March 2024 Commentary

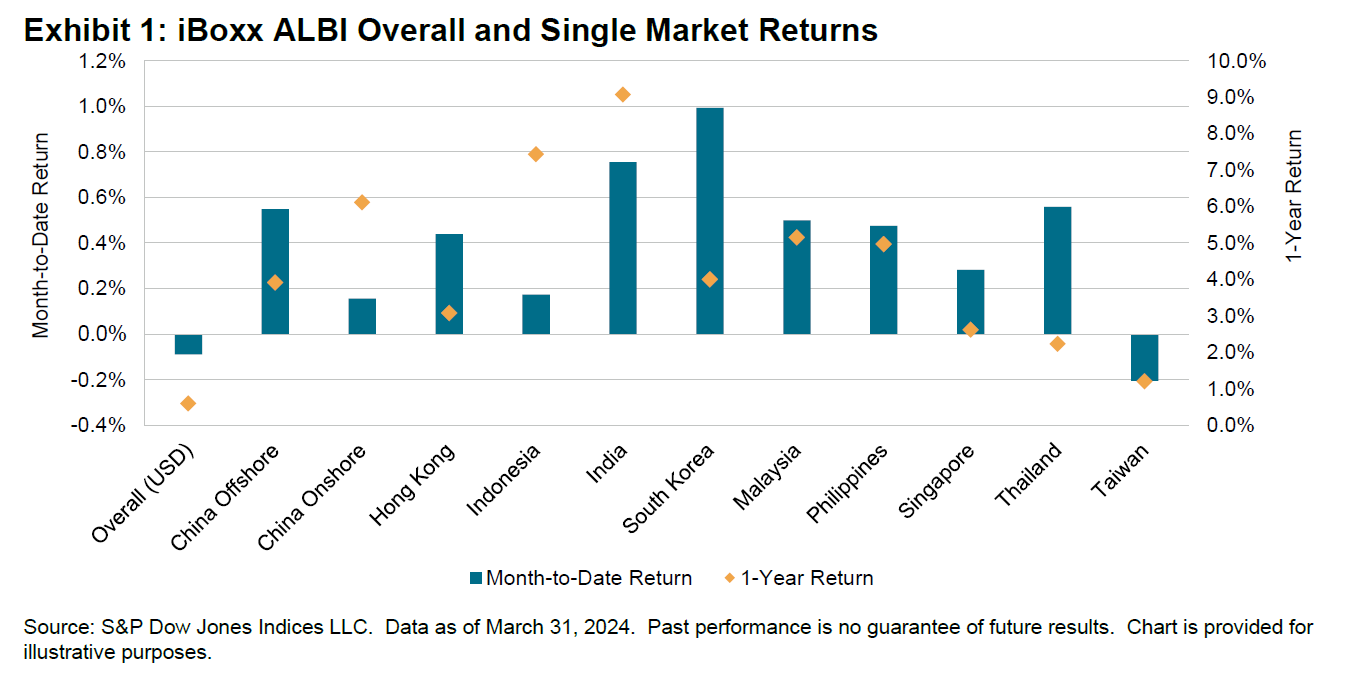

The U.S. Federal Reserve, alongside the European Central Bank (ECB) and most Asian economies, maintained interest rates in March. Swiss National Bank (SNB) became the first major central bank to cut interest rates, after having implemented multiple rate hikes in the past two years as other central banks did globally to battle inflation. On the other hand, Japan introduced its first interest rate hike in 17 years and ended its negative interest rate regime. Regardless of the opposing direction of interest rate changes, the U.S. dollar strengthened and appreciated against the Swiss franc, Japanese yen and most Asian currencies.

