Featuring iBoxx USD Asia-Pacific

February 2025 Commentary

Tensions rose among global economies in February when U.S. President Donald Trump announced tariffs targeting key trading partners—Mexico, Canada and China. These countries opposed the tariffs and planned reciprocal measures against the U.S. The tit-for-tat tariffs could reignite inflation and jeopardize economic growth, particularly in the U.S., potentially leading the Federal Reserve to be even more prudent when it comes to policy rates. In Asia Pacific, the Reserve Bank of Australia (RBA) noted progress on inflation and joined other major central banks in cutting interest rates, reducing theirs by 25 bps for the first time since 2020. Similarly, central banks in New Zealand, India, South Korea and Thailand also lowered rates to support economic growth.

Asian currencies exhibited mixed performance against the U.S. dollar in February driven by the rising global trade tensions and varying domestic economic conditions. The Indonesian rupiah weakened the most due to concerns over tariffs and the government’s fiscal policy maneuvers, dropping 1.72% after a 1.27% decline in January.

10-year U.S. Treasury yields—as represented by the iBoxx USD Treasuries Current 10-Year—fell by 34 bps to 4.27%. The index was up 2.97% for the month. The S&P 500® declined 1.42% as concerns over trade tensions and softening economic indicators added to uncertainty about the U.S. economy.

Chinese equities—as represented by the S&P China 500 (USD)—rallied by 6.74% in February fueled by enthusiasm around China’s AI sector, while Chinese-issued U.S. dollar bonds—as represented by the iBoxx USD Asia ex-Japan China—returned 1.39%.

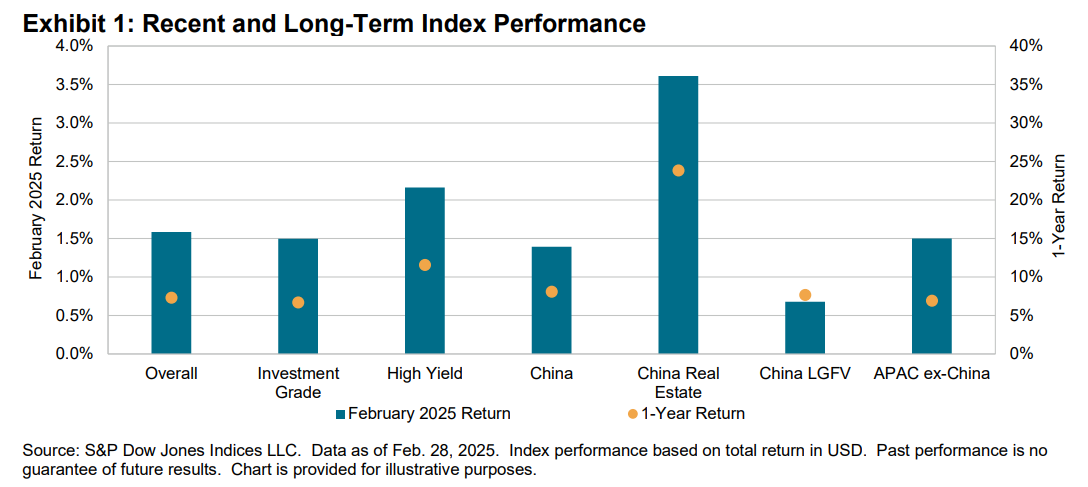

The Asian U.S. dollar bond market concluded the month up 1.58%, propelled by a 2.16% return from the high yield bonds and a 1.50% return from investment grade bonds. In terms of the one-year return, high yield bonds continued to lead in performance (up 11.55%) among the three broad categories, followed by the overall market (up 7.32%) and the investment grade segment (up 6.67%).

China Real Estate sustained its momentum from the last month and rose another 3.61% in February. It also stood out as one of the best-performing segments in the past one-year period with a return of 23.83%. The APAC ex-China U.S. dollar bond market underperformed the Asian ex-Japan U.S. dollar bond market by 8 bps in February and by 41 bps for the past one-year period.

All rating and maturity segments gained this month. In sync with the performance of U.S. dollar Treasuries, the longer-dated bonds generally outperformed, with 10+ year segments appreciating close to 4%. Among the CCC rated bonds, the 3-5 year segment performed the best as many of the China Real Estate bonds fall within this category.