Key Highlights

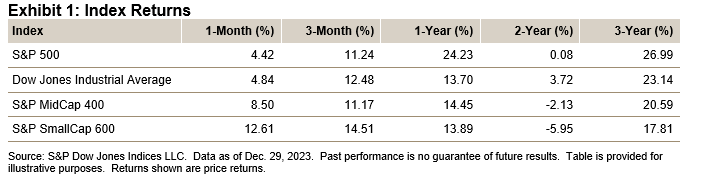

- The S&P 500® was up 4.42% in December, bringing its one-year return to 24.23%.

- The Dow Jones Industrial Average® rose 4.84% for the month and was up 13.70% in 2023.

- The S&P MidCap 400® posted 8.50% for the month, bringing its one-year return to 14.45%.

- The S&P SmallCap 600® was up 12.61% in December and was up 13.89% for the year.

MARKET SNAPSHOT

For 2023, the S&P 500 posted a 24.23% return (26.44% with dividends), which made up for 2022’s loss of 19.44% (-18.11%), leaving the two-year gain at 0.08% (3.42% with dividends). However, the breakdown of the year showed clear winners and losers, which differed greatly from the results in 2022 and over the two-year period. For 2023, Information Technology and Communication Services were the big winners, gaining 56.39% and 54.36%, respectively. Those gains followed 2022 losses of 28.91% and 40.42%, respectively, leaving the two-year return at a 11.18% gain for Information Technology and a loss of 8.03% for Communication Services. Energy declined 4.80% for 2023 but was the only sector up for 2022 (with a gain of 59.05%), as it finished the two-year period with a gain of 51.41%. Utilities did the worst in 2023, down 10.20%, and with 2022’s 1.44% decline, it was down 11.49% over the past two years.

At the sector level, eight sectors gained for 2023, compared with one in 2022, with three up over the past two years. Breadth was positive for 2023, with 322 issues up and 179 down, compared with 2022’s 139 gainers and 363 decliners, as the two-year run posted negative breadth, with 213 issues up (78 up at least 30%) and 286 down (74 down at least 30%).

As for the Magnificent Seven, they did great this year (with an average total return gain of 104.7%), accounting for 62.2% of the S&P 500’s 26.29% total return (excluding this group, the index return was 9.94% for 2023). This gain made up for last year, when they all declined (average -45.31%), leaving only Amazon.com (AMZN) and Tesla (TSLA) still in the red from year-end 2021. For the two-year period, the S&P 500 was up 3.42% (total return), with the Magnificent Seven accounting for 2.05% of it (leaving the index up 1.37% for the two-year period without them).

The year ended on a nine-week run of gains, up 15.85% (last seen in January 1994, up 10.26%). The S&P 500 closed at 4,769.83, up 24.23% for the year, 0.56% off its Jan. 3, 2022, closing high of 4,796.56, and up 40.86% from the pre-COVID-19 high (Feb. 19, 2020) of 3,386.15.

January 2024 will be active, as the U.S. Congress returns and has to address issues on Ukraine, Israel and the U.S. border, while a potential government shutdown looms if a new budget (or stopgap bill) is not reached by Jan. 19, 2024. Adding to the market’s activities is earnings season, starting on Friday, Jan. 12, 2024, with the big banks.