INTRODUCTION

Islamic indices provide market participants with a comprehensive set of Shariah-compliant benchmarks for equities and sukuk, covering a wide variety of investment themes and strategies. These have been created to support the investment needs of the Islamic investment community and have gained considerable traction over the past years.

REVIEW OF 2022

Landscape of Islamic Funds

Shariah-compliant investment strategies have been offered for many years in an actively managed mutual fund wrapper, with predominance in traditional Islamic markets such as Malaysia and Saudi Arabia. However, index investing has made significant inroads in this category over the past five years. For example, more than one-half of currently available Islamic index funds were launched after 2017. Also, Islamic index funds, unlike their actively managed counterparts, are now available to most investors around the world—in North America, Europe and other Islamic markets in the MENA and Asia Pacific regions.

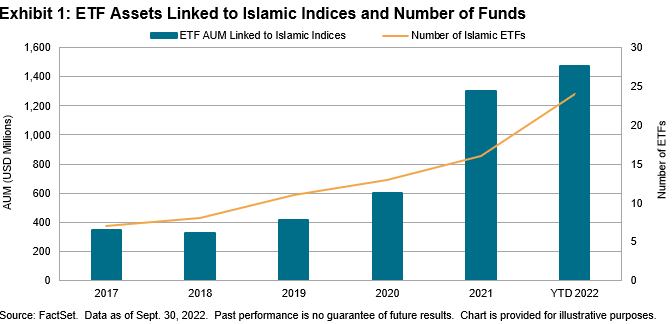

As of Sept. 30, 2022, there were over USD 4.7 billion in assets tracking Shariah-compliant indices in mutual funds and ETFs. This represents an increase of USD 425 million year-over-year and USD 3.4 billion since 2017. While it is still a relatively small asset base compared with other major categories, this segment ranks among the fastest growing, with an annualized growth of 30% since 2017. Islamic ETFs have been a key part of this trend, with a general proliferation of new products across investment themes and listing regions.

Growth of Islamic ETFs

This year has been exceptional for Islamic ETFs; there were USD 1.5 billion in assets under management tracking Shariah-compliant indices as of Sept. 30, 2022, which represents 13% growth YTD, despite difficult market conditions. Islamic ETF AUM have been supported by the launch of eight new ETFs this year, along with all-time-high inflows of more than USD 500 million.

These recent launches raise the total number of Islamic ETFs to 24, covering a wide set of investment exposures from global, regional and country-specific core to more specialized investment themes such as factors and real estate.

This article was first published in Islamic Finance News’ IFN Guide 2023 on Dec. 20, 2022.