Monthly performance, maturity, yield and duration of the iBoxx ALBI, iBoxx ABF and iBoxx SGD Indices.

One of the key highlights in March was the decision from the Bank of Japan to increase short-term interest rates for the first time in 17 years, bringing the key rate up from -0.1% to 0%-0.1% and ending 8 years of negative interest rates. Japan was the final central bank to move away from negative rates. Japanese government bonds—as represented by iBoxx Global Government Japan—ended the month down 1.26% (in USD Unhedged terms).

In the same month, the U.S. Federal Reserve decided to keep rates unchanged for the fifth straight meeting, backed by higher-than-expected inflation data and a strong labor market. U.S. Treasuries—as represented by the iBoxx $ Treasuries—reversed losses in January and February and posted a modest gain of 0.62% in March. The overall index yield tightened by 4 bps to 4.44%.

On the equities front, the S&P 500® continued its positive performance in March, posting 3.10% to reach another record high, having accumulated gains of more than 10% since the start of this year. Chinese equities—as represented by the S&P China 500 (USD)—posted marginal returns of 0.58%, while the broader Asian equity market—as represented by the S&P Pan Asia Ex-Japan LargeMidCap (USD) fared better at 2.11%.

iBoxx Asian Local Bond Index (ALBI)

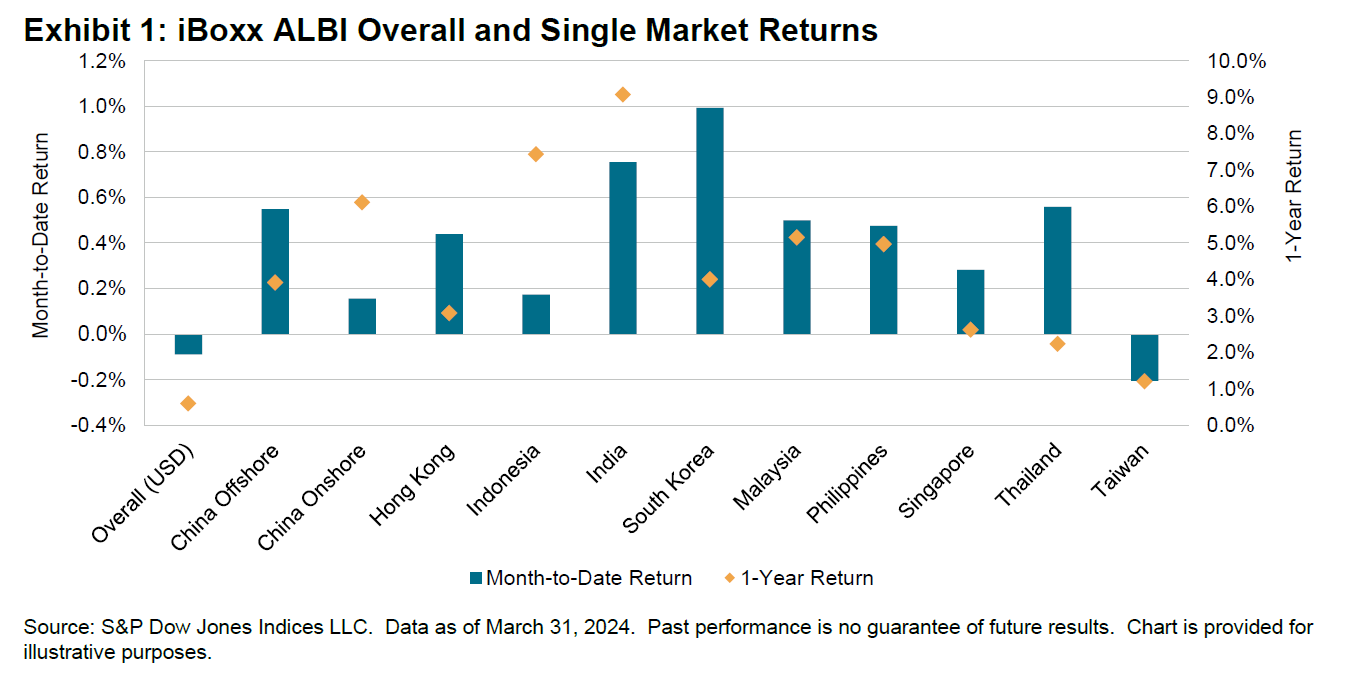

In Asian fixed income, despite gains in local markets, the overall iBoxx Asian Local Bond Index (ALBI) (USD Unhedged) retreated 0.09% due to the relative strength of the U.S. dollar against local currencies this month.

South Korea and India were on top of the pile, in local currency terms, increasing 0.99% and 0.76%, respectively. China Onshore (up 0.16%) and Indonesia (up 0.17%) ranked the lowest (excluding Taiwan, which has 0% weight in the index) from a return perspective. As the first quarter of 2024 ends, India and Thailand stood out with year-to-date gains of 3.18% and 2.60%, respectively.

Among eligible markets, positive returns were observed throughout the range of maturities except for China Onshore 10+ (down 0.78%) and Indonesia 7-10 (down 0.02%). Investors favored longer-dated debt in the Offshore RMB market and South Korea, as China Offshore 10+ and South Korea 10+ posted 2.75% and 1.67% upticks, respectively.

As of the end of March, the overall index yield decreased marginally by 1 bp to 3.89%. India remained the highest-yielding bond market in the index, posting 7.11%, while China Onshore (2.42%) represented the lowest-yielding market.