KEY HIGHLIGHTS

Sign up to receive updates via email

Sign Up

MARKET SNAPSHOT

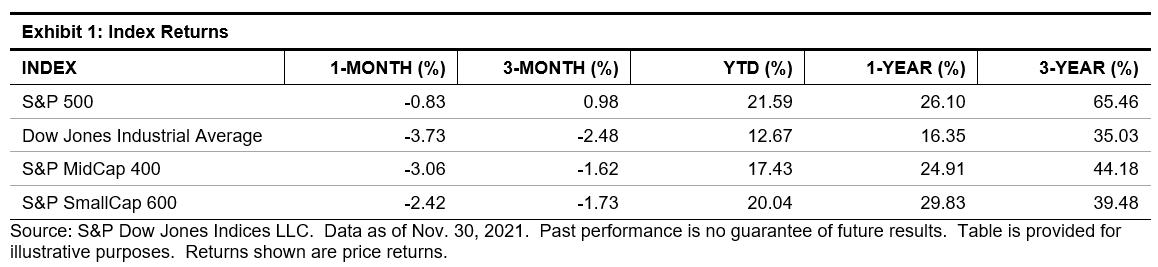

Another COVID-19 variant emerged, as was expected, and the World Health Organization named it Omicron. It will take at least another week to determine any of the infection or health hazards of Omicron, but the initial data on the variant has it containing approximately 50 mutations, with 30 spike proteins (which allow it to attach to human cells). Even before Omicron emerged, infections were on the rise (especially in Europe), as were restrictions, and many countries have now added travel restrictions to slow the potential spread of Omicron. As for the market’s reaction, it was strong, but not significant. In the U.S., the S&P 500 declined 2.27% when the news was released during Black Friday’s shortened holiday session (Nov. 26, 2021), the third worst day of the year (646th worst since 1928), which left the S&P 500 2.34% off its Nov. 18, 2021, closing high (its 66th of the year, second only to 1995’s 77). While the impact of the variant was not known, the Street took an optimistic view (buy on the dip), not seeing (or wanting to see) a return to lockdowns, as it recouped 1.32% the next day. Then on the following day, Tuesday (Nov. 30, 2021) came Powell’s disallowance of elevated inflation as transitory, as tapering was seen as happening more quickly (with the first rate hike earlier than expected; no more debate on one or two increases in 2022). As a result, the S&P 500 declined 1.90% for the day, turning the month negative at -0.83%, but only 2.92% away from a new closing high and up 21.59% YTD (after 16.26% in 2020)

As for the part of the month not as affected by Omicron COVID-19 news (the first 18 of the 21 trading days), the S&P 500 posted seven new closing highs, and both earnings and sales (as well as buybacks and dividends) appeared to set a quarterly record. Consumers continued to be the backbone, as pre-holiday shopping increased, spurred on by supply concerns. Initial estimates for the start of the actual holiday season (Black Friday) showed an estimated 48% increase over the depressed 2020 period as customers returned to the stores, but it was still 28% shy of the 2019 level, as Americans spent an estimated USD 8.9 billion (margins are expected to be much higher). As for my indicator, my wife and daughter ventured out for their 17th Black Friday expedition (this year starting in SoHo, then making their way up to Midtown), as they reported banners were large, but sales were few, and some limited inventories had them texting me to make a run to Hudson Yards for a jacket (it’s not my area, but that shopping center was not crowded at all, and the jacket had a minor 10% discount; there were only two in stock). Cyber Monday added (disappointingly) to the spree, but U.S. shoppers have been on cyber for most of the pandemic.

At this point, COVID-19 does not appear to be the biggest long-term Street fear, although it could have the largest impact if the new (or next) variant turns out to be worse than expected. The honor of biggest Street fear goes to inflation, which continues to be fed by supply shortages, labor costs, worker shortages, and consumers, who have not pulled back (high demand). The shorter-term fear, however, is the budget, which is due Dec. 3, 2021 (which some feel will be given another band-aid), and the debt (which should meet its limit in the first half of December), as many on the Street still look for a Santa Claus rally. Given the inflows and optimism, far be it for me to say “bah humbug”—long live irrational exuberance (and may the trades be with you).

The S&P 500 closed at 4,567.00, down 0.83% (-0.69% with dividends) for November from last month’s 4,605.38, when it was up 6.91% (7.01%), and the prior month’s 4,307.54 close, when it was down 4.76% (-4.65%). The three-month return was 0.98% (1.32%), the YTD return was 21.59% (23.18%), the one-year return was 26.10% (27.92%), and the index was up 34.87% (38.80%) from its pre-COVID-19 closing high on Feb. 19, 2020 (there have been 85 new closing highs since the pre-pandemic high). The S&P 500 posted seven new closing highs in November (5 in October, 1 in September, 12 in August, 7 in July, 6 in June, 1 in May, 10 in April, and 5 in March, February, and January) and 66 YTD; it has posted new closing highs in every month since November 2020 (it missed October 2020 but had new closing highs in August and September 2020). Since Biden won the Nov. 3, 2020, U.S. election, the S&P 500 has gained 35.55% (37.74%), with 64 closing highs since his inauguration (Jan. 20, 2021). The bull market was up 104.12% (109.64%) from the low on March 23, 2020. The index closed the month 2.92% off its Nov.18, 2021, closing high (4,704.54).

The S&P 500 started November where it ended October, with more new closing highs (the last two days of October posted new closing highs; Oct 29-30, 2021). November opened with a perfect week—all five days had a new closing high (Nov. 1-5, 2021; making it seven trading days in a row). The index went on to post another the following Monday (Nov. 8, 2021; making it eight trading days in a row—it was the fifth such occurrence since 1928). The index then defended its gains but continued on, setting another new closing high on Nov. 18, 2021, making it 66 new closing highs YTD (second only to the record 77 in 1995). The last three trading days of the month (after the Thanksgiving Day holiday) posted 1% moves, as reaction to the Omicron variant produced a knee-jerk decline of 2.27%, while the next day rebounded 1.32%, but then Chair Powell’s testimony of higher inflation and more tapering led into a decline of 1.57% for the end of the month.