Introduction

Islamic indices provide market participants with a comprehensive set of Shariah-compliant benchmarks for equities and sukuk, offering a diverse range of strategies tailored to various investment goals. These have been developed to cater to the unique needs of the Islamic financial ecosystem, reflecting the evolving dynamics of the global market. Historically, Islamic investing has been predominantly actively managed; however, a recent shift toward passive investing is evident, especially as Shariah investors see the benefits of ETFs—including transparency and cost-efficiency—over active funds. In the predominantly Muslim Middle East and North Africa (MENA) region, the benefits of passive investments are especially pronounced. According to the S&P Indices Versus Active (SPIVA®) MENA Mid-Year 2023 Scorecard, 85%-88% of equity funds in the region underperformed their benchmarks and only 42% survived over the past decade.

Review of 2023

Global Islamic indices dropped by over 20% in 2022, paving the way for a 2023 resurgence. During the first nine months of 2023, the S&P Global BMI Shariah and Dow Jones Islamic Market World Index increased by approximately 12.3% and 13.0%, respectively. Over the past 10 years, the S&P Global BMI Shariah outperformed its conventional benchmark in five-year rolling returns nearly 75% of the time.

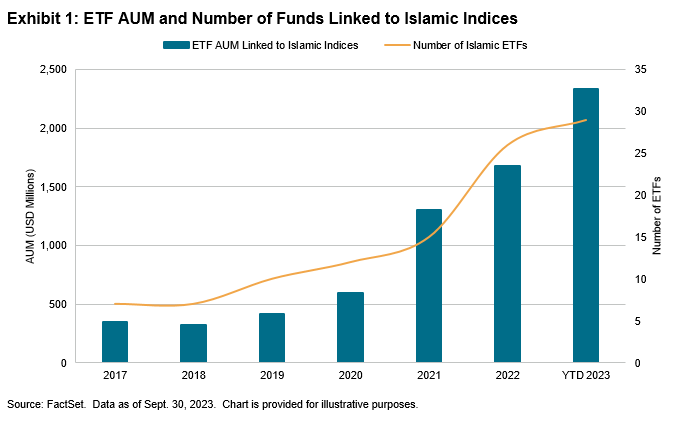

The asset landscape mirrored this upward trend. By Sept. 30, 2023, there were 29 Islamic ETFs with a combined AUM of USD 2.33 billion—a significant jump from 2022's 26 ETFs and USD 1.67 billion AUM. Looking back five years, the growth has been even more remarkable: from 7 ETFs and an AUM of USD 326 million in 2018.

In response to the surging interest in Shariah-compliant investing, especially among Australia’s growing Muslim community, S&P Dow Jones Indices (S&P DJI) collaborated with Australia Securities Exchange (ASX) to introduce its first Shariah-compliant series of benchmarks to the Australian market, the S&P/ASX Shariah Indices, in March 2023. With the launches of the S&P/ASX 200 Shariah and S&P/ASX 300 Shariah, the renowned S&P/ASX Indices now complement other globally recognized Shariah-compliant equity benchmarks, including the S&P 500® Shariah, S&P/TOPIX 150 Shariah and S&P/TSX 60 Shariah.

In parallel to equity indices, sukuk listings increased significantly over the past decade. Conventional and Shariah-compliant bonds increased notably to USD 180 billion in outstanding debt, with sukuk representing a substantial portion, at USD 77 billion. Among the notable listings are the U.A.E. Ministry of Finance sukuk and the debut of ESG sukuk, with the total ESG sukuk reaching approximately USD 18 billion. Concurrently, in Saudi Arabia, the domestic government sukuk market, as represented by the iBoxx Tadawul SAR Government Sukuk Index, flourished between 2019 and 2022, establishing Saudi Arabia as the premier global sovereign sukuk issuer. Since the index's inception (June 30, 2019), the sukuk count rose from 29 to 50, with the total notional outstanding advancing from about USD 40 billion to USD 115 billion.

The past few years have witnessed a significant pivot from predominantly active Shariah-compliant mutual funds to passive index-based investing. Notably, nearly two-thirds of Islamic index funds launched post-2017 have extended their influence beyond traditional Islamic centers such as Malaysia and Saudi Arabia to North America and Europe. This evolution is underscored by the listing of Shariah-compliant ETFs on major platforms, like the London Stock Exchange, New York Stock Exchange and elsewhere, signifying the increased value of these offerings.