January 2024 Commentary

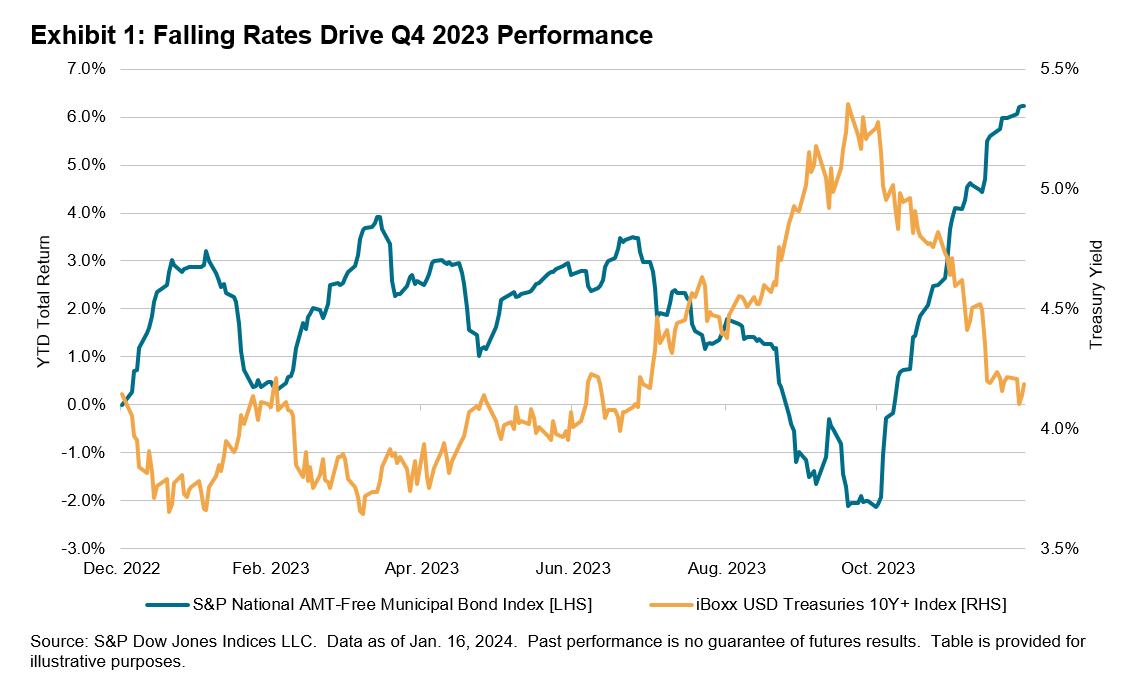

2024 began with no change in interest rates for most of the global and Asian central banks, with the U.S. Federal Reserve and the European Central Bank expressing that they would like to see more signs of inflation dampening, quashing market expectations of rate cuts in the short term. On the fiscal side, the U.S. Treasury department announced a further increase in debt issuances in the next three months, as the federal budget deficit continues to grow. U.S. 10-year Treasuries, which are regarded as the benchmark for global borrowing costs, retreated by 1.79%, as represented by iBoxx $ Treasuries 10Y+, after rallying for two consecutive months.

