iBoxx ALBI, iBoxx ABF and iBoxx SGD

March 2025 Commentary

Concerns regarding the implications of U.S. tariffs persisted in March, acting as a major factor contributing to volatility in the financial markets. This uncertainty triggered a ripple effect across markets, raising questions about the potential impact on business costs and whether these increased expenses would ultimately be transferred to consumers. This situation was reflected in the correction of the S&P 500®, which fell for the second consecutive month, decreasing by 5.75%—its largest one-month drop in over two years.

Additionally, the U.S. Federal Reserve convened for the FOMC meeting in March, where it decided to maintain interest rates at 4.25%-4.50% for the second consecutive meeting. This decision came amid continued expectations of slower economic growth and potential inflationary pressures amplified by tariffs. Amid these developments, U.S. Treasuries, as indicated by the iBoxx $ Treasuries, experienced relatively stable yields in March, rising by just 2 bps to 4.39%, while the index returned 0.23% during the same period.

In China, the central government persisted in its efforts to stimulate the economy by introducing a “Special Action Plan to Boost Consumption.” This initiative aims to enhance domestic spending through measures such as promoting wage growth and stabilizing the stock and real estate markets. Following the public announcement, there was a brief uptick in the S&P China 500 (USD) but this momentum waned as the month progressed. Ultimately, the index concluded the month with a modest increase of 0.90%.

iBoxx Asian Local Bond Index (ALBI)

March 2025 Commentary

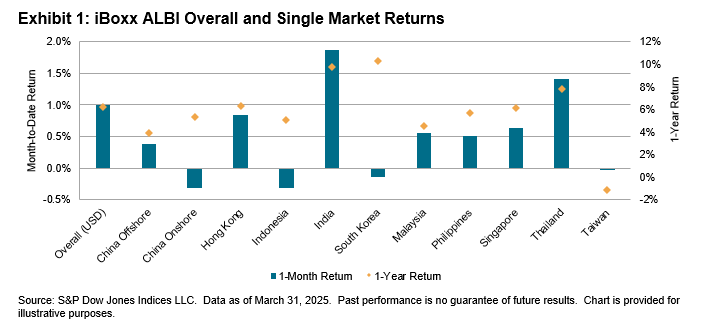

The iBoxx Asian Local Bond Index (ALBI), which tracks Asian local currency bonds, gained 0.99% in unhedged USD terms during March, surpassing the 0.76% increase of U.S. Treasuries. This growth was driven by decent gains in most local markets, along with favorable foreign exchange movements in most markets relative to the U.S. dollar.

In the local bond markets, China Onshore experienced a slight decline of 0.31% in March, marking another month of downturn. Indonesia and South Korea were the other two eligible markets that recorded declines, with decreases of 0.32% and 0.14%, respectively. Among the top performers, India led with an increase of 1.88%, followed closely by Thailand, which rose by 1.42%.

Throughout the yield curve, the long-dated segments exhibited the most significant gains and losses, with India 10+ Year bonds rising 2.55%, while China Onshore 10+ Year bonds fell 1.69%. Notably, all shorter-term segments (1-3 Years, 3-5 Years) delivered positive returns.

By the end of March, the overall index yield rose by 4 bps to 3.58%. Indonesia reclaimed its status as the highest-yielding market (from India), recording a yield of 7.07%, while China Onshore continued to be the lowest-yielding market at 1.93%.