December 2022 Commentary

2022 started off with (somewhat) bullish market expectations, but soon after, rising inflation, interest rate hikes and recessionary fears took over, which made it a year to forget for both fixed income and equities. The S&P 500® lost 19.44% in 2022, recording its worst year since 2008. U.S. Treasuries—as represented by the iBoxx $ Treasuries—also lost ground, falling 12.94% in 2022.

The People’s Bank of China (PBOC) loosened its monetary policy in 2022, in contrast to central banks from other developed markets. Despite woes in the Real Estate sector, Chinese Government Bonds and Policy Bank bonds performed well in 2022—as represented by the iBoxx ALBI China Onshore—returning 3.30% (in local currency terms). Investors were also keeping a keen eye on how the recent pivot in China’s COVID-19 strategy would play out and how it would affect regional and global markets in 2023.

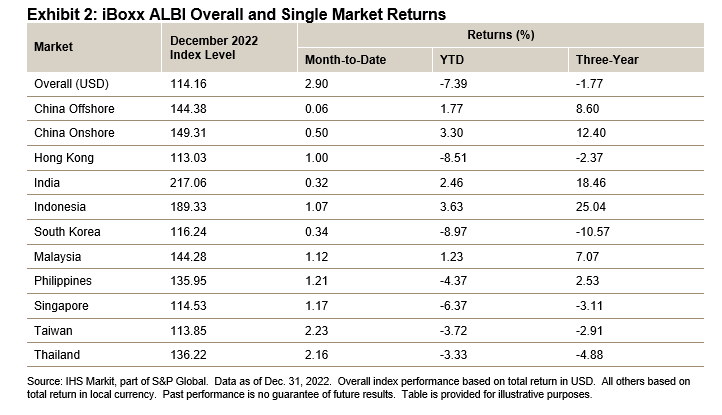

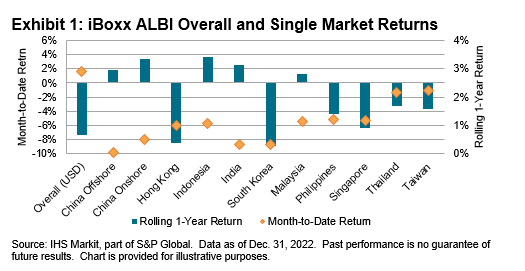

In the broader Asian fixed income markets, the iBoxx Asian Local Bond Index (ALBI) (unhedged in USD) returned 2.90% in December 2022 but ended the full year down -7.39%. In 2022, one-half of the eligible markets recorded positive returns in local currency terms. Gains were led by Indonesia (up 3.63%), China Onshore (up 3.30%) and India (up 2.46%). Among the bottom performers were South Korea (-8.97%), Hong Kong (-8.51%) and Singapore (-6.37%).

Apart from China Onshore (-2.55%) and Indonesia (-1.87%), short-dated bonds (1-3 years) significantly outperformed long-dated ones (10+ years) in 2022. The difference in performance between short-and long-dated bonds was greatest in South Korea and Hong Kong, recording gaps of 18.38% and 18.95%, respectively (see Exhibit 11). Compared to last year, yields across iBoxx ALBI eligible markets rose across the board (except for China Onshore). Hong Kong saw its yield surge 282 bps to 4.80% as of Dec. 31, 2022, while the Philippines, South Korea and Singapore recorded increases of more than 100 bps. Combined with changes in the other markets, the overall index yield increased by 85 bps to 4.15%.