Featuring iBoxx USD Asia-Pacific

July 2024 Commentary

Mixed inflation results globally in July led central banks to adopt different policy stances and administer various policy rate moves in their respective economies. On the back of cooling inflation numbers, the Bank of Canada and Bank of England lowered their policy rates. The U.S. Federal Reserve (Fed) also signaled that rates could be cut as soon as September. With the Japanese yen sliding against the U.S. dollar by 13.85% in the first half of 2024, the Bank of Japan raised interest rates to the highest level in 15 years, to 0.25%, causing the yen to sharply rebound in July. Central banks in other key Asian markets, except China, kept interest rates unchanged.

10-year U.S. Treasuries yields—as represented by the iBoxx USD Treasuries Current 10-Year—dropped by 32 bps to 4.10%. This is U.S. Treasuries’ third consecutive positive month, their longest streak since 2021. The S&P 500® reached a new all-time high level in the middle of July but lost steam in the second half of the month after disappointing earnings reports from some large-cap names. The index did, however, close the month with a modest 1.13% gain, with a YTD return of 15.78%.

Sluggish domestic demand continued to add deflationary pressures to China’s economy, threatening its ability to meet the growth target of 5%. To stimulate the economy, the People’s Bank of China (PBoC) announced cuts to its key short-term policy rate, market operations rates and benchmark bank lending rates. Chinese-issued U.S. dollar bonds—as represented by the iBoxx USD Asia ex-Japan China—were up 0.48%, while Chinese stocks—as represented by the S&P China 500 (USD)—were down 1.28%, bringing their YTD return to -0.55%.

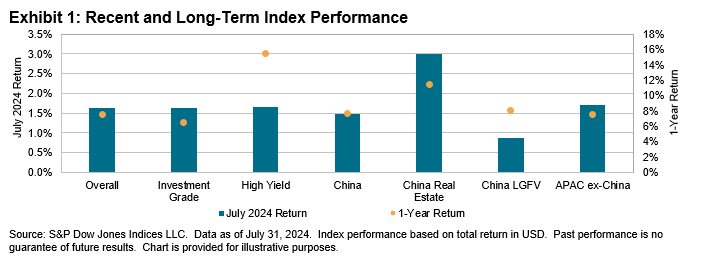

The Asian U.S. dollar bond market ended the month with a 1.64% gain, supported by a 1.65% rise in the high yield segment and a 1.64% gain in investment grade bonds. For the one-year period, the high yield segment was the best performer, with a gain of 13.53%. The China Real Estate segment posted a 3% gain in July and brought its one-year performance out of the negative territory with an 11.45% return. The APAC ex-China U.S. dollar bond market outperformed the Asian U.S. dollar bond market by 8 bps in July.

All rating and maturity segments rallied this month, with the exception of the CCC 7-10 years and B 10+ years buckets, which had no representative bonds. In the first half of the year, high yield segments outshone investment grade segments. In July, investment grade bonds were almost on par with the high yield segment, with the long end of the investment grade segment outperforming the shorter end. At the same time, gains were scattered across the high yield segments. For the YTD period, high yield bonds posted 11.53%, while investment grade bonds posted 3.01%.