Introduction

The year 2023 was marked by significant events that affected global financial markets, including a bear market for most of the year, geopolitical conflicts, the U.S. regional banking crisis and the UBS acquisition of Credit Suisse. These events contributed to heightened market volatility and shifts in trading volumes across various financial instruments. This report aims to highlight the tradeable volumes in index products linked to key S&P DJI credit indices, with a focus on exchange-traded funds (ETFs), credit default swap (CDS) Indices, standardized total return swaps (TRS) and futures. Finally, we close with an analysis of the bid-ask spreads across these products and on the individual bonds that comprise key iBoxx indices.

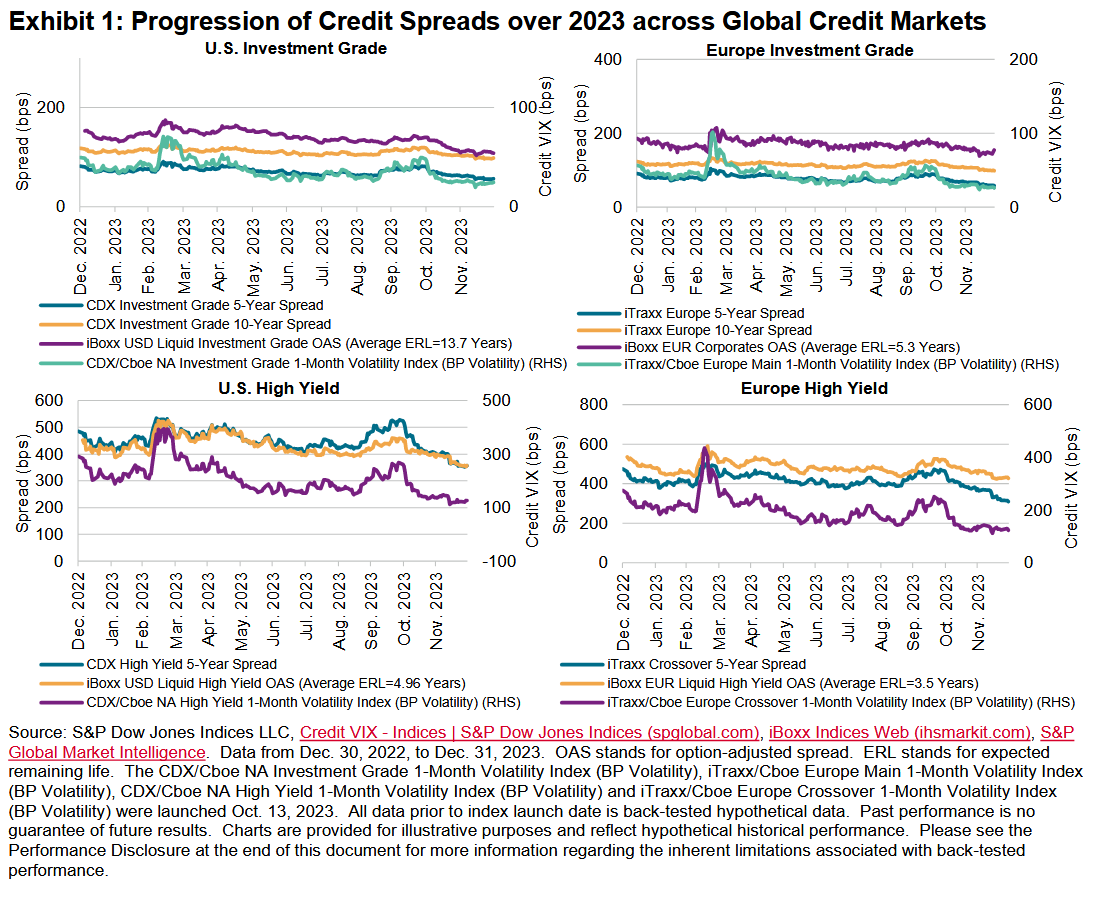

Credit Spreads and Volatility

After consistent interest rate hikes in 2022 across the U.S. and European markets, 2023 started off with expectations of interest rates peaking during the year. These expectations manifested in credit spreads tightening in the first two months of 2023, as well as a decrease in the market’s expectations of future credit volatility as indicated by the Credit VIX® indices. However, these expectations were relatively short lived, with credit spreads spiking in March 2023 due to stress in the U.S. regional banking sector and concerns related to the potential default of Credit Suisse prior to its acquisition by UBS.

As wider repercussions of the banking sector events were avoided, credit spreads recovered and set off on a consistent path of tightening over the following few months. Since April 2023, the market’s expectations of credit volatility across the North American and European investment grade and high yield credit markets have been on a downward trend, barring a brief period in October, which saw a rise in credit spreads and expected credit volatility.

Overall, spreads across all major credit markets ended the year tighter than when had started, driven by the U.S. Federal Reserve Bank and the European Central Bank halting interest rate hikes in the second half of 2023 and the market pricing in potential interest rate cuts in 2024.

The charts in Exhibit 1 illustrate the progression of credit spreads over the course of 2023 across global credit markets, as indicated by the relevant iTraxx/CDX index spreads and the iBoxx bond index option-adjusted spreads. For the U.S. and European markets, the relevant Credit VIX indices indicate the market’s expectations of credit volatility over the following one-month period.