Monthly performance, maturity, yield and duration of the iBoxx ALBI, iBoxx ABF and iBoxx SGD Indices.

As anticipated, the U.S. Fed started its rate cut cycle in September, starting off with a 50 bps cut. This buoyed U.S. financial markets, with key indices across U.S. equities and U.S. fixed income reporting decent gains. The S&P 500® continued its good run, inching up 2.02% in September. U.S. fixed income—as represented by the iBoxx $ Overall—returned 1.38% for the same period, with corporate bonds (up 1.72% as represented by the iBoxx $ Corporates) outperforming U.S. Treasuries (up 1.24% as represented by the iBoxx $ Treasuries).

Monetary easing measures have also been implemented across other significant economies in September, such as those in the eurozone (down 60 bps) and Switzerland (down 25 bps), reflecting a broader trend in economic policy shifts. In Asia, there were also actions taken by the People’s Bank of China, Hong Kong Monetary Authority and Bank Indonesia.

The People’s Bank of China announced a 50 bps cut in the Reserve Requirement Ratio (RRR) for financial systems. Additionally, new measures pertaining to relaxed regulations on home purchases were introduced, including lowering the minimum-down-payment ratio from 25% to 15%, as well as a general reduction in interest rates on existing mortgages to ease the burden of repayments. Chinese equities—as represented S&P China 500 (USD)—responded positively to the stimulus with a large gain of 22.65% in September.

Bank Indonesia also executed its first rate cut in more than three years, reducing its key rate by 25 bps, with the goal of boosting the economy. Hong Kong followed suit with a 50 bps reduction after the move by the U.S. Fed.

iBoxx Asian Local Bond Index (ALBI)

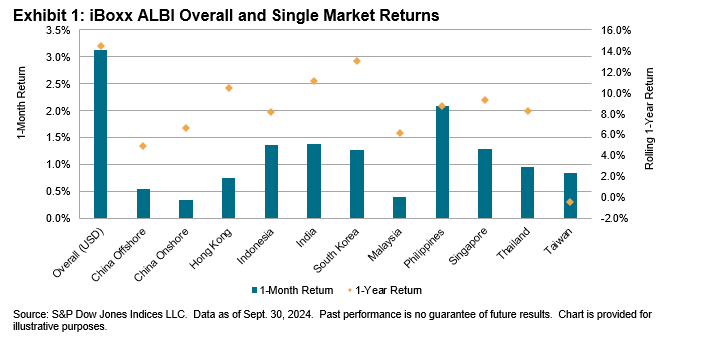

It was a good month across the board for Asian local currency bonds. The iBoxx Asian Local Bond Index (ALBI), representing Asian local currency bonds, maintained its momentum from the previous month and returned another 3.13% in September in USD unhedged terms. All local markets reported both capital and FX gains as the dollar weakened against the basket of ALBI local currencies. Notably, the Thai baht and Malaysian ringgit strengthened by 5.42% and 5.12%, respectively, against the greenback in September.

When examining individual market performance in September, the Philippines (increasing by 2.08%), India (rising by 1.38%) and Indonesia (gaining 1.36%) stood out as the best-performing markets. Conversely, China Onshore, Malaysia and China Offshore performed the worst, despite posting gains of 0.34%, 0.39% and 0.55%, respectively.

Throughout the yield curve, a similar trend was observed, with gains noted across all maturity segments and local markets. The top local market segments for the month were the Philippines 10Y+ (up 3.40%), Singapore 10Y+ (up 2.84%) and the Philippines 7-10Y (up 2.56%). The shorter end of the curve generally underperformed this month compared to longer tenures.

As of the end of September, the overall index yield contracted by another 9 bps to 3.60%. India continued its position as the highest-yielding bond market, posting 6.83%, while China Onshore (2.12%) remained the lowest-yielding market.