KEY HIGHLIGHTS

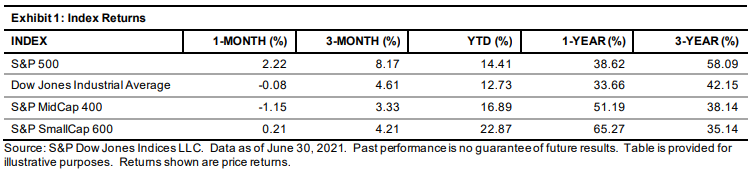

- The S&P 500® was up 2.22% in June, bringing its YTD return to 14.41%.

- The Dow Jones Industrial Average® fell 0.08% for the month and was up 12.73% YTD.

- The S&P MidCap 400® decreased 1.15% for the month, bringing its YTD return to 16.89%.

- The S&P SmallCap 600® returned 0.21% in June and had a YTD return of 22.87%.

MARKET SNAPSHOT

The S&P 500 continued up, posting 8 new closing highs in the 22 trading days (5 in a row, ending the month with 1 of them) and 34 YTD (124 trading days, with 11 of the 34 on the last trading day of the week). Even the fear of inflation (and the end of Fed stimulus) failed to stop the index from reaching new highs. Earnings and cash flow for Q1 2021 closed at all-time highs, with Q2 earnings expected to decline (and potentially rank as number 2 historically). If there were mask futures, they would be going down quicker than SPACs—but both would still be up YTD and year-over-year. The U.S. was reopening, as the first cruise ship left port (in Florida), and Americans did what they do best—spend, baby, spend. What may be unusual, however, is that they were not borrowing as much (can't say that about corporations or the government), but instead they started to spend all the money they didn't during the height of the COVID-19 pandemic. As for the non-U.S. markets (such as India, the U.K., Australia, or the WHO's outlook on China), many appeared to be in another wave of COVID-19, which will limit their reopening growth, as concern remained loud, but mostly in the background, that the U.S. could be vulnerable to their own new wave (due to a ~30% resistance rate to the vaccine).

However, the bottom line for June was similar to May, except with a much larger gain; the S&P 500 posted a return of 2.22% (30.17% annualized), compared with May's 0.55% increase, which was after significant gains in April (5.24%) and March (4.24%), while the Q2 2021 period posted an 8.17% increase (compared to Q1 2021's 5.77%, or Q2 2020's 19.95% rebound). Year-to-date, the return was 14.41%, as the post-COVID-19 gain (from Feb. 19, 2020) was 26.91%, with the index closing the month at a new high.

President Biden met with Republican leaders to discuss his infrastructure plan, proposing an additional USD 1 trillion program (to the projected USD 400 billion over the next five years), up from his previous USD 1.7 billion plan. Biden said he was committed to paying for the plan with corporate tax increases. The updated Republican plan was for USD 928 billion (over eight years).

The G7 nations (Canada, France, Germany, Italy, Japan, U.K., and the U.S.) agreed to back new rules intended to implement a minimum 15% tax rate on corporate profits, as well as taxing corporations where goods and services are sold. Details weren't worked out, as agreement among the G20 nations would first be required. In the U.S., tax policy change was seen as moving slowly (due to politics, as well as the recovery), with no significant change expected by the Street in 2021.

Biden's eight-day trip to Europe (his first) had two goals. The first, to meet, greet, and make friends with European allies, as he met with some leaders privately, and met with the Queen, while attending the G7 meeting (with a noticeably more friendly greeting than the past few years). The second goal (and highlight) was his meeting with Russian President Putin (in Geneva); the meeting was civil and politically correct, with no agreement, but it represented the start of a dialog.

The EU and U.S. announced a five-year truce (compared to a settlement) in their 17-year dispute (which had grown worse over the past few years) regarding subsidies for Airbus SE (EADSY) and Boeing (BA). Discussions between Biden and U.S. senators on a USD 1 trillion infrastructure bill appeared to move forward, as a bipartisan group of senators signed on. Considering inflation, it's not Jimmy Carter's time (when it was in the double digits), but prices are higher, and while I won't debate "transitory," we are paying more today. Biden revoked Trump's orders limiting TikTok and WeChat, as he directed the Commerce Department to evaluate software applications with ties to foreign governments.

Canada said it would permit entry to its country for vaccinated travelers, as the U.S. loosened foreign travel restrictions. The Biden administration said it would donate 500 million Pfizer vaccines to non-U.S. countries (200 million in 2021 and 300 million in the first half of 2022). The COVID-19 delta variant continued to spread, as Hong Kong, Portugal, and Spain imposed new restrictions (joining Italy), with Sydney in a full two-week shutdown. Meanwhile, the U.S. reopened, with the variant accounting for a larger percentage of the diminishing cases.