iBoxx Tadawul SAR Government Sukuk Index

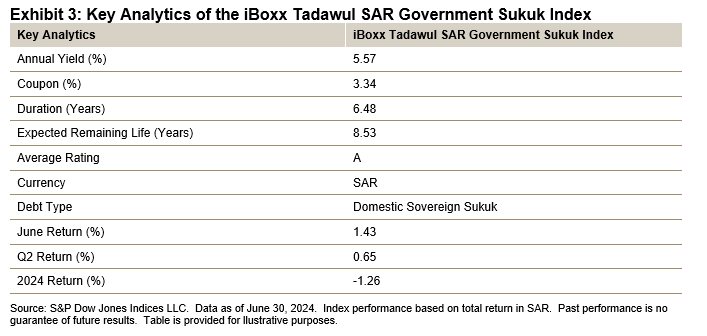

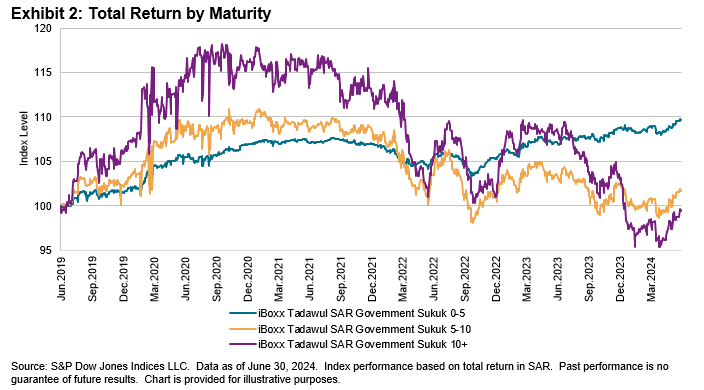

Following Q1’s -1.89% return, the iBoxx Tadawul SAR Government Sukuk Index began Q2 down 1.52% in April, inching closer toward the lows of October 2022 before recouping its losses with two consecutive months of gains (up 0.75% in May and 1.43% in June). The index closed Q2 up 0.65%, bringing its YTD return to -1.26%.

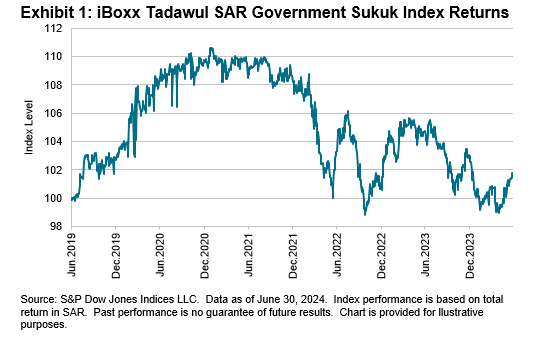

In Q2, the 10+ year segment, which is the most sensitive to interest rate changes, performed the best at 0.82%, followed by the 0-5 year segment (up 0.60%) and the 5-10 year segment (up 0.59%). On a YTD basis, the 10+ year segment was still in the red (down 3.56%) due to its lackluster performance in Q1. Year-to-date, the 0-5 year sleeve was the only segment in the black, up 0.76%, while the 5-10 year segment was down 0.84%.