February 2024 Commentary

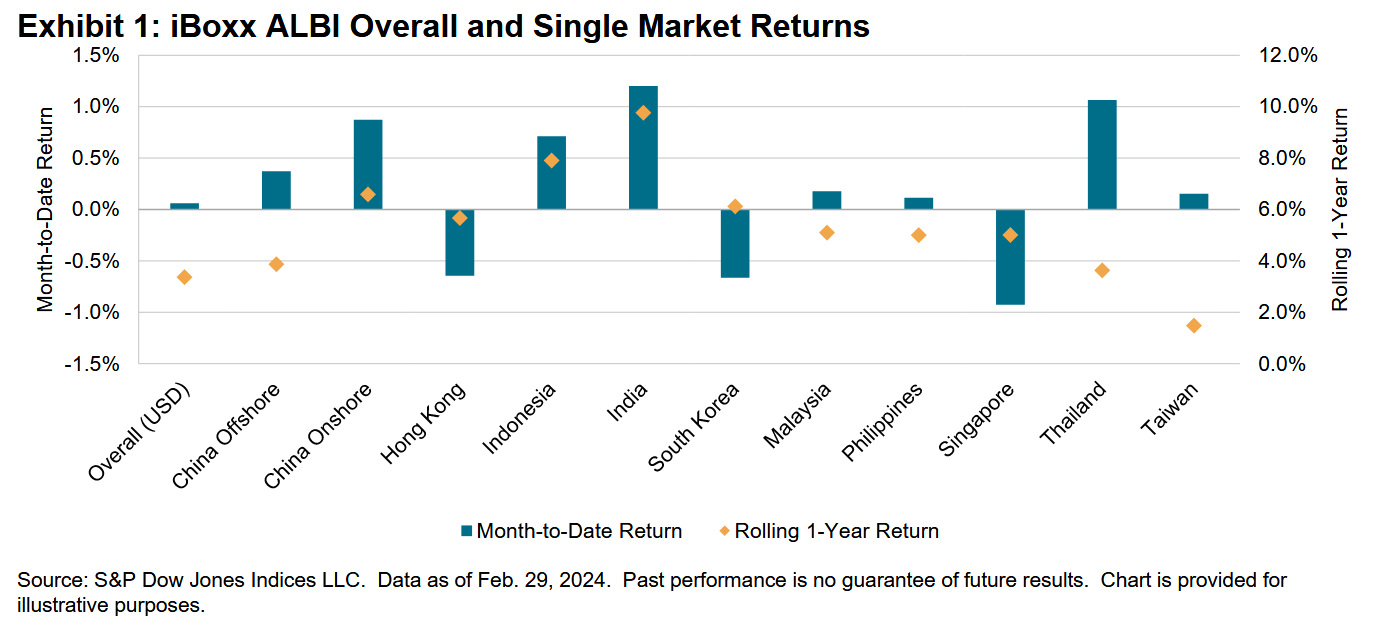

Global central banks continued to hold rates steady in the month of February, and it has been close to half a year since most monetary policymakers, including the European Central Bank and U.S. Federal Reserve, introduced any interest rate changes. In Asia, central banks have been paying close attention to their currencies’ strength against the U.S. dollar when assessing their countries’ economic conditions and interest rate policies. Most Asian currencies have depreciated against the dollar since the start of the year.

