The S&P Kensho New Economy Indices seek to track the industries and innovation of the Fourth Industrial Revolution

The U.S. equities market's overall performance in 2023 was incongruous to many predictions made at the beginning of the year. The global economy was resilient, avoiding a recession despite negative geopolitical headlines (link). The U.S. remained a prominent contributor to this optimism, countering the weaker-than-expected growth in the world’s second-largest economy, China. Macro conditions turned more favorable in the final quarter of year, with inflation gliding lower and interest rates across most countries stabilizing, albeit at a higher level for now.

The fourth quarter saw a broad recovery of the equities market from the previous quarter’s weakness to reach near all-time highs. The S&P Global BMI was up 11.2% over the quarter, within roughly 1% of its all-time high. Similar patterns played out across the S&P United States BMI (12%) and S&P Europe 350® (11%), while the S&P Emerging BMI (7%) was hindered by a relatively weaker performance of the S&P China BMI (-3%).

As U.S. interest rates took a breather, U.S. equities across the market-cap spectrum posted their best quarterly returns in nearly three years, with the S&P 500®, S&P MidCap 400® and S&P SmallCap 600® up 12%, 12% and 15%, respectively. This optimism within equities has been supported by, among other things, the pause in Fed rate hikes since August, the Fed's December 2023 meeting minutes signaling potential rate cuts in 2024, strong buyback activity and solid fund inflows, especially within the U.S. small-cap space.

Sign up to receive updates via email

Sign Up

The end-of-year cheer was widespread across S&P 500-linked factors, with high beta (18%) and momentum (15%) taking the top spots, value (14%) outperforming growth (10%), and low volatility (7%) near the bottom. However, the “bad breadth” syndrome was notable, as 72% of the stocks in the S&P 500 underperformed the benchmark over the year. The S&P 500’s outperformance (10.2%) of its equal-weight counterpart was the largest in more than two decades. Except for Energy, all other S&P 500 sectors posted positive quarterly returns, led by the interest rate-sensitive Real Estate sector (19%). The S&P Kensho New Economies Composite Index (19%) had its best quarter since Q4 2020, having broad-based positive contributions from 24 of its 25 subsector indices. In terms of 2023 performance, 19 of the 25 S&P Kensho New Economies subsectors posted gains, underscored by Distributed Ledger’s impressive 228% annual return, followed by the Tech- and Semiconductor-heavy Virtual Reality (64%).

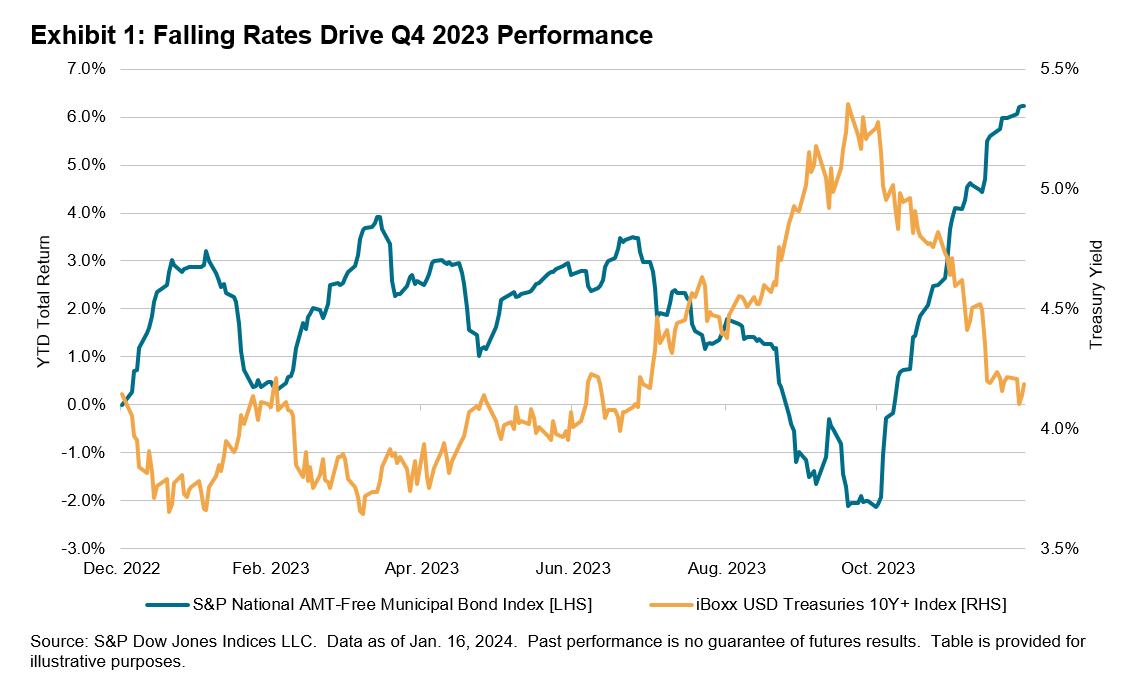

U.S. interest rates, which had been steadily rising since mid-2021, fell sharply over the quarter. The S&P U.S. Treasury Bond Index staged an impressive rally (5%), more than recovering the losses of the past two quarters and posting its first annual gain (4.5%) since 2020. The European Central Bank also paused its interest rate hikes in October but has refrained from suggesting any possibility of rate cuts in 2024. The quarterly gain of the S&P Eurozone Sovereign Bond Index (up 6.6%) was the best in more than 20 years. In a reversal of its previous quarter, the relatively longer-duration S&P U.S. Investment Grade Corporate Bond Index (10.3%) outperformed its high-yield counterpart index (7.25%) and the floating-rate leveraged loans index (2.5%). Fed futures are pricing in more than 125 bps of rate cuts over 2024, much higher than the FOMC’s forecast. While the Fed rate path will be key in 2024, U.S. economic growth will be closely watched for any signs of deviation from the “soft landing” scenario we seem to be in. The Conference Board’s U.S. leading economic indicators have steadily fallen for 20 consecutive months.

The commodities segment was one of the few areas with negative performance. Supply cuts supported oil prices during the first half of the year, but growing concerns over demand outweighed and dragged the price down near USD 70. The S&P GSCI Energy was down 16.8% over the fourth quarter, as oil futures positioning appears cautious. The S&P GSCI Agriculture (-1%) was down and near three-year lows from near-record supplies. The S&P GSCI Industrial Metals (0.8%) barely moved due to rising concerns and weak manufacturing activity evidenced from PMI surveys across the U.S. and Europe. The S&P GSCI Precious Metals (11%) was the anomaly, posting positive quarterly performance. Easing interest rates, a softening U.S. dollar and increased geopolitical tensions have played into precious metals’ appeal.