Featuring iBoxx USD Asia-Pacific

August 2024 Commentary

Cooler inflation numbers globally have led to more central banks shifting toward monetary easing for their respective economies. Citing a slowdown in the labor market and progress made toward restoring price stability, the U.S. Federal Reserve (Fed) indicated that they are on track to cut interest rates. In Europe, central banks in Sweden and the Czech Republic have already lowered their policy rates several times in 2024. In Asia-Pacific, the central banks of New Zealand and the Philippines have joined the camp of central banks to lower their key policy rates ahead of the Fed.

The U.S. dollar weakened against most Asian currencies in August, except for the Indian rupee. Both the Malaysia ringgit and Indonesia rupiah strengthened at least 5% against the dollar. The depreciation of the dollar has clawed back most of the currency gains it had on Asian currencies in the first half of the year.

10-year U.S. Treasury yields—as represented by the iBoxx USD Treasuries Current 10-Year—dropped by 13 bps to 3.96%. This is their fourth consecutive positive month and their longest streak since 2021. At the start of the month, the S&P 500® dipped to May 2024 levels after recession fears struck the market, but it recovered to near all-time high levels after U.S. consumer spending was reported to have increased in July with moderate inflation numbers. The index closed the month up 2.28% and at 18.42% YTD.

The People’s Bank of China (PBoC) left rates unchanged after their recent move in July. Chinese-issued U.S. dollar bonds—as represented by the iBoxx USD Asia ex-Japan China—were up 1.18%, while Chinese stocks—as represented by the S&P China 500 (USD)—were down 0.55%, bringing their YTD return to -1.10%.

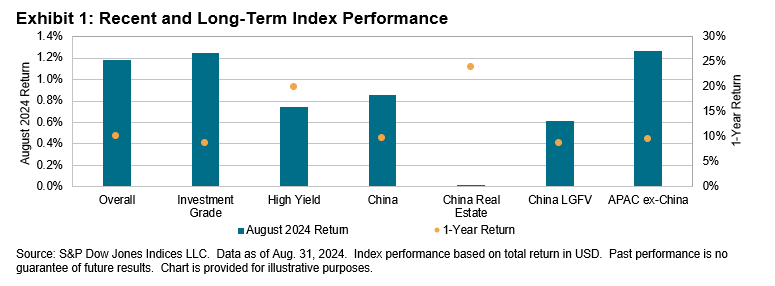

The Asian U.S. dollar bond market ended the month with a 1.18% gain, supported by a 1.25% gain in investment grade bonds and a 0.74% rise in the high yield segment. China Real Estate, which has been one of the best-performing segments since March, was one of the weaker-performing segments in August despite a gain of 0.02%. Nevertheless, for the one-year period, the China Real Estate segment gained 23.91%. The APAC ex-China U.S. dollar bond market outperformed the Asian U.S. dollar bond market by 9 bps in August.

All rating and maturity segments rallied this month, except for the CCC buckets. The tides changed after seven consecutive months of high yield segments outshining their investment grade counterparts. Investment grade bonds outperformed high yield bonds by 51 bps in August. Sovereigns bonds, which make up 15% of the overall index, also outperformed non-sovereign bonds by 83 bps. Across most rating and maturity segments, the longer end of the curve outperformed the shorter end. Year-to-date, high yield bonds returned 12.35%, while investment grade bonds trailed, posting 4.29%.