iBoxx Tadawul SAR Government Sukuk Index

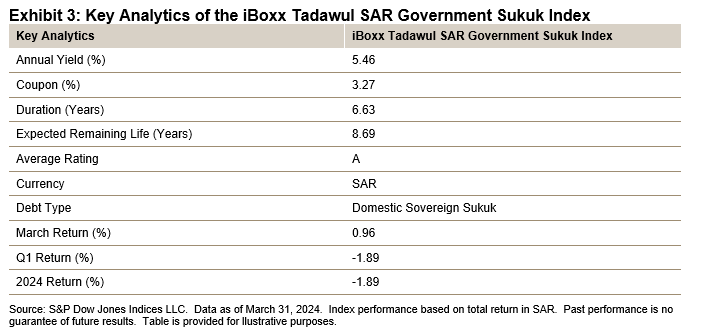

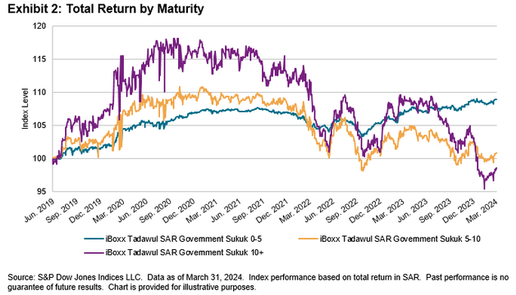

The iBoxx Tadawul SAR Government Sukuk Index started the year with two consecutive months of losses (-2.41% and -0.42%), almost revisiting the lows of October 2022 in February before rebounding with a 0.96% gain in March. The index closed the first quarter of the year with a -1.89% return.

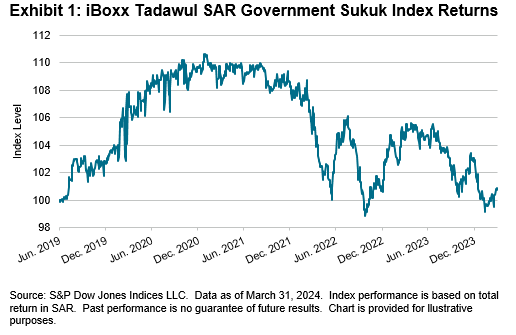

In Q1, the 0-5 year segment maintained its lead and performed the best, up 0.16%, followed by the 5-10 year maturity segment, which was down 1.43%. The 10+ year maturity segment, which is the most sensitive to interest rate changes, dropped to an all-time low in February before recovering by 1.22% in March, bringing its Q1 return to -4.35%.