Featuring iBoxx USD Asia-Pacific

September 2024 Commentary

After months of maintaining interest rates steady while inflation stabilized, the U.S. Fed took a significant step by lowering its benchmark policy rate by 50 bps to address rising unemployment concerns. Several countries in the Americas, including Canada and Mexico, along with nations that peg their currencies to the U.S. dollar, also opted to reduce their interest rates. In Europe, September marked the second rate cut by the European Central Bank this year, while central banks in Sweden and Switzerland cut rates for the third time. In the Asia-Pacific region, both Indonesia and Hong Kong initiated their first rate cuts of this tightening cycle.

The U.S. dollar continued to weaken against most Asian currencies in September; the Malaysia ringgit, Thai baht and Japanese yen strengthened at least 10% in Q3. The depreciation of the U.S. dollar reversed most gains against Asian currencies in H1 2024.

10-year U.S. Treasury yields—as represented by the iBoxx USD Treasuries Current 10-Year—dropped by 14 bps to 3.82%. The index was up 1.35%—its fifth-consecutive month with positive performance and its longest streak since 2021. The S&P 500® broke its all-time high level after the Fed announced the 50 bps rate cut, and the index closed the month up 2.02%, at 5.53% QTD and 20.81% YTD.

Following the People’s Bank of China (PBoC) announcement of aggressive easing measures, which include lowering of interest rates and liquidity injection, Chinese-issued U.S. dollar bonds—as represented by the iBoxx USD Asia ex-Japan China—were up 1.18%, while Chinese stocks—as represented by the S&P China 500 (USD)—were up 22.65% in September, lifting their YTD return out of the red to 21.30%.

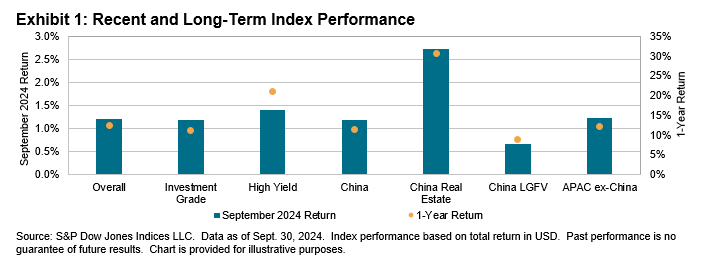

The Asian U.S. dollar bond market ended the month up 1.21%, supported by a 1.19% gain in investment grade bonds and a 1.39% rise in the high yield segment. China Real Estate, which has been one of the best-performing segments since March, rose 2.73%. For the one-year period, the China Real Estate segment was up 30.63%. The APAC ex-China U.S. dollar bond market outperformed the Asian U.S. dollar bond market, albeit marginally, by 1 bp in September.

All rating and maturity segments rallied this month, except for the AA and CCC 0-1 buckets. High yield segments regained their lead, outperforming the investment grade segments by 20 bps after a month of underperformance. Sovereign bonds, which made up 16% of the overall index, also outperformed non-sovereign bonds by 53 bps. Across most rating and maturity segments, the longer end of the curve generated higher returns than the shorter end. Year-to-date, high yield bonds were up 13.91%, while investment grade bonds trailed, posting 5.53%.