Key Highlights

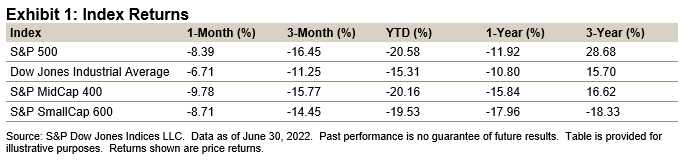

- The S&P 500® was down 8.39% in June, bringing its YTD return to -20.58%.

- The Dow Jones Industrial Average® lost 6.71% for the month and was down 15.31% YTD.

- The S&P MidCap 400® decreased 9.78% for the month, bringing its YTD return to -20.16%.

- The S&P SmallCap 600® was off 8.71% in June and had a YTD return of -19.53%.

Market Snapshot

Enter the bear, exit the bull. We decidedly entered a bear market this month, as higher inflation, higher interest rates and a slowing economy pushed the S&P 500 into official bear territory (down 20% from its last closing high, in this case Jan. 3, 2022’s 4,796.56). It reached a closing low of -23.55% (3,666.77, on June 16), then seesawed upward, as buyers went bargain hunting, but with slower trading than when sellers dominated the market. The S&P 500 closed the month at 3785.38, down 8.39%, and it closed at -16.45% for Q2 (the worst Q2 since 1970’s -18.87%) and -20.58% YTD (the worst start to a year since 1970’s -21.01% ). Last Fourth of July, investors were opening their half-year statements with a 14.41% gain; now it’s a 20.58% decline.

At this point, inflation is being placed squarely as the fall guy for the market declines, as the market’s “expert” historians cite the Fed’s “excess” stimulus programs as the reason for the 40-year high inflation rate, and then the Fed’s attempts to Volker its way out of inflation and avoid a recession, with the market still split on if they can avoid one (but more seeing it than not).

As for the current downturn (which is broad), it should be noted where it came from. The S&P 500 posted a closing high pre-COVID-19 on Feb. 19, 2020 (3,386.15), and it quickly declined 33.93% by March 23, 2020 (closing at 2,237.40), reacting to the pandemic. It also quickly rebounded from that low to set a new closing high on Aug. 18, 2020 (3,389.78), 181 days later, and it set another 90 new closing highs until this year’s Jan. 3, 2022, closing high (4,796.56). During that time period, earnings (operating and as reported), sales, cash-flow, buybacks and dividends all set new records.