iBoxx ALBI, iBoxx ABF and iBoxx SGD

February 2025 Commentary

February was a bumpy month, characterized by pending tariffs (confirmed in early March) from the U.S. on Canada, Mexico and China, alongside a notable exchange between President Trump and President Zelenskyy in the Oval Office. During this period, central banks around the globe were also busy evaluating their monetary policies. Several banks, including the Bank of England, decided to lower rates by 25 bps. The U.S. Federal Reserve did not meet in February and its next meeting is scheduled for March. Market analysts do not anticipate a rate cut at this meeting, but we may hear more after the close of the meeting.

In the Asia Pacific region, the Reserve Bank of Australia and the Reserve Bank of New Zealand both lowered their rates by 25 bps points and 50 bps, respectively. Additionally, central banks in India, Thailand and South Korea, which are part of the iBoxx Asian Local Bond Index, also reduced their rates by 25 bps.

Against this backdrop, the S&P 500® declined 1.42% for the month (after hitting an all-time high in January), primarily due to a downturn in the tech sector. Meanwhile, Chinese equities, as represented by the S&P China 500 (USD), posted a strong return of 6.74%. However, this was insufficient to lift broader Asian stocks, as indicated by the S&P Pan Asia Ex-Japan LargeMidCap (USD), which fell slightly by 0.22%.

Amid investor concerns about economic growth, U.S. Treasuries, as measured by the iBoxx $ Treasuries, experienced a yield decline of 31 bps in February, settling at 4.37%. During this period, the index was up 2.20%.

iBoxx Asian Local Bond Index (ALBI)

February 2025 Commentary

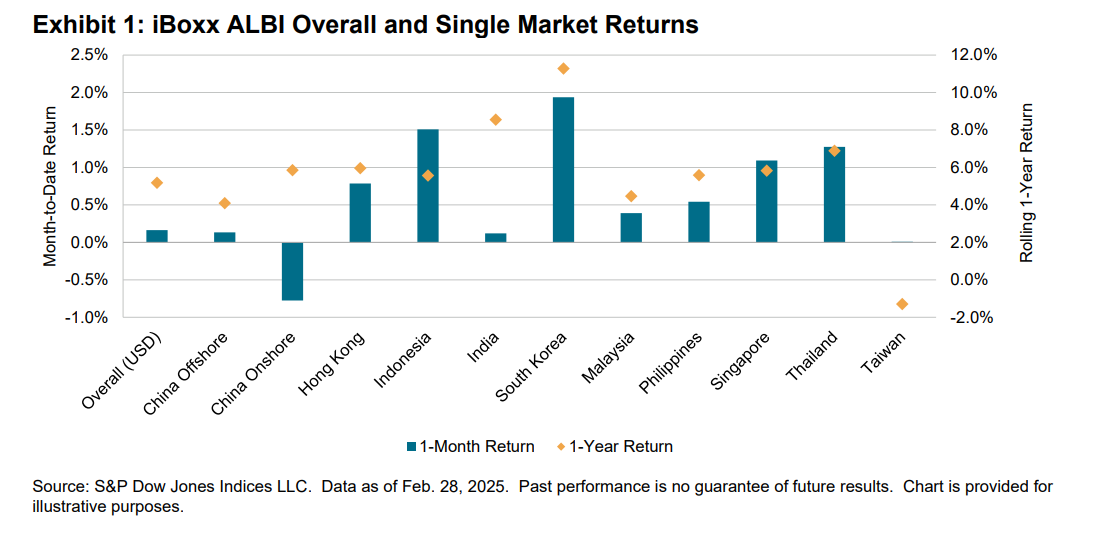

In February, Asian local currency bonds, as indicated by the iBoxx Asian Local Bond Index (ALBI), increased marginally by 0.16% in unhedged USD terms, falling short of the stronger performance of U.S. Treasuries by 2.04%.

In fact, most local bond markets posted gains in February, except for China Onshore, which declined 0.78%. However, overall index performance was negatively affected by foreign exchange losses in several markets against the U.S. dollar, including Indonesia and Thailand, among others. Among the local markets, South Korea, Indonesia and Thailand stood out as the top performers, yielding returns of 1.94%, 1.51% and 1.27%, respectively. It is important to note that both the Bank of Korea and the Bank of Thailand announced a 25 bps reduction in their key interest rates in February.

Overall, most maturity segments in local markets performed positively, except for China Onshore, which experienced losses across all maturity categories. Notably, South Korea's 10+ year bonds were up 3.65%, while Hong Kong's 10+ year bonds increased 2.52%, making them the best-performing segments. For shorter maturities, Indonesia's 1-3 year bonds yielded the highest return at 1.24%.