December 2023 Commentary

To suppress the effects of the post-pandemic inflation, central banks around the world have been hiking interest rates since 2021. However, signs of slowing inflation have been observed since Q2 2023, and most central banks in Asia held rates steady in Q4 2023, as did the U.S. Federal Reserve and European Central Bank. As the pause in rate hikes has been extended, market sentiment has increasingly shifted toward predicting rate cuts in the new year. Bolstered by the expectations of potentially lower interest rates, the iBoxx $ Treasuries 10Y+, which is regarded as a benchmark for global borrowing costs, climbed 8.21% in December, bringing its Q4 and one-year returns to 12.12% and 3.47%, respectively. Despite the impressive performance in Q4 2023, 10+-year U.S. Treasury yields were still at 4.19%, 4 bps above the level at the end of 2022.

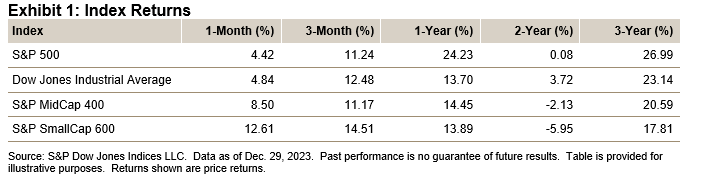

For the second month in a row, the S&P 500® rallied in tandem with the iBoxx $ Treasuries 10Y+, gaining 4.42% and bringing its Q4 and one-year returns to 11.24% and 24.23%, respectively.

Contrary to the policy stance of other central banks in 2023, the People’s Bank of China maintained an accommodative monetary stance by lowering its key policy rate and carrying out multiple liquidity injection operations to support its economy impacted by the real estate market slump, local government debt risks and slow economic growth. For the year, Chinese-issued U.S. dollar bonds—as represented by iBoxx USD Asia ex-Japan China—returned 4.07%, while Chinese stocks—as represented by the S&P China 500 (USD)—lost 14.25%.

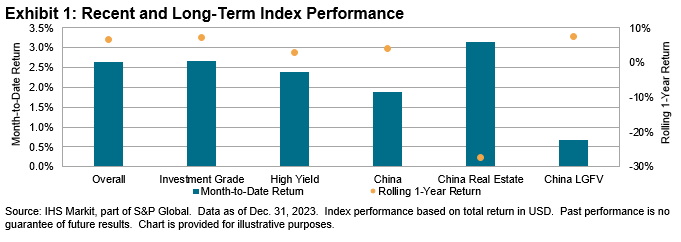

The Asian U.S. dollar bond market kept the positive momentum from last month as the overall index rose 2.64%, with the investment grade and high yield segments climbing 2.67% and 2.38%, respectively. In terms of the rolling one-year returns, China Real Estate remained the worst-performing segment, at -27.50%, while China LGFVs were one of the best-performing segments, with a positive return of 7.59%.

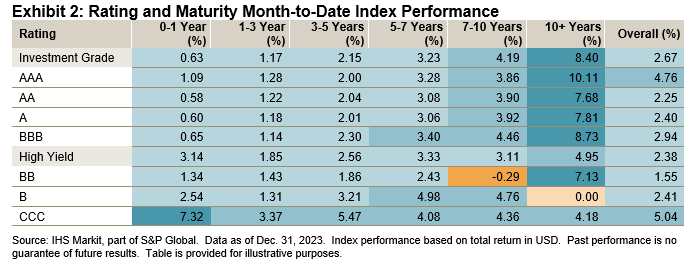

Almost all rating and maturity segments continued their uptrend from November to December, with the long-end maturity buckets performing the best. In particular, the 10+ years segment of the USD-denominated Asia bond market rallied the most in 2023, with a gain of 13.01%, after being the worst performer in 2022, with a loss of 23.47%.

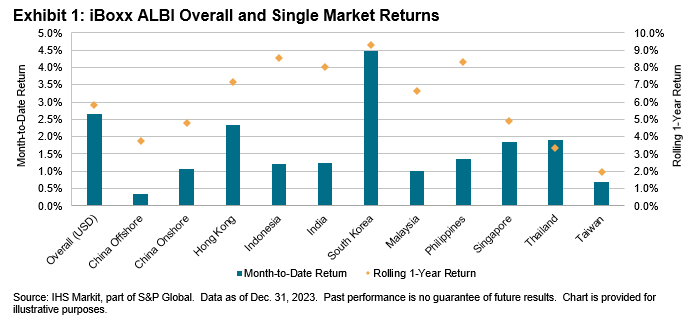

All of the top seven markets by market value in the index posted positive returns in December, as well as for 2023. The three best-performing markets in December were also the best-performing markets for the year overall: Indonesia (4.94% in December; 9.88% in 2023), India (2.87% in December; 9.56% in 2023) and the Philippines (4.14% in December; 9.03% in 2023). Spreads across all seven markets narrowed by at least 30 bps, while duration lengthened across all markets except for South Korea.