It is of no surprise to anyone following the markets of late that the returns of larger companies have generally fared better than their smaller brethren during the pandemic. The extent of this dynamic was brought into sharp relief when looking at YTD total returns through May 29, 2020: the large-cap S&P 500® returned -4.97%; the S&P MidCap 400® returned -13.86%; and the S&P SmallCap 600® returned -20.81%. In the small-cap segment, the Russell 2000 reflected the same story over this period with a return of -15.95%.

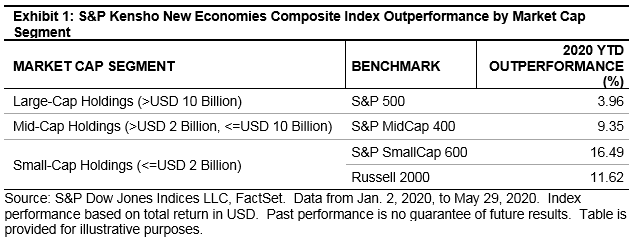

Meanwhile, the equivalent market-cap segments of the S&P Kensho New Economies Composite Index, which seeks to capture the industries and innovation of the Fourth Industrial Revolution, have significantly outperformed their broad market peers by 3.96%, 9.35%, and a substantial 16.49%, respectively, over this same time period (see Exhibit 1).

This persistent outperformance across market-cap segments may illustrate the positive impact of the security selection effect and underscores the benefits of a robust, disciplined, and transparent framework when investing in innovation and growth.

This commentary will discuss our approach to capturing the New Economies and explore how persistent this pattern has been over different time periods and weighting strategies. Let’s start out with some context setting.