Featuring iBoxx USD Asia-Pacific

December 2024 Commentary

During 2024, global central banks significantly reduced interest rates as they work to guide their economies toward their respective neutral policy rates in response to easing inflation and decelerating growth. The U.S. Federal Reserve implemented a 25 bps rate cut for the second month in a row, prompting several economies (including Hong Kong, which ties its currency to the U.S. dollar) to follow suit. Also in December, the European Central Bank, facing concerns over political instability and slow growth, reduced rates for the fourth time in 2024. Meanwhile, most central banks in the Asia-Pacific region opted not to change interest rates in December, with the notable exception of the Bangko Sentral Ng Pilipinas, which announced a 25 bps cut the day after the U.S. Federal Reserve's decision.

Trump’s election win in the U.S. continued to provide a boost to the U.S. dollar against most Asian currencies, wiping out Asian currencies’ gains from earlier in the year. Among Asian currencies in 2024, the best performer was the Malaysian ringgit (up 2.52%) and the worst performer was the Korean won (down 14.31%).

10-year U.S. Treasury yields—as represented by the iBoxx USD Treasuries Current 10-Year—rose by 40 bps to 4.62%. The index was down 2.76%, bringing its 2024 return to -1.72%. The S&P 500® receded from the 6,000 mark and declined by 2.50%, bringing its YTD return to 23.31%.

Chinese equities—as represented by the S&P China 500 (USD)—climbed slightly by 0.49% in December and was up 12.53% for the full year. This was the first positive year for the index after three years of double-digit losses.

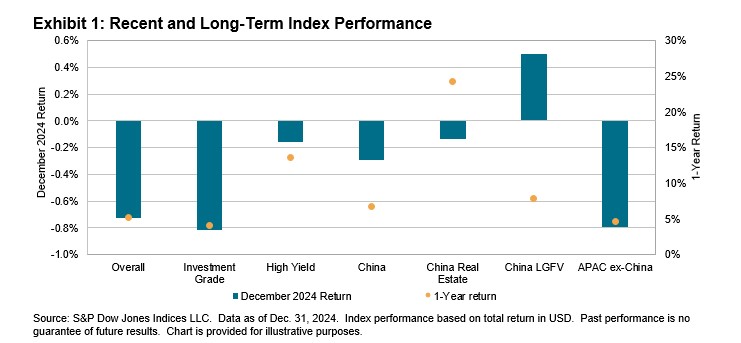

The Asian U.S. dollar bond market ended the month down 0.73%, weighed down by a 0.81% drop in investment grade bonds, while the high yield segment posted a slight loss of 0.16%. High yield bonds were the best performers in 2024 (up 13.68%), followed by the overall market (up 5.28%) and the investment grade segment at (up 4.08%).

China Real Estate extended its decline for a second consecutive month by 0.13%, however it remained one of the best-performing segments in 2024, returning 24.33%. The APAC ex-China U.S. dollar bond market underperformed the Asian (ex-Japan) U.S. dollar bond market by 4 bps in December and by 65 bps in 2024.

The long-end investment grade segments retreated the most in December after gaining the most last month, while the ultrashort 0-1 maturity segment extended its gains from last month. The BB rated segments performed the best this month with all maturity bands in the black. Sovereign bonds, which make up approximately 16% of the overall index, underperformed non-sovereign bonds by 200 bps in December, and 416 bps in 2024. The yields of the Real Estate segment rose by 107 bps to 10.90% in December, bringing it back above 10% after five months of closing below that level. All key segments shown in Exhibit 2 posted negative returns in December and Q4, but they still delivered positive returns in 2024, supported by the strength of the first three quarters of the year.