Introduction

In the first quarter of 2022, insurance companies traded USD 19.5 billion in ETFs; this is roughly in line with the amount traded in the first quarter for 2020 and 2021. However, insurers only added USD 0.2 billion in ETFs to their general accounts, which was much lower than the past two years. Insurers continued the trend from 2021 of selling Equity ETFs and buying Fixed Income ETFs.

ETF Trades

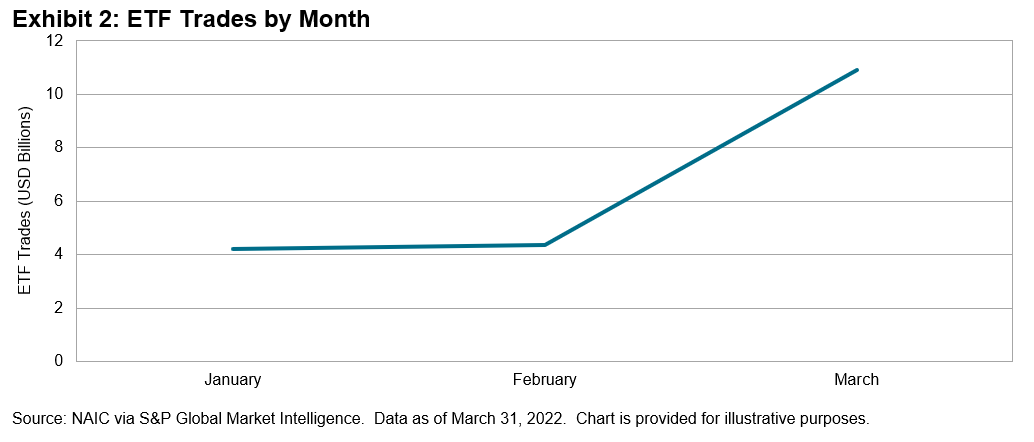

In the first quarter of 2022, insurance companies traded USD 19.5 billion in ETFs. This is down from USD 24.6 billion in the first quarter of 2020 but higher than USD 15.2 billion in Q1 2021 (see Exhibit 1).

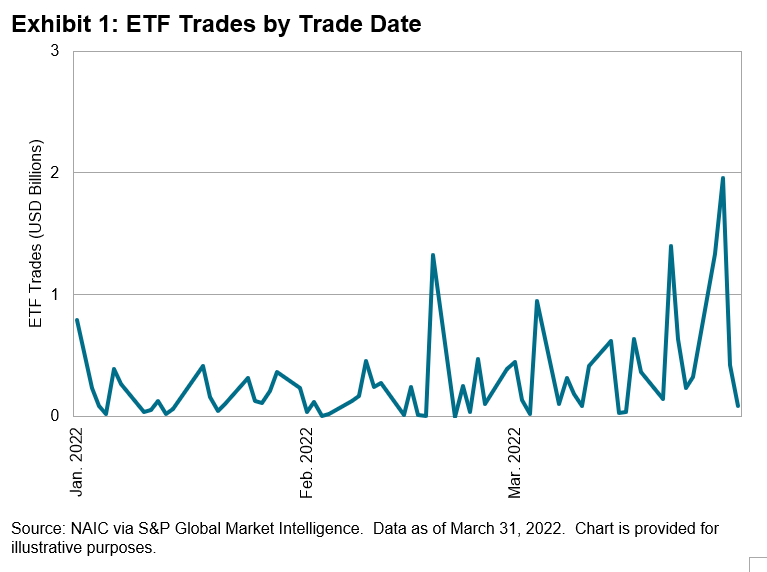

As we have seen before, companies traded more at the end of the quarter. Indeed, companies traded more in March than in January and February combined (see Exhibit 2).