Amid the backdrop of fluctuating U.S. economic conditions, evolving interest rate policies and persistent inflation, the municipal bond market has demonstrated resilience. As investors grapple with uncertainties in equity and bond markets paired with rising tariffs affecting inflation, municipal bonds seem to be well positioned for diversification and stability. In 2024, the U.S. Federal Reserve executed a series of three interest rate cuts, with the final adjustment in December lowering the benchmark rate to a range of 4.25% to 4.50%. This move reflects a cautious shift in monetary policy, signaling the Fed's intention to adopt a more calculated approach as it navigates the economic landscape in 2025.

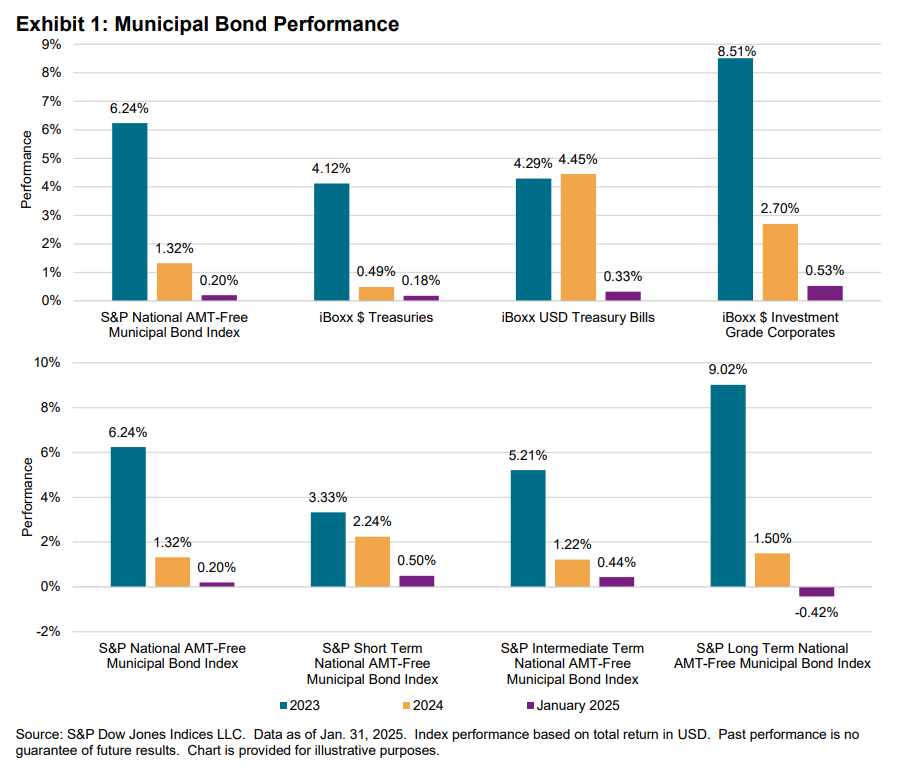

As the Fed adjusted interest rates, the municipal bond market, as measured by the S&P National AMT-Free Municipal Bond Index, concluded 2024 with a return of 1.32%. This performance surpassed U.S. Treasury returns—as measured by the iBoxx $ Treasuries—by 83 bps but lagged investment grade corporates—as measured by the iBoxx $ Investment Grade Corporates—by 138 bps. Although municipal bond returns for 2024 were lower than 2023, January 2025 marked a rebound, with the S&P National AMT-Free Municipal Bond Index edging out the iBoxx $ Treasuries by 2 bps. Notably, the short end of the municipal curve, as tracked by the S&P Short Term National AMT-Free Municipal Bond Index, outperformed both the S&P Intermediate Term National AMT-Free Municipal Bond Index and the S&P Long Term National AMT-Free Municipal Bond Index by 6 and 92 bps, respectively (see Exhibit 1).

Yield versus Risk: The Essential Equation

Over the past two years, municipal bonds have shown higher yields for a strong risk/return profile. We define yield per unit of duration as the index annual yield-to-maturity (tax-equivalent yield for municipal indices) divided by modified duration. By this metric, the S&P National AMT-Free Municipal Bond Index yield was higher than the iBoxx $ Treasuries by 30 bps in 2023 and by 13 bps in 2024. The S&P National AMT-Free Municipal Bond Index yield surpassed the iBoxx $ IG Corporates by 15 bps in December 2023, which narrowed to just 2 bps by the close of 2024 (see Exhibit 2).