Featuring iBoxx USD Asia-Pacific

January 2025 Commentary

In January 2025, the U.S. Federal Reserve decided to hold policy rates unchanged as the unemployment rate stabilized and inflation continued to exceed its target. In Europe, the European Central Bank and the central banks of Sweden and Denmark expressed concerns about sluggish economic growth and opted to reduce rates by 25 bps. In Asia, most central banks kept their rates unchanged, with the exception of Bank Indonesia, which unexpectedly cut interest rates by 25 bps to bolster economic growth and defend its weakening currency. Additionally, the Bank of Japan raised its key short-term interest rate to 0.5%, marking the highest level in 17 years.

After strengthening substantially against most Asian currencies in 2024, the U.S. dollar retreated slightly in January. Among Asian currencies in January, the best performer was the Thai baht (up 1.47%), and the worst performer was the Indonesian rupiah (down 1.27%).

10-year U.S. Treasury yields—as represented by the iBoxx USD Treasuries Current 10-Year—fell by 2 bps to 4.60%. The index was up 0.53% for the month after a 1.72% decline last year. The S&P 500® reached a new all-time high right after President Trump’s inauguration for his second term, concluding the month with a gain of 2.70%.

Chinese equities—as represented by the S&P China 500 (USD)—declined by 0.95% in January, while Chinese-issued U.S. dollar bonds—as represented by the iBoxx USD Asia ex-Japan China—returned 0.71%.

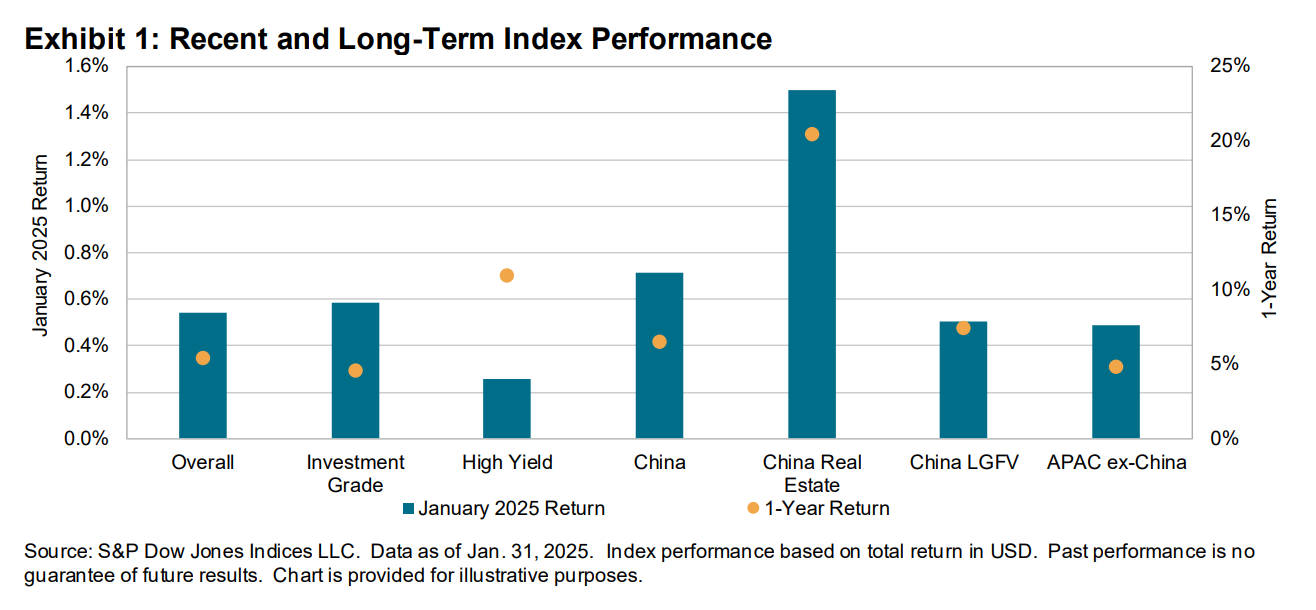

The Asian U.S. dollar bond market ended the month up 0.54%, supported by a 0.59% rise in investment grade bonds, while the high yield segment posted a slightly smaller rise of 0.26%. In terms of the 1-year return, high yield bonds continued to be the best performers (up 10.97%) among the three broad categories, followed by the overall market (up 5.42%) and the investment grade segment (up 4.59%).

China Real Estate reversed its declining trend as it rose by 1.50% in January. It also remained one of the best-performing segments in the past one-year period with a return of 20.45%. The APAC ex-China U.S. dollar bond market underperformed the Asian ex-Japan U.S. dollar bond market by 5 bps in January and by 57 bps for the past one-year period.

Most rating and maturity segments rallied this month, with the exception of the 3-5 Years High Yield and some of the CCC rated buckets. The CCC 10+ and 0-1 Years buckets performed the best in January 2025, up 4.87% and 4.85%, respectively.