Monthly performance, maturity, yield and duration of the iBoxx ALBI, iBoxx ABF and iBoxx SGD Indices.

As widely expected, the ECB cut its key interest rate by 25 bps in June, while the U.S. Federal Reserve maintained its key rate, citing a lack of progress toward the objective of 2% inflation. Some other economies also introduced their first rate cuts, including Canada and Denmark, while Switzerland made its second rate cut in 2024.

The movement of the 10-2 Treasury Yield Spread also remained relatively rangebound in June and has been inverted since the second half of 2022. At the end of the month, it read -0.35%, up 3 bps from May.

As we end the first half of 2024, eurozone government bonds—as represented by the iBoxx € Eurozone—inched up 0.08% in June but pulled back 2.13% YTD. Similarly, U.S. Treasuries—as represented by the iBoxx $ Treasuries—gained 1.04% this month but declined 0.87% YTD.

In the equities space, the U.S. market—as represented by the S&P 500®—gained 3.47% in June and 14.48% for the first half of the year. In Asia, the S&P Pan Asia Ex-Japan LargeMidCap (USD) managed a 3.28% gain for the month, but its YTD performance lagged the S&P 500®, standing at 7.25%. Chinese stocks, as represented by S&P China 500 (USD), gave up some ground in June (-3.01%), though the index managed a slight YTD gain (up 0.75%).

iBoxx Asian Local Bond Index (ALBI)

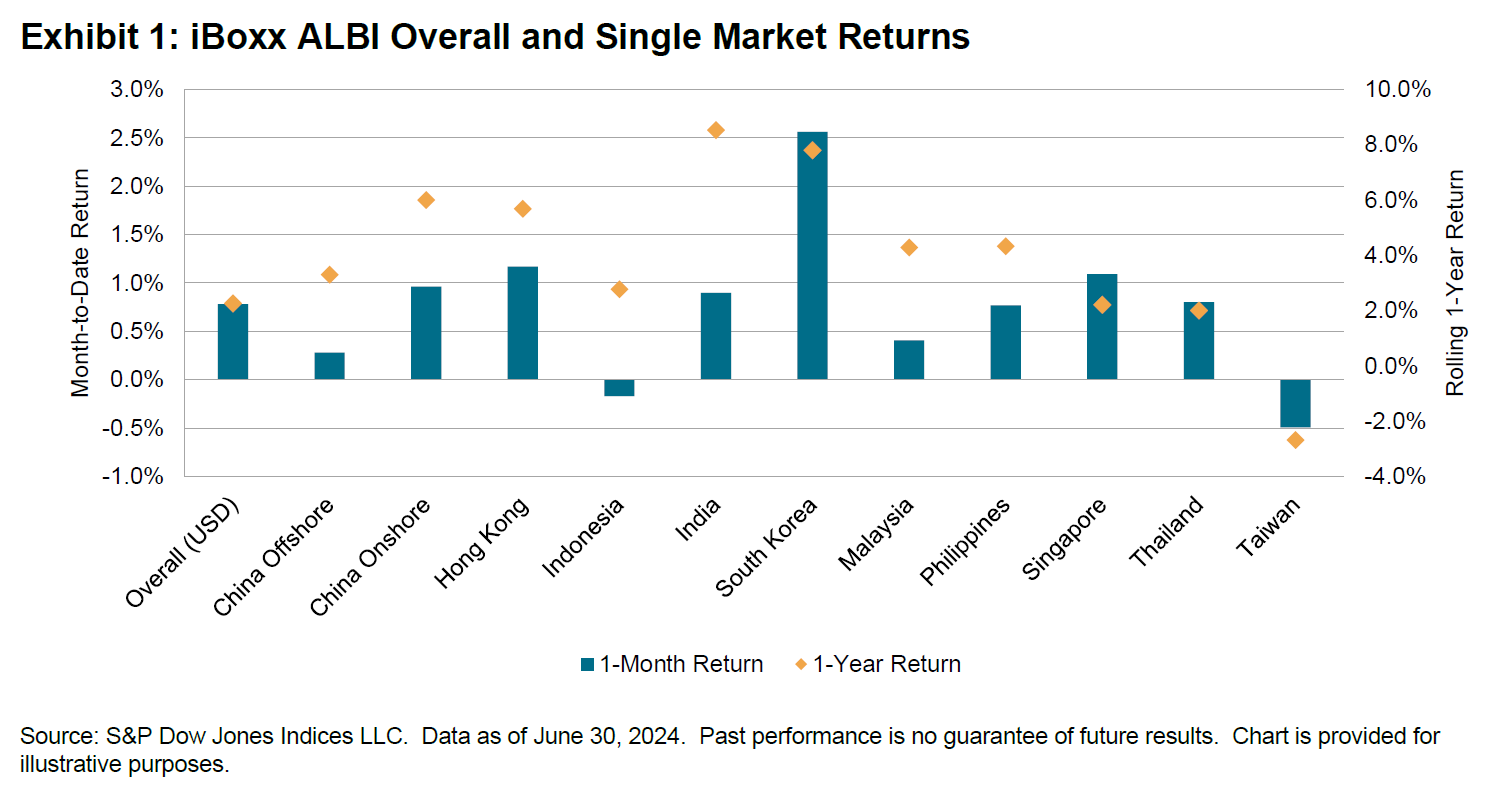

Similar to eurozone government bonds and U.S. Treasuries, the iBoxx Asian Local Bond Index (ALBI), which consists of 80% government bonds, also had a small uptick in June, gaining 0.78% in USD unhedged terms. This month, we saw decent performance in most markets, but the strength of the U.S. dollar against local currencies eroded most of the gains. Year-to-date, the index performance pulled back 2.15%.

In the local markets, South Korea was the standout performer, up 2.56%. Coming in second was Hong Kong, with a return of 1.17%. Indonesia was the only eligible market with a loss, declining 0.17%.

Across the yield curve, the longer-end maturity segments of the overall index drove most gains, namely 10+ (up 1.61%) and 7-10 (up 0.74%). Among local markets, South Korea 10+ and Hong Kong 10+ led the gains, up 4.46% and 3.92%, respectively.

As of the end of June, the overall index yield contracted by another 16 bps to 3.90%. Indonesia overtook India as the highest-yielding bond market in the index, posting 7.08%, while China Onshore (2.22%) represented the lowest-yielding market.