Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsOctober 2024 New Vehicle Inventory: Volumes Still at Post-pandemic Highs

Despite a slight overall increase in total vehicle inventory in the US in October 2024, electric vehicle (EV) inventory has continued to decline, signaling potential challenges in EV demand and production.

Here are the top 4 takeaways from our monthly US inventory review:

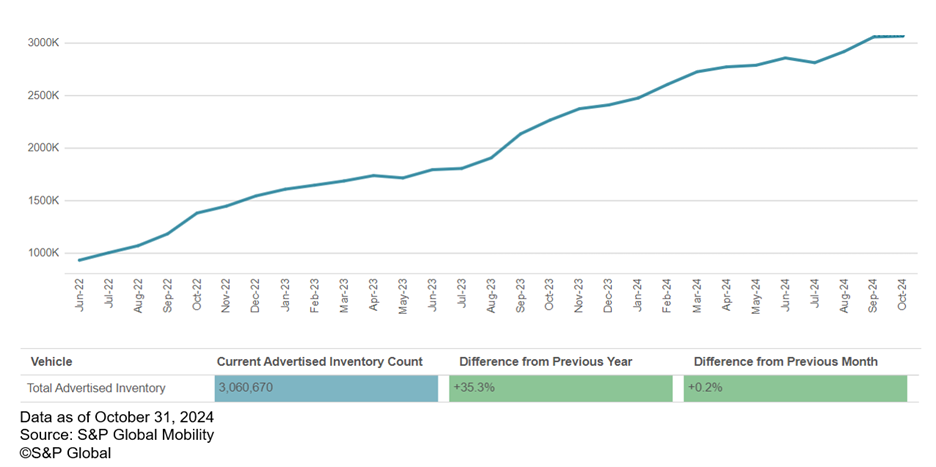

1. Inventory hits post-pandemic high for second month in a row.

At the end of October 2024, available retail advertised inventory in the US was 3.06 million vehicles, a slight 0.2% increase over September. This marks the second consecutive month of new vehicle inventory being over three million units, which is a high since the pandemic.

Advertised Inventory Count, June 2022 - October 2024

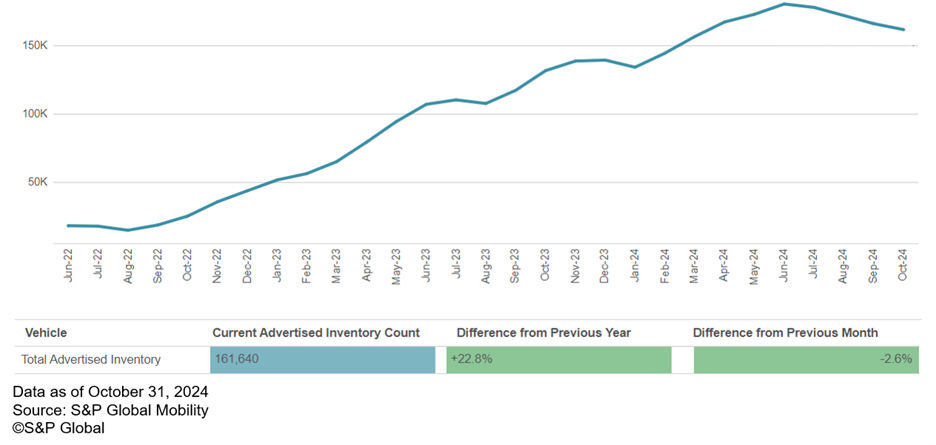

2. Conversely, electric vehicle inventory continues to fall

Despite the overall growth in inventory during the past several months, electric vehicle inventory continued to fall, decreasing 2.6% compared to September. The recent decrease is a reversal of the trend from the past couple of years—where EVs inventory grew at a rate exceeding that of ICE vehicles—and is perhaps a sign of lower-than-expected demand leading to reduced EV production.

Electric Vehicle Retail Advertised Inventory, June 2022 - October 2024

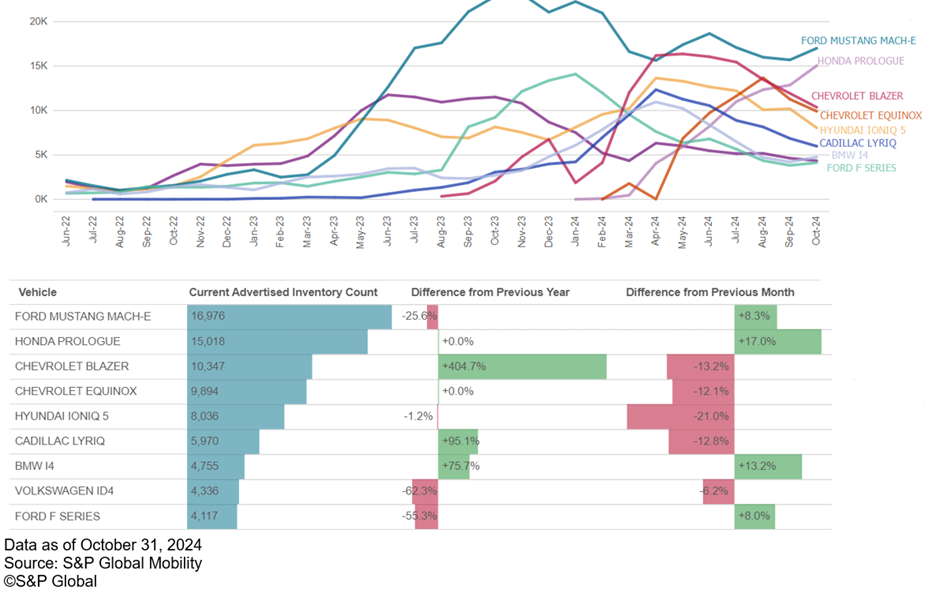

