iBoxx ALBI, iBoxx ABF and iBoxx SGD

December 2024 Commentary

December proved to be volatile in the financial markets, with the

S&P 500® retreating 2.50% and the Dow Jones Industrial Average® down 5.27%, the latter’s largest monthly loss in more than two years. Some market analysts pointed to uncertainties regarding Trump’s return to the White House and his economic policies as reasons for the December downturn. However, U.S. equities ultimately demonstrated a robust performance for the year, with both the S&P 500 and the DJIA 30 posting double-digit returns of 23.31% and 12.88%, respectively.

The U.S. Federal Reserve also implemented another rate reduction in December, cutting it by 25 bps to bring the target range to 4.25%-4.50%. Transitioning into 2025, the Fed signaled a restrictive stance for potential future rate cuts. Against this backdrop, the U.S. Treasury yield—as represented by the iBoxx $ Treasuries—increased 25 bps in December to close off the year at 4.71%. The index pulled back 1.75% for the month but was marginally up for the year with a return of 0.49%.

Asian equities, as represented by the S&P Pan Asia Ex-Japan LargeMidCap (USD), declined 1.35% in the final month of the year. However, the performance for the entire year was commendable, up 7.94%. Notably, China equities, which constitute a significant portion of the broader Asian equities market, managed to achieve a gain of 0.49% in December, as indicated by the S&P China 500 (USD). For the year, the index posted a respectable return of 12.52%, which can be attributed to a series of measures implemented by the government aimed at stimulating domestic demand and fostering economic stability despite the challenging macro-environment.

iBoxx Asian Local Bond Index (ALBI)

December 2024 Commentary

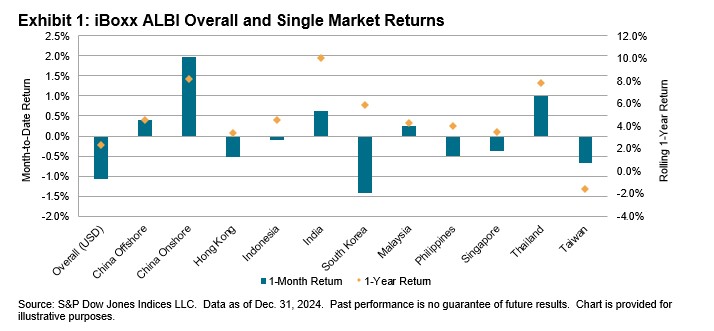

Asian local currency bonds—as represented by the iBoxx Asian Local Bond Index (ALBI)—posted a decline of 1.06% in USD unhedged terms in December, but they posted a return of 2.33% for the year. This was its second consecutive year of gains, after posting 5.81% for 2023.

Underlying local market performance (in local currency terms) was mixed in December. China Onshore and Thailand were the standout performers, returning 1.96% and 1.01%, respectively. In contrast, South Korea (down 1.42%) and Hong Kong (down 0.52%) were the bottom two performers. Across the year, India, China Onshore and Thailand were the best-performing local markets, returning 10.04%, 8.14% and 7.81%, respectively.

Looking at FX movements, in December, most local currencies depreciated against the U.S. dollar, with the Korean won declining the most, by 5.24%. Only the Philippines peso and the Hong Kong dollar appreciated this month against the greenback, by 1.37% and 0.25%, respectively.

Gains were observed across the yield curve in a few select local markets, including China Onshore, China Offshore, India, Malaysia and Thailand. However, Indonesia saw losses across all maturity sleeves. The segments that performed the best were China Onshore 10+ year (up 4.75%), China Onshore 7-10 year (up 2.75%) and Thailand 10 year (up 2.20%). Meanwhile, the worst-performing segments were Hong Kong 10+ year, which declined by 3.67%, and South Korea 10+ year, which fell by 2.75%.