Monthly performance, maturity, yield and duration of the iBoxx ALBI, iBoxx ABF and iBoxx SGD Indices.

Toward the end of August, the 10-2 Year Treasury Yield Spread turned positive for the first time in more than two years, and it ended the month flat at 0 bps, potentially signaling a shift in market sentiment on the upcoming U.S. interest rate policy. As U.S. annual inflation dipped below 3% for the year ending July 2024, investor attention is turning toward the upcoming FOMC meeting in mid-September with rising expectations of the first rate cut by the Fed since March 2020.

U.S. Treasuries—as represented by the iBoxx $ Treasuries—extended their gains in August, returning another 1.30%. It is also noteworthy that longer-dated U.S. Treasuries (iBoxx $ Treasuries 10Y+, up 2.00%) outperformed shorter-dated ones (iBoxx $ Treasuries 1-3Y, up 0.90%). To round things off in the U.S., on the equities front, the S&P 500® inched up 2.28% in August against the backdrop of a potential rate cut and gains in the Technology sector, shaking off a global stock market rout earlier in the month.

In Asia-Pacific markets, New Zealand and the Philippines dropped their official cash rate and key rate, respectively, by 25 bps in August. New Zealand government bonds—as represented by S&P/NZX NZ Government Bond Index—rose 0.97% in August (in local currency terms), while Philippine government bonds—as represented by the iBoxx ALBI Philippines—returned 0.86% (in local currency terms).

iBoxx Asian Local Bond Index (ALBI)

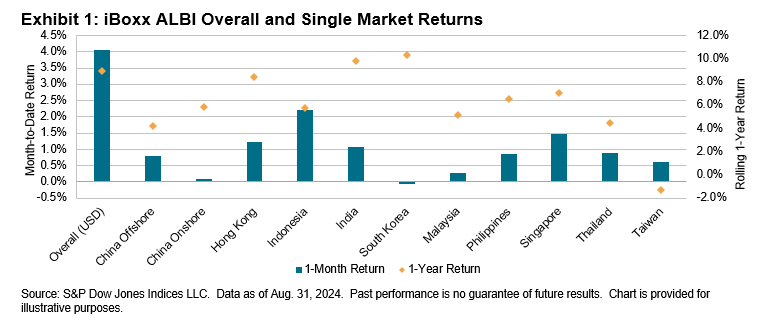

Asian local markets—as represented by the iBoxx Asian Local Bond Index (ALBI)—performed well in August, returning 4.06% in USD unhedged terms. Most local markets contributed to the returns, which was also boosted by the weakness of the U.S. dollar against domestic currencies. The Malaysian ringgit and the Indonesia rupiah both appreciated more than 5% against the greenback. In the past 12 months, the overall index (in USD unhedged terms) has returned 8.90%.

Looking at single market performance in August, Indonesia and Singapore stood out, returning 2.22% and 1.48%, respectively. For the second month running, Singapore was among the top two markets in the index. South Korea, the top performer in July, fell to the bottom as it was the only market with a slightly negative return (down 0.08%).

Returns were largely positive for the second straight month across the yield curve, with only certain pockets showing small declines, namely South Korea 10Y+ (down 0.53%) and China Onshore 7-10Y (down 0.21%). Indonesia 10Y+ and Hong Kong 10Y+ were the top segments this month, returning 3.13% and 2.47%, respectively.

As of the end of August, the overall index yield contracted by another 5 bps to 3.69%. India continued its position as the highest-yielding bond market, posting 6.94%, while China Onshore (2.14%) remained the lowest-yielding market.