Featuring iBoxx USD Emerging Markets Broad Saudi Arabia Sovereigns

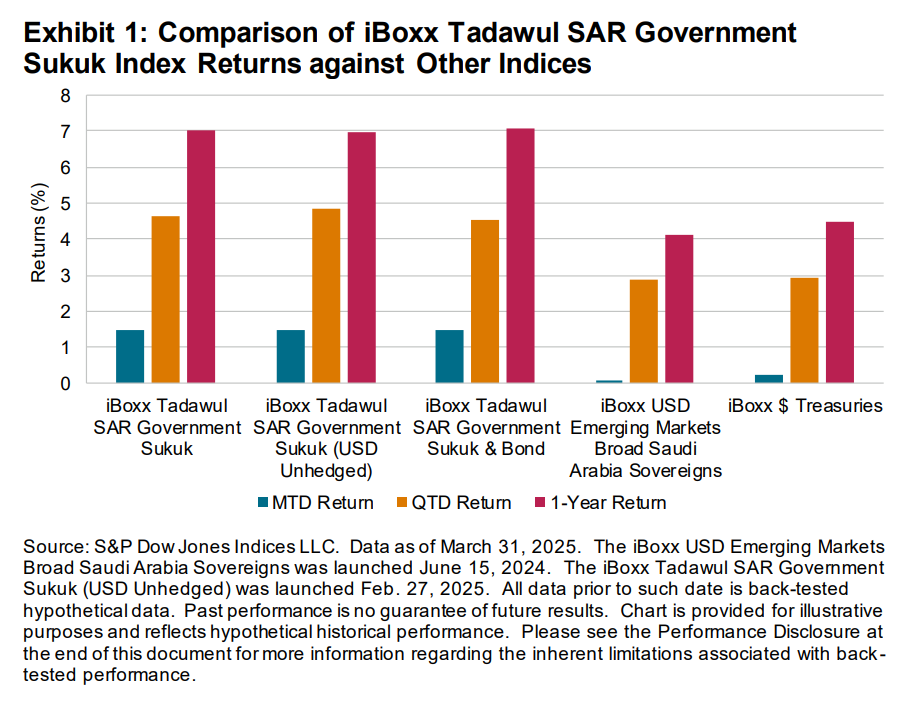

In Q1 2025, the iBoxx Tadawul SAR Government Sukuk Index recorded three consecutive months of gains and concluded the quarter up 4.66%. Since the Saudi riyal is pegged to the U.S. dollar, the local currency and USD unhedged versions of the iBoxx Tadawul SAR Government Sukuk Index exhibited similar performance due to only negligible currency fluctuations. SAR-denominated bonds make up less than 2% of the iBoxx Tadawul SAR Government Sukuk & Bond Index, resulting in minimal deviations in performance when compared to the sukuk-only index. The Kingdom of Saudi Arabia diversifies its debt portfolio between domestic and international financing, with USD-denominated debt being the primary source of international issuances. The iBoxx USD Emerging Markets Broad Saudi Arabia Sovereigns Index tracks the performance of USD-denominated government sukuk and bonds.

The performance of USD-denominated securities resembles that of U.S. Treasuries more closely than other indices shown in Exhibit 1. This similarity stems from the USD-denominated debt interest rate curve reflecting the prevailing U.S. Treasuries interest curve with a credit spread compensating for the additional risk associated with the Saudi Government compared to the U.S. government, which is the issuer of the U.S. dollar.

