, but limited, pullback (-4.16%, -4.08%), which seems to have become a distant memory. The 500™ posted a gain of 3.92% for Q2 2024 (4.28%), but (again) breadth was negative (199 down and 304), as the index remained top heavy. Not that Q1 2024 wasn’t top heavy, but that quarter’s broad gain of 10.16% (10.56%) saw strong positive breadth of 369 up and 134 down. Year-to-date, the index’s return was 14.48% (15.29%), which annualizes to a 31.18% (33.05%) rate, with breadth positive at 301 up and 200 down (May YTD was 312 up and 189 down). June posted gains for 12 of its 19 trading days (14 of 22 last month; 69 of 124 YTD). Of the 11 sectors, 5 were up (10 up last month), while breadth became negative; trading increased 1% (adjusted for days) over May and was down 4% over June 2023.

The S&P 500’s market value increased USD 1.546 trillion for the month (up USD 2.063 trillion last month) to USD 45.843 trillion and was up USD 5.804 trillion YTD; it was up USD 7.906 trillion for 2023 and down USD 8.224 trillion in 2022.

The Dow Jones Industrial Average did not set a new high in June, as it closed at 39,118.86, up 1.12% (1.23% with dividends) from last month’s close of 38,686.32, when it was up 2.30% (2.58%). For Q2 2024, The Dow® was down 1.73% (-1.27%), while it was up 3.79% (4.79%) YTD. The one-year return was 13.67% (16.02%), 2023 was up 13.70% (16.18%) and 2022 posted an 8.78% decline (-6.86%).

S&P 500 trading increased 1% (adjusted for trading days) for June, after being up 6% in May, and the year-over-year June trades were 4% lower relative to June 2023; the 12-month June 2024 volume was 6% lower than the prior 12-month period. The 2023 trading volume was down 1% over 2022; 2022 posted a 6% increase over 2021.

The S&P 500 closed at 5,460.48 (reaching a closing high of 5,487.03), up 3.47% (3.59% with dividends) from May’s close of 5,277.51, when it was up 4.80% (4.96%) from April’s 5,035.69 close (-4.16%, -4.08%). The Q2 three-month gain was 3.92% (4.28%), bringing the 2024 YTD return to 14.48% (15.29%). The one-year period was up 22.70% (24.56%), the 2023 return was up 24.23% (26.29%) and the 2022 return was -19.44% (-18.11%).

Target prices continued up, as the S&P 500’s one-year Street consensus target price increased for a seventh month to 5,972, a 9.4% gain (11.6% last month) from the current price and up from last month’s 5,890 and 5,766 the month before that, which followed 11 consecutive months of gains (which was after 9 consecutive months of declines). The Dow target price also increased for the seventh month, after two consecutive months of declines, which was after three consecutive months of gains, to USD 43,158, a 10.3% gain (12.0%) from now (42,955, 42,808).

The Federal Reserve said all 31 big banks passed their annual stress test, which included a simulation of a 10% U.S. unemployment rate, a 32% decline in housing prices and a 40% drop in commercial real estate. After the end of the month, the banks started to announce their intent to increase their dividends, as well as update their share repurchase program.

OPEC+ (Organization of the Petroleum Exporting Countries and other countries, including Russia) extended its production cuts (which started in Q4 2022) of 5.86 million barrels a day (5.7% of global production) into 2025, although it was not clear at what level the cuts may be set.

The Congressional Budget Office (CBO) raised its federal budget deficit forecast for fiscal 2024 from USD 1.6 trillion (February 2024) to USD 2 trillion, citing USD 300 billion in extra spending (mostly due to reducing student loan balances), as corporate taxes were below expectations. The CBO also reported that federal interest payments for Q1 2024 (USD 1.059 trillion) surpassed spending on defense (USD 1.030 trillion), as interest costs were seen as still increasing.