September 2022 Performance

The rise in headline inflation continued to underpin the market narrative in Singapore. On a year-over-year basis, the Monetary Authority of Singapore (MAS) Core Consumer Price Index (CPI) climbed to 5.1% in August from 4.8% in July, while the CPI-All Items rose to 7.5% in August, up from 7.0% the month before. Food, Services and Private Transport were the main components contributing to the price pickup in the CPI measures.

As global central banks stepped up their fight against inflation and raised rates aggressively, the Singapore government bond yields have been on an uptrend analogous to those seen in other major economies. In September, the 10-year Singapore sovereign benchmark yield reached 3.49%, the highest level since July 2008. Against this backdrop, neither stocks nor bonds were able to build up any positive local momentum.

The Strait Times Index shed 2.84% this month, as the market assesses the implications of further rises in inflation risk and bond yields for economic activities domestically and abroad.

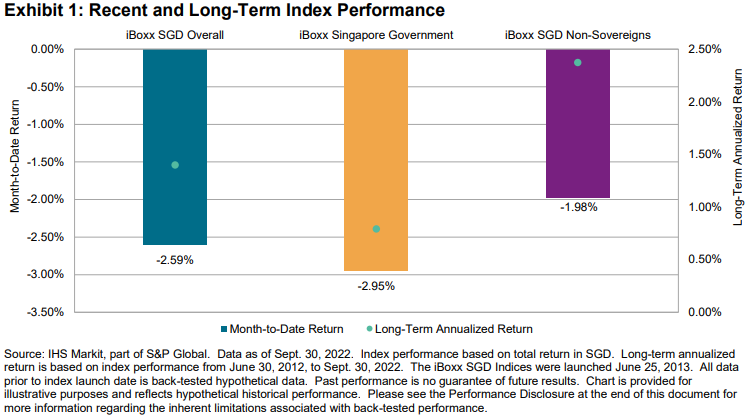

Similarly, the iBoxx SGD Overall Index dropped 2.59% this month and 9.04% YTD, resuming its monthly downtrend this year. The index finished the third quarter with a duration of 6.68 years and a yield of 3.70%.

With a proportion of over 60% by market value in sovereign bonds, the performance of the overall index this month was largely dragged down by sovereign bonds, which underperformed non-sovereign bonds by 97 bps.

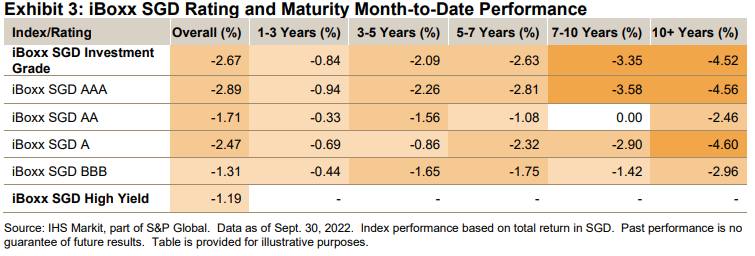

Amid a rapid rate-rising environment this month, all individual rating subindices fell into the red, with the sharpest declines generally observed in the mid-to-long end of the curve. Among the rating subindices, the best relative performance came from sectors rated BBB and below, notably the high yield subindex, which outperformed the investment grade subindex by 148 bps.

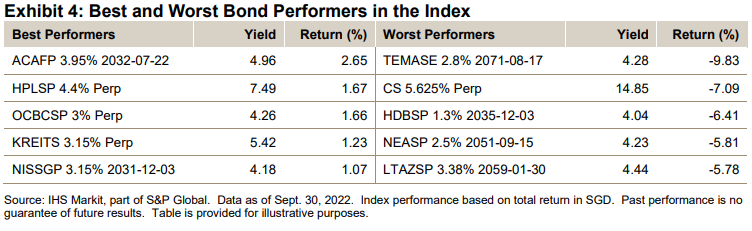

The top five performers were all corporate bonds in the 1-10 year maturity segment, with four subordinated hybrid securities from the Financials sector and one senior fixed-rate debt (NISSGP) from the Consumer Services sector.

On the other side, the worst five performers were all sub-sovereign bonds, except for a subordinated fixed-to-float perpetual bond by Credit Suisse Group AG (CS). These laggards each dropped more than 5% in the index this month.