Key Highlights

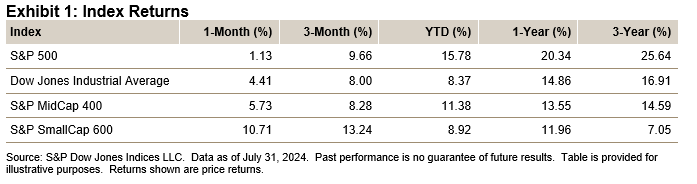

- The S&P 500® was up 1.13% in July, bringing its YTD return to 15.78%.

- The Dow Jones Industrial Average® increased 4.41% for the month and was up 8.37% YTD.

- The S&P MidCap 400® gained 5.73% for the month, bringing its YTD return to 11.38%.

- The S&P SmallCap 600® added 10.71% in July and turned positive YTD, up 8.92% YTD.

Market Snapshot

The first half of July continued the 2024 gains and new closing highs (7 in July and 38 YTD); the last closing high (of 5,677.20; intraday high of 5,669,67) was on July 16, when the S&P 500 was up 3.79% month-to-date and up 18.90% YTD. However, starting on July 17, 2024, the perception and economics changed, with reallocation to small caps from large caps, especially in Information Technology (including the Magnificent 7). The index then declined 4.72%, putting it into the red month-to-date (-1.12%), as some buying and bottom-fishing came in to lift the market. The S&P 500 posted a strong 1.58% gain on the last day of the month, helped by expectations of the U.S. Fed decreasing interest rates at its next meeting, resulting in the index posting a gain of 1.13% for July (1.22% with dividends), as it avoided a second monthly decline for 2024 (April was -4.16% and -4.08% with dividends); June was up 3.47% (3.59%) and May added 4.80% (4.96%). For the three-month period, the S&P 500 posted a gain of 9.66% (10.05%), with the YTD return up 15.78% (16.70%), which annualizes to a 28.26% (29.99%) rate; breadth improved to 364 issues up and 139 down (June YTD was 301 up and 200 down). July posted gains for 14 of its 22 trading days (12 of 19 last month; 82 of 146 YTD). Of the 11 sectors, 9 were up (5 up last month), as trading decreased 10% (adjusted for days) over June and was down 4% over July 2023.

The S&P 500’s market value increased USD 0.536 trillion for the month (up USD 1.546 trillion last month) to USD 46.379 trillion and was up USD 6.340 trillion YTD; it was up USD 7.906 trillion for 2023 and down USD 8.224 trillion in 2022.

The Dow Jones Industrial Average set three new closing highs in July (22 YTD; 41,198.08 closing high and 41,221.98 intraday high), as it closed above 40,000 and 41,000 for the first time. The index’s decline from its highs was limited, helped by being a price-weighted index with limited weight in the Magnificent 7. It closed at 40,842.79, up 4.41% (4.51% with dividends) from last month’s close of 39,118.86, when it was up 1.12% (1.23%) from the prior month’s close of 38,686.32 (2.30%, 2.58%). For the three-month period, The Dow® was up 8.00% (8.53%), as the YTD period was up 8.37% (9.52%). The one-year return was 14.86% (17.22%), 2023 was up 13.70% (16.18%) and 2022 posted an 8.78% decline (-6.86%).

Donald Trump became the official Republican candidate for president at the Republican convention (July 15-18). Polls at the time had shown Donald Trump's lead was increasing, and the Street had started to take positions based on a second Trump administration. On July 13, 2024, Trump survived an assassination attempt with minor injuries. At the start of July, President Joe Biden continued to address his poor presidential debate performance on June 27 (the second debate is scheduled for Sept. 10), ahead of the Democratic convention on Aug. 19-22. He was diagnosed with COVID-19 and was facing calls for him to leave the presidential race, as he recovered and returned to work. On July 21, 2024, President Joe Biden said he would not run for re-election, choosing instead to endorse his vice president, Kamala Harris, to be the Democratic candidate.

The Fed minutes from its June 11-12, 2024, meeting showed the members saw that upward price pressure was diminishing, but the group favored a wait-and-see approach before taking any action. Fed Chair Jerome Powell testified before Congress (a semiannual requirement) and indicated that interest rate cuts were coming, but gave no indication of the timeline, as he remarked that there are other risks to the economy (and responsibilities of the Fed), referring to employment. The Fed Beige Book showed slowing growth and a loosening labor market, as inflation was declining and the Street saw it as supporting evidence for a September interest rate cut by the Fed.