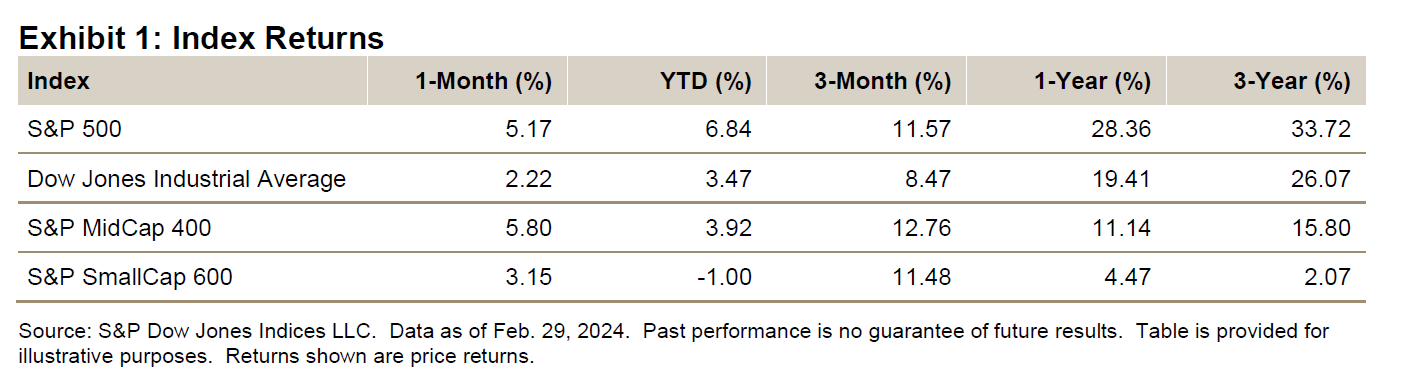

February 2024 was the second consecutive month the S&P 500® broke its all-time high, as it rallied by 5.17%. U.S. 10-year Treasuries, as represented by the iBoxx $ Treasuries 10Y+, continued to give up their 2023 gains, retreating 2.39%. This brings their YTD return to -4.14% and yield to 4.53%.

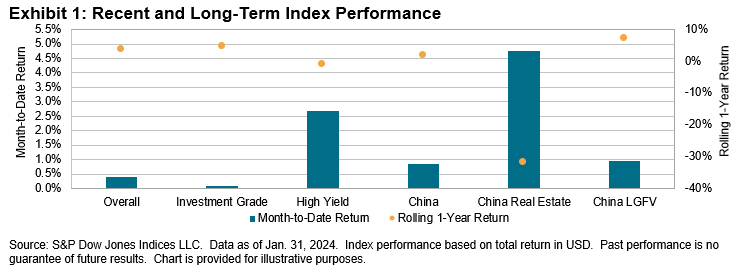

In China, following the fall of new home prices in January despite stimulative policy changes, the People’s Bank of China (PBoC) persisted in its efforts to revive the property market by unveiling its largest ever reduction in benchmark mortgage rate, slashing the five-year loans prime rate by 25 bps (to 3.95%). This would reduce the cost of new residential purchases and ease repayment pressure on existing home loans. For the month of February, Chinese-issued U.S. dollar bonds—as represented by the iBoxx USD Asia ex-Japan China—returned 0.07%, while Chinese stocks—as represented by the S&P China 500 (USD)—fell to their eight-year low before rebounding and gaining 9.08% during the month.

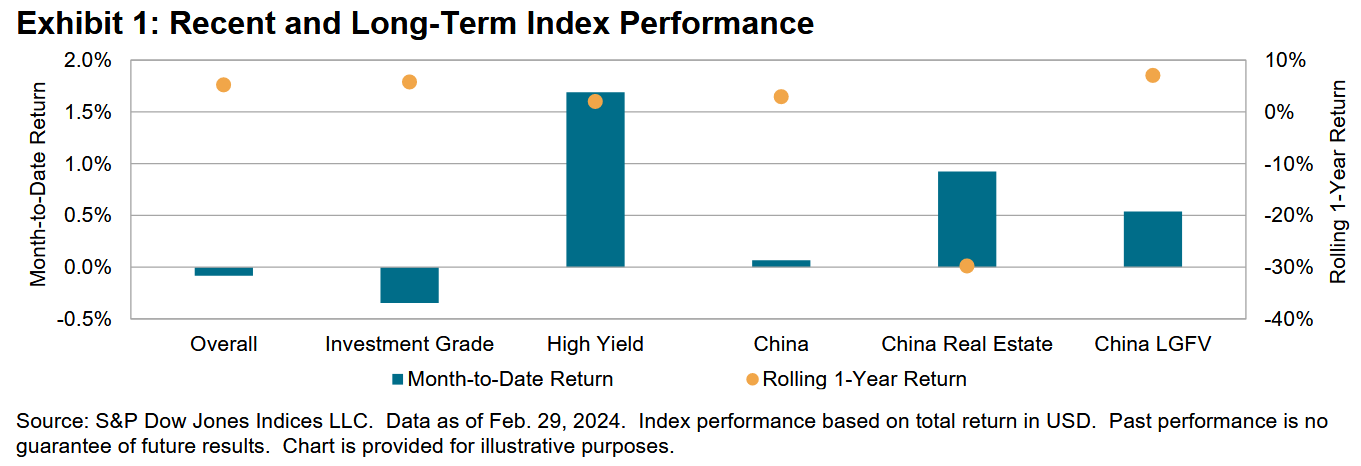

The Asian U.S. dollar bond market’s second month of the year ended with a 0.08% loss, supported by a 1.69% rise in the high yield index and a 0.35% loss in the investment grade index. In terms of the rolling one-year returns, China Real Estate remained the worst-performing segment, at -29.80%, while China LGFVs was one of the best-performing segments, with a return of 7.03%.

