Monthly performance, maturity, yield and duration of the iBoxx ALBI, iBoxx ABF and iBoxx SGD Indices.

Across the globe, 2024 will bring more than 50 elections and over a billion voters going to the polls, including in Taiwan (just ended), Indonesia, South Korea and India, as well as the U.S. toward the end of the calendar year. The outcome of the elections will no doubt have an impact on fiscal policies and the broader financial markets.

As January went on, expectations of the first U.S. interest rate cut in March were dampened after statements made from the Federal Reserve Chair at the FOMC meeting at the end of the month. Rates were unchanged after the meeting, which highlighted elevated inflation persisting despite slowing over the past year, as well as strong data on the economy and unemployment fronts.

In the immediate aftermath, the S&P 500® erased some gains that were accumulated through the month, but still managed a 1.59% return in January. In contrast, Chinese stocks—as represented by the S&P China 500 (USD)—started the year on the wrong foot, losing 9.61%. Similarly, broader Asian markets—as represented by the S&P Pan Asia Ex-Japan LargeMidCap (USD)—lost ground by 4.47%.

U.S. Treasuries, usually thought of as a safe haven, lost 0.22% in January, as represented by the iBoxx $ Treasuries.

iBoxx Asian Local Bond Index (ALBI)

Sign up to receive updates via email

Sign Up

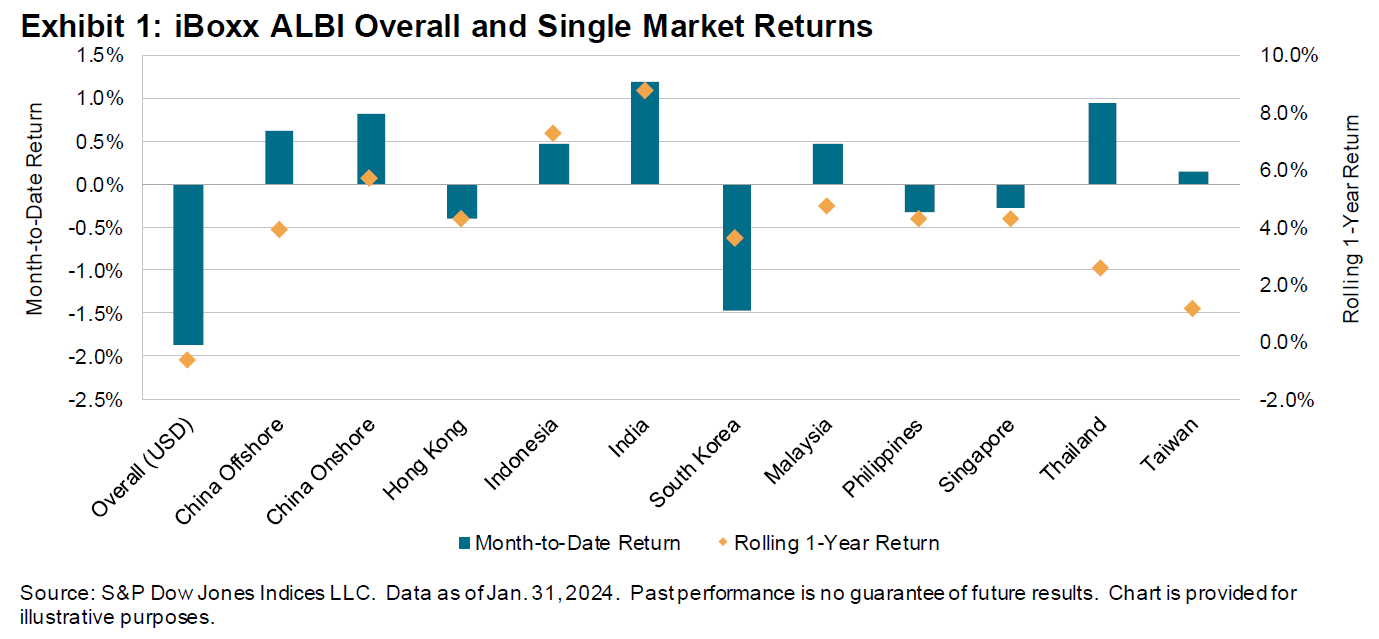

In Asian fixed income, Asian local currency bonds—as represented by the iBoxx Asian Local Bond Index (ALBI) (USD Unhedged)—pulled back 1.86%, owing to a combination of mixed performance in the local bond markets and the relative strength of the U.S. dollar against the local currencies as we start the year.

In local currency terms, India (up 1.19%) and Thailand (up 0.95%) were the best performers. China On- and Offshore bonds were not far behind, returning 0.82% and 0.63%, respectively. South Korea, the best-performing market in 2023, was bottom of the pile as we started 2024, losing 1.47% in January.

Gains were observed across local bond markets in the short-end 1-3 year maturity segment. However, performance became mixed as we look to longer maturity segments. China Onshore 10+ and China Offshore 10+ fared the best, returning 3.26% and 2.40%, respectively. On the other hand, South Korea 10+ (down 3.35%) and Hong Kong 10+ (down 2.72%) were the worst-performing segments.

As January ended, the overall index yield increased by a modest 3 bps to 3.88%. India remained the highest-yielding bond market in the index, posting 7.22%, while China Onshore (2.52%) represented the lowest-yielding market.