Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsOctober 2024 auto sales volume to hold steady in the US

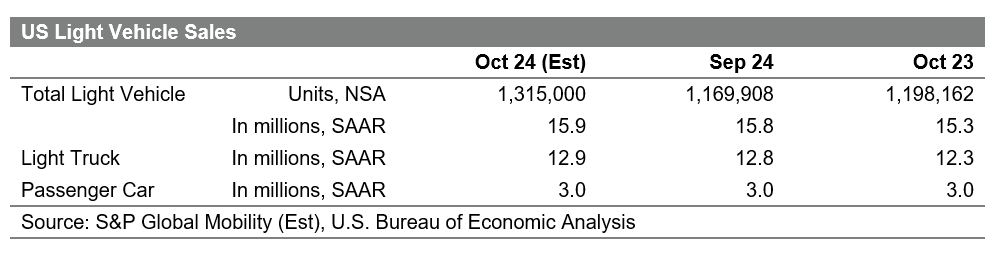

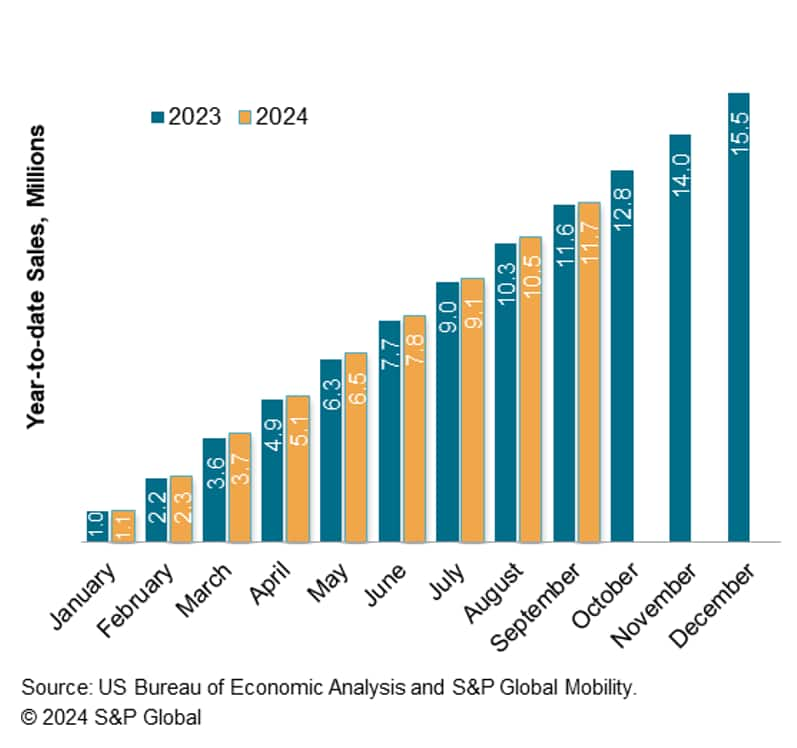

On a volume estimate of 1.315 million units, US auto sales in October 2024 are expected to realize year-over-year growth of 11%.

While the volume improvement can be attributed to two additional selling days in the month compared to last year, this result would translate to a seasonally adjusted rate (SAAR) of 15.9 million units, one of the better results for the SAAR metric this year.

"As we begin the final quarter of the calendar year, there's potential that automakers will look to provide some additional support for consumers," said Chris Hopson, principal analyst at S&P Global Mobility. "This would be warmly received by new vehicle shoppers who continue to be pressured by high interest rates and slow-to-recede vehicle prices, which are translating to high monthly payments."

Support from advancing inventories also provides some signals that auto sales could develop further to close out the year.

According to S&P Global Mobility Retail Advertised Inventory data, retail advertised inventory in the US soared to just over 3 million units in September 2024. "This is a significant 4.7% increase from the previous month and breaking the three-million mark for the first time in our dataset," said Matt Trommer, associate director at S&P Global Mobility. "This surge aligns with a broader trend we've observed over the past two years, where inventory levels consistently rise in the fall."

US Light Vehicle Sales October 2024

US Light Vehicle Sales Comparisons October 2024

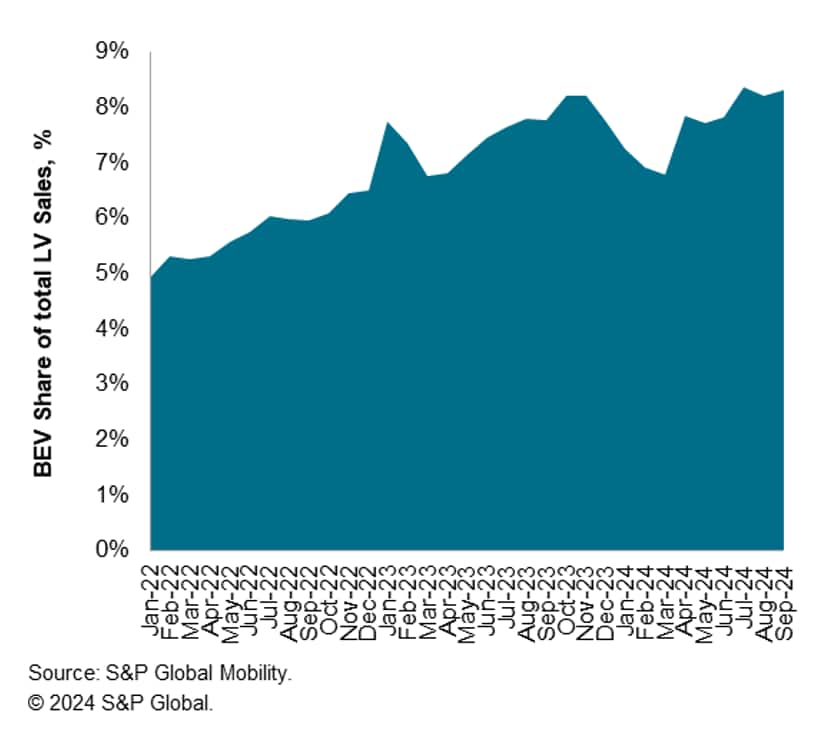

According to S&P Global Mobility new registration data, battery electric vehicle (BEV) share of sales has been above 8% every month since June, certainly reflecting progress from levels earlier in the year. September BEV share was estimated to reach above 9% and we expect October BEV sales to remain above that level again.

Assisted by the sustained roll outs of vehicles such as the Chevrolet Equinox EV and Honda Prologue and to be followed by new BEVs such as the Polestar 3, Jeep Wagoneer S and Volkswagen ID. Buzz slated for release in the fourth quarter, electric vehicle sales are expected to advance over the remainder of the year.

US Battery Electric Vehicle Sales Share October 2024

Get a free preview of our Light Vehicle Sales Forecast.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.