Featuring iBoxx USD Asia-Pacific

June 2024 Commentary

Divergence in global interest rate policies continued in June as central banks such as the European Central Bank, Bank of Canada and Swiss National Bank cut interest rates by 25 bps. On the other hand, many countries (such as the U.S. and Australia) still wrangled with stubborn inflation levels, and their central banks held existing rates steady. In Asia, most central banks left their interest rates unchanged, and most Asian currencies have depreciated against the U.S. dollar during the first half of the year. One exception was the Hong Kong dollar, which is pegged to the U.S. dollar and flipped the trend of three continuous months of weakening in Q1 with three consecutive months of appreciation against the U.S. dollar in Q2.

In the U.S., the S&P 500® continued to break records as it closed June and Q2 with gains of 3.47% and 3.92%, respectively, bringing its YTD return to 14.48%. 10-year U.S. Treasuries yields—as represented by the iBoxx USD Treasuries Current 10 Year—dropped by 29 bps to 4.26% before climbing in the last week to end the month at 4.42%. Since the start of the year, the 10-year U.S. Treasury yield has gained 50 bps and remained above 4%.

Faced with a weakening currency and challenging economy, the People’s Bank of China (PBoC) opted to keep its benchmark lending rates unchanged. Chinese-issued U.S. dollar bonds—as represented by the iBoxx USD Asia ex-Japan China—returned 0.70%, while Chinese stocks—as represented by the S&P China 500 (USD)—retreated by 3.01%; this brings their Q2 2024 returns to 1.66% and 0.75%, respectively.

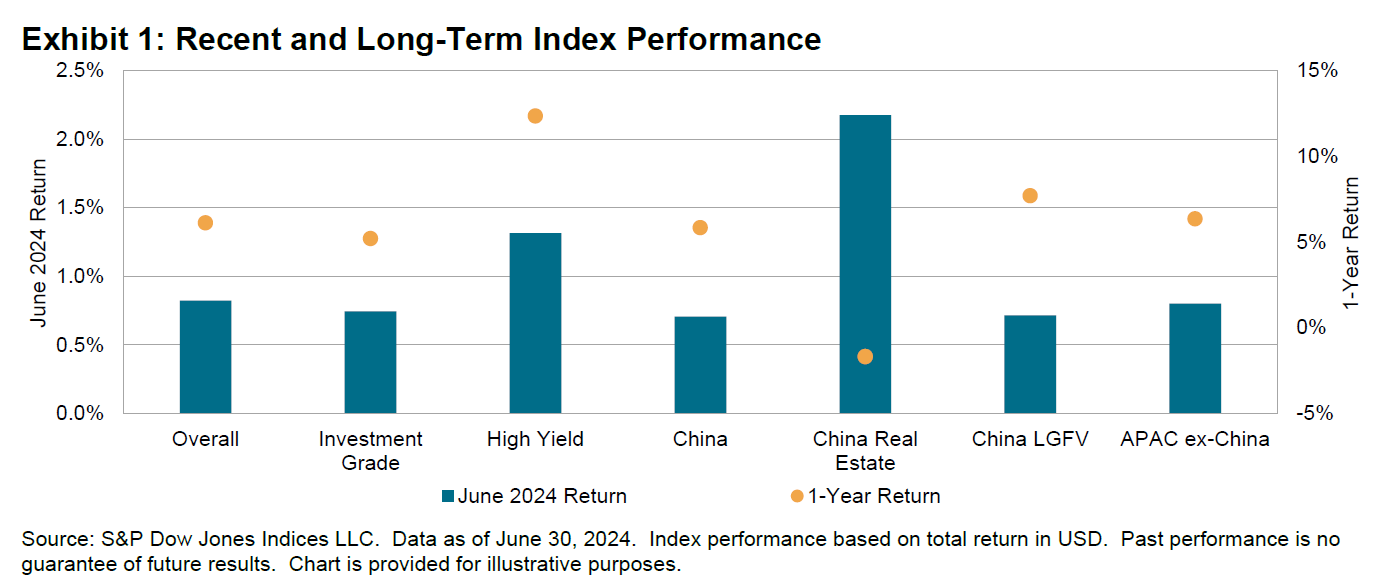

The Asian U.S. dollar bond market ended the month with a 0.82% gain, supported by a 1.31% rise in the high yield segment and a 0.74% rise in investment grade bonds. The overall market gained 1.21% in Q2 and 2.40% on a YTD basis. The China Real Estate segment, which was the worst-performing segment in 2023 (down 1.71%), has become the best-performing segment YTD in 2024 (up 11.81%).

All rating and maturity segments rallied this month, with the exception of the CCC 7-10 Year and 10+ Year high yield buckets, which were dragged down by negative returns from Pakistan bonds. Since the start of the year, the high yield segment has been favored by investors (up 9.72%) and has outperformed the investment grade segment (up 1.35%) on a YTD basis.