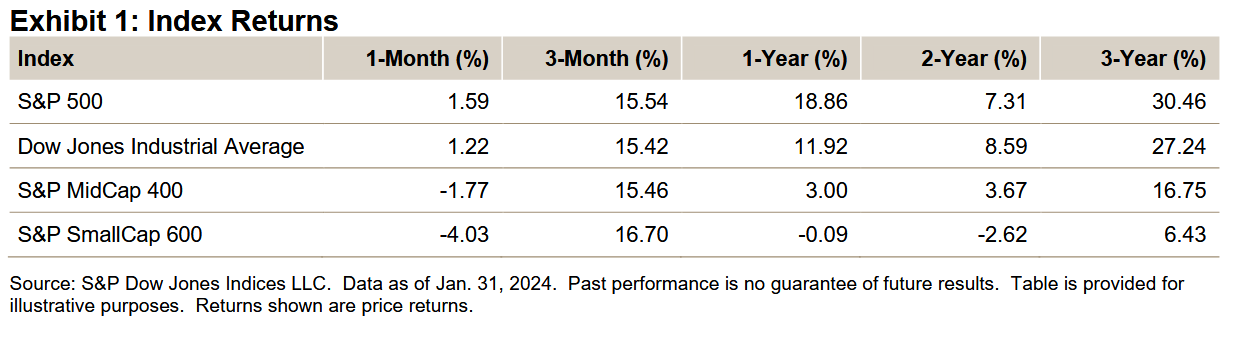

On the equities front, following a 24.24% gain in 2023, the S&P 500® experienced a modest gain of 1.59% in January, unfazed by the higher yields of the 10+ year U.S. Treasuries.

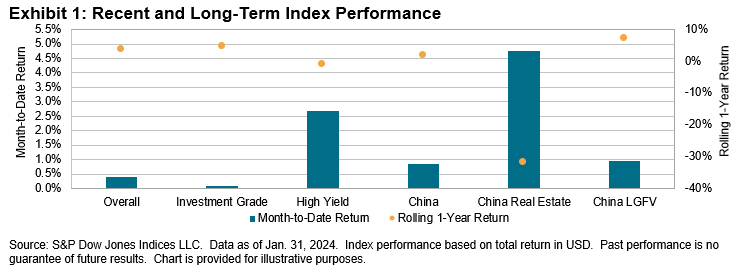

In China, the Real Estate sector continues to be a drag on the economy, as the government expands fiscal injections and targeted policy measures to give support to the weak housing demand and property developers’ liquidity issues. One measure introduced in January was to whitelist development projects eligible for loans and coordinate with financial institutions to issue loans on development projects rather than on the basis of developers. For the month of January, Chinese-issued U.S. dollar bonds—as represented by the iBoxx USD Asia ex-Japan China—gained 0.86%, while Chinese stocks—as represented by the S&P China 500 (USD)—lost 11.03%.

The Asian U.S. dollar bond market started the year with a 0.41% gain, supported by a 2.70% rise in the high yield index and a 0.09% rise in the investment grade index. In terms of the rolling one-year returns, China Real Estate remained the worst-performing segment, losing 31.65%, while China LGFVs were one of the best-performing segments, with a positive return of 7.10%.

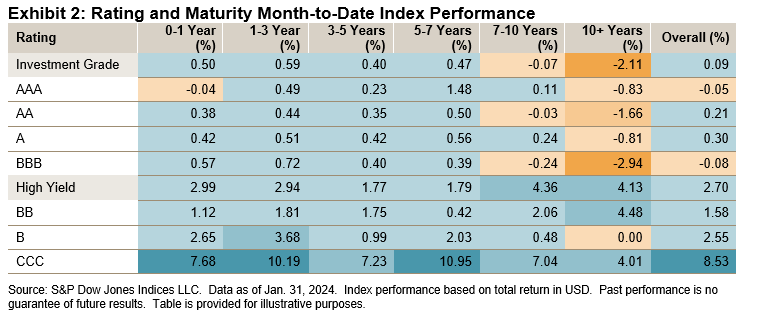

Similar to the U.S. Treasuries 10+ segment, the investment grade long-end maturity buckets broke their two-month uptrend, while short- to medium-end investment grade segments posted slight gains. In the high yield segment, CCC rated bonds rallied the most (up 8.53%).

Of the top seven markets by market value in the index, five posted positive returns in January (Indonesia and Philippines were the two outliers). India, the second-best performer in 2023, was the only top seven market that gained more than 1% this month. Spreads across the five markets that posted positive returns narrowed, while duration lengthened across all markets except for China, Indonesia and Singapore.