Monthly performance, maturity, yield and duration of the iBoxx ALBI, iBoxx ABF and iBoxx SGD Indices.

The past few weeks have been busy for major central banks, as they announced their next move to tackle market conditions according to their respective positions. To kick things off, China cut the one-year loan prime rate by 10 bps to 3.35% to support their economy, its first cut in a year. Likewise, the Bank of England lowered its interest rate by 25 bps to 5.0% on Aug. 1, 2024, for the first time in more than four years.

In the U.S., the FOMC decided to hold interest rates steady in July, but it signaled a willingness to make the first reduction in September if certain conditions regarding inflation targets, economic growth and the labor market are met. Conversely, the Bank of Japan decided to raise its key interest rate to about 0.25% (up from zero-0.1%) to prevent the yen’s slide against other major currencies.

As of Aug. 2, 2024, the 10-2 Year Treasury Yield Spread has tightened to -0.08%, its highest point in two years.

U.S. Treasuries—as represented by the iBoxx $ Treasuries—gained 2.23% in July. During the same period, Japanese government bonds, as represented by iBoxx Global Government Japan (in local currency terms) lost 0.10%. However, due to the rally in the Japanese yen against the U.S. dollar, the index in USD unhedged terms gained 6.80%. Chinese government bonds—as represented by iBoxx Global Government China (USD Unhedged)—inched up by 1.40%.

iBoxx Asian Local Bond Index (ALBI)

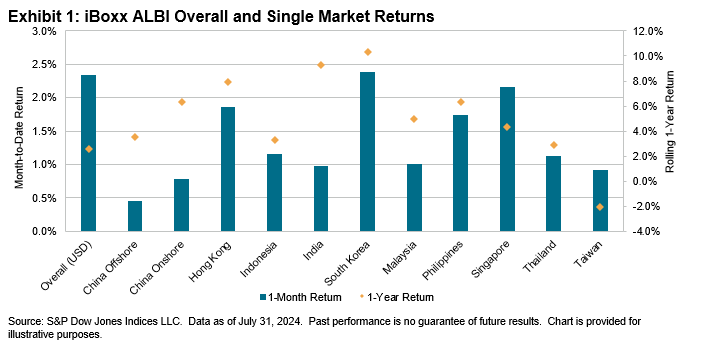

Similar to U.S. Treasuries, the iBoxx Asian Local Bond Index (ALBI) gained 2.34% in USD unhedged terms. This was contributed to by all underlying markets posting positive returns, as well as most local currencies appreciating against the greenback. Year-to-date, the index returned 0.14%.

In the local markets, South Korea (up 2.39%) and Singapore (up 2.17%) led the pack, while China Offshore and China Onshore were at the bottom, despite registering gains of 0.45% and 0.78%, respectively.

Returns were observed across the yield curve, with the longer-end maturity segments driving most of the gains. Hong Kong 10+ and South Korea 10+ were once again among the top 2 segments, returning 4.83% and 4.40%, respectively.

As of the end of July, the overall index yield contracted by another 14 bps to 3.74%. India reassumed its position as the highest-yielding bond market, posting 7.01%, while China Onshore (2.13%) remained the lowest-yielding market.