Key Highlights

Sign up to receive updates via email

Sign Up

Market Snapshot

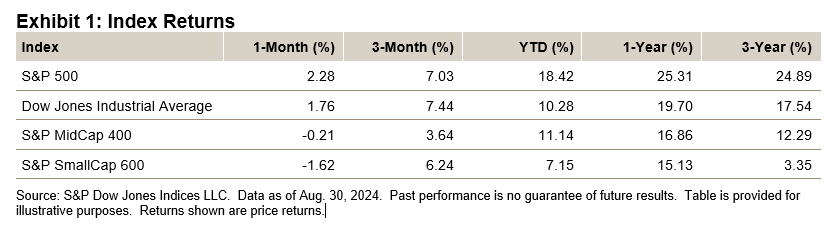

August continued July’s volatility and uncertainty, but in the end, the S&P 500 delivered gains (2.28%, 2.43% with dividends), just as July had done (1.13%, 1.22%), as the index closed the month (5,648.40) just shy (-0.33%) of its July 16, 2024, closing high (5,667.20) and was up 18.42% YTD (19.53% with dividends). The Magnificent 7 still counted, but its dominance of overall returns was diminished (at least for August), as the group as a whole reduced the S&P 500’s total return by 0.75% for August. On a sector basis, consumer groups stood out, as spending and inflation concerns pushed Consumer Discretionary down 1.08% for the month (up 5.78% YTD), while Consumer Staples was up 5.78% (up 15.78% YTD), the best sector in the index for the month. Energy took the lead on the way down, as pump prices continued to decline (which is unusual during the summer driving months), with the sector falling 2.32% for the month (8.72% YTD). For the three-month period, the S&P 500 posted a gain of 7.03% (7.39% with dividends), with the YTD return up 18.42% (19.53%), which annualizes to a rate of 28.66% (30.46%), and the one-year return was 25.31% (27.14%). Breadth for August declined but stayed strongly positive, as 355 issues were up and 148 down (July YTD was 364 up and 139 down). August posted gains for 13 of its 22 trading days (14 of 22 last month; 82 of 146 YTD), as 8 days moved at least 1% (5 up and 3 down). Of the 11 sectors, 9 were up (9 were up last month as well), as trading increased 1% (adjusted for days) over July and was up 2% over August 2023.

The S&P 500’s market value increased USD 1.059 trillion for the month (up USD 0.536 trillion last month) to USD 47.448 trillion and was up USD 7.400 trillion YTD; it was up USD 7.906 trillion for 2023 and down USD 8.224 trillion in 2022.

The Dow Jones Industrial Average set four new closing highs for August (26 YTD; 41,563.08 closing high and 41,585.21 intraday high), after setting three in July. The Dow® ended the month at a new closing high of 41,563.08, up 1.76% (up 2.03% with dividends) from last month’s close of 40,842.79, when it was up 4.41% (4.51%) from the prior month’s close of 39,118.86 (1.12%, 1.23%). For the three-month period, The Dow was up 7.44% (7.95%), as the YTD period was up 10.28% (11.75%). The one-year return was 19.70% (22.06%); 2023 was up 13.70% (16.18%), while 2022 posted a decline of 8.78% (-6.86% with dividends).

Target prices continued up, as the S&P 500’s one-year Street consensus target price increased for the ninth consecutive month, after declining for 2 consecutive months, which followed 11 consecutive months of gains (which was after 9 consecutive months of declines), to 6,238, a 10.4% gain (10.8% last month) from the current price and up from last month’s 6,119 (5,972 the month before that). The Dow target price also increased for the ninth consecutive month, after two consecutive months of declines, which was after three consecutive months of gains, to USD 44,282, a 6.5% gain (8.0% last month) from now (44,097, 43,158).

In U.S. election news, the Democratic National Convention (held Aug. 19-22) nominated Vice President Kamala Harris as its candidate for president and Governor Tim Walz of Minnesota for vice president. They will oppose the Republican ticket of former president Donald Trump for president and Senator JD Vance from Ohio for vice president for the Nov. 5, 2024, election.

Campaigning for the presidential election increased, as polls showed a close race, with most within the statistical margin of error for the White House and conflicting predictions for the control of Congress (Senate and House of Representatives).