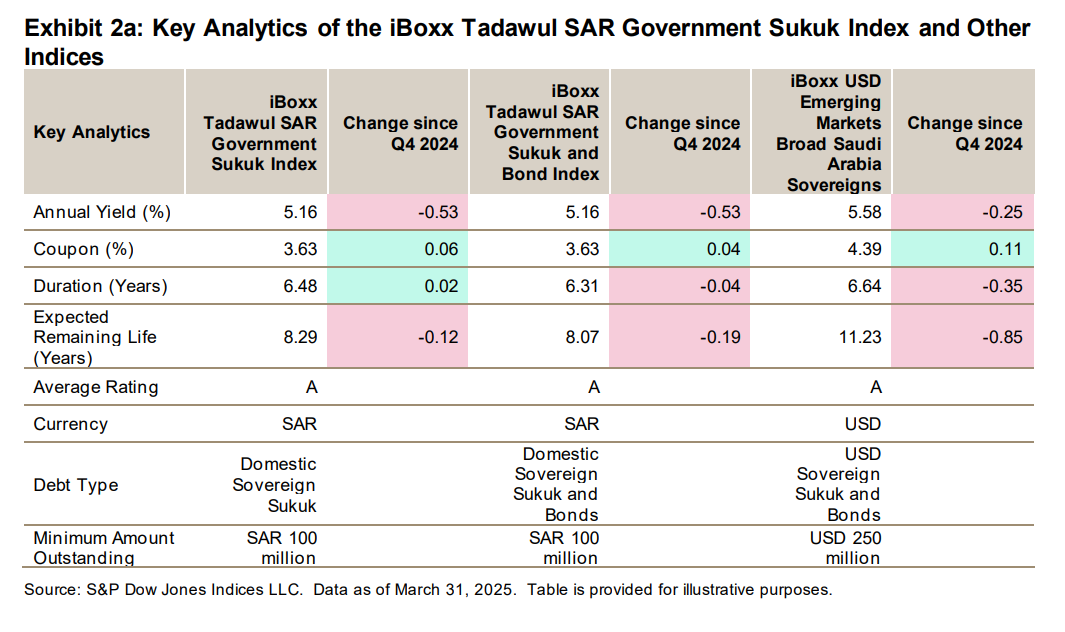

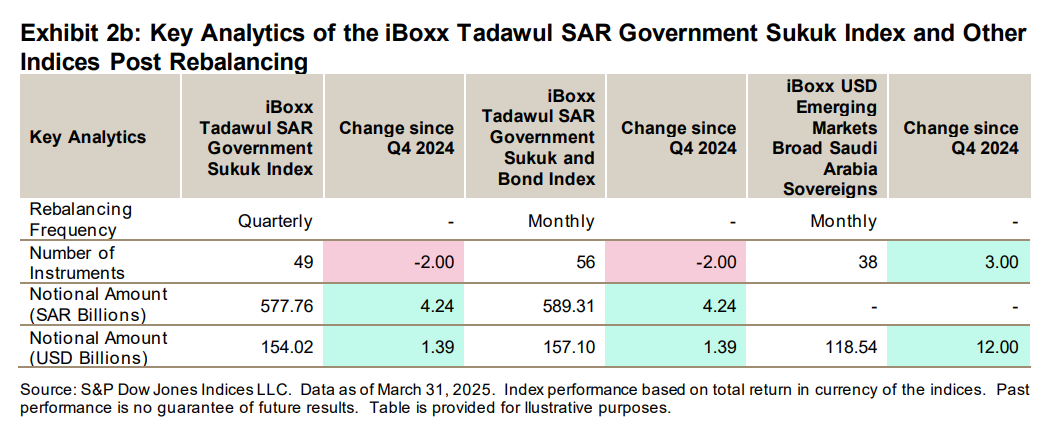

Diving into index analytics in Exhibit 2, the annual yield of the SAR-denominated indices reduced by 53 bps to 5.16% while the USD-denominated debt yield only decreased by less than half of the SAR-denominated debt (down 25 bps). Duration for SAR-denominated indices remained largely unchanged while the USD-denominated debt duration shortened by 0.35 years. Post rebalancing, the number of iBoxx Tadawul SAR Government Sukuk Index constituents fell from 51 to 49, after two sukuk with notional amounts of approximately SAR 7.00 billion and SAR 3.78 billion matured. Saudi Arabia did not issue any new SAR-denominated sukuk in Q1, choosing instead to tap existing issuances. However, they did issue new USD-denominated debt totaling USD 12 billion through three bond offerings during the same period.