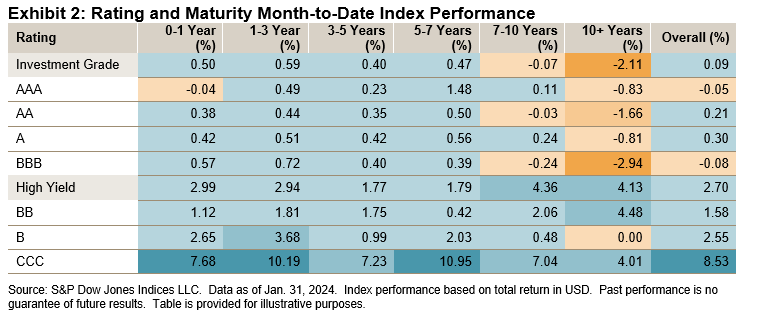

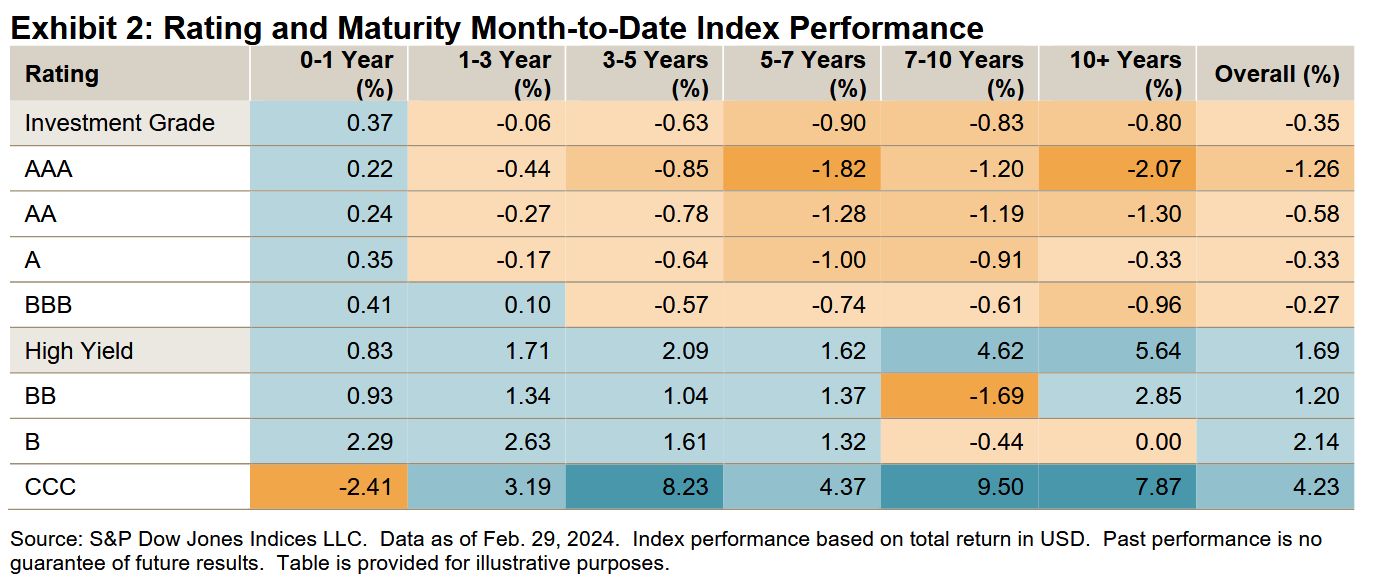

Aside from the 0-1 year segment, which posted modest gains (except CCC bonds), there was a rather stark contrast in the performance of the investment grade and high yield rated bonds this month. The investment grade bonds retreated slightly, as the AAA 10+ years segment posted the second-worst performance at -2.07%. On the flipside, high yield bonds mostly climbed, especially the 7-10 years and 10+ years segments, returning 4.62% and 5.64%, respectively.

Half of the top seven largest markets by market value in the index posted negative returns. Spreads across all seven markets narrowed, while duration shortened across all markets except for South Korea, which experienced no change.