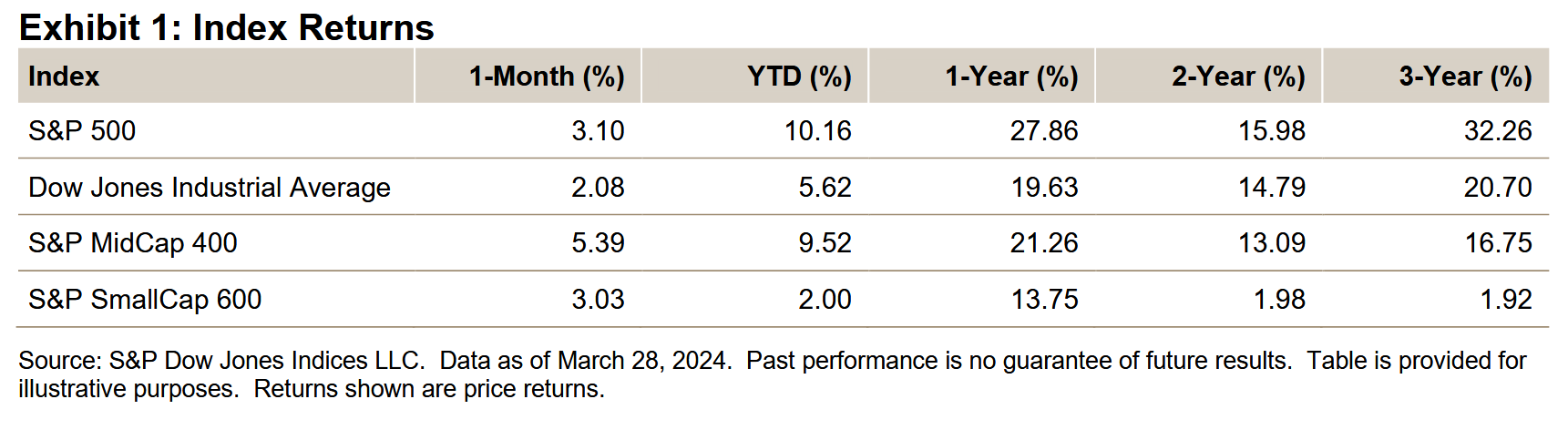

On the equities front, the S&P 500® surpassed its all-time high for the third month in a row as it rallied by 3.10%. This brings the QTD return to 10.16%. U.S. 10-year Treasuries, as represented by the iBoxx USD Treasuries Current 10 Year, gained 0.75% after two consecutive months of losses, and its yield decreased by 7 bps to 4.24%. Despite the gain in March, the QTD return was -1.56%.

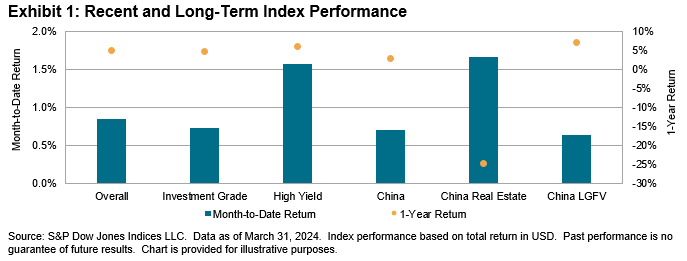

With an accommodative monetary policy, the Chinese yuan was no exception as it weakened against the U.S. dollar and declined to a four-month low in March, before state-owned banks came in to defend the yuan. There was no change in benchmark lending rates after previous months of benchmark mortgage rate cuts and stimulative policy changes. Chinese-issued U.S. dollar bonds—as represented by the iBoxx USD Asia ex-Japan China—returned

0.71%, while Chinese stocks—as represented by the S&P China 500 (USD)—climbed by 0.58%, bringing their QTD returns to 1.64% and -0.83%, respectively.

The Asian U.S. dollar bond market ended the month with a 0.84% gain, supported by a 1.57% rise in the high yield segment and a 0.73% rise in investment grade bonds. The overall market gained 1.17% in the first quarter of the year. While China Real Estate had a good month in March (up 1.66%), it remained the worst-performing segment in the past year (down 24.85%). In contrast, China LGFVs was one of the best-performing segments, with a return of 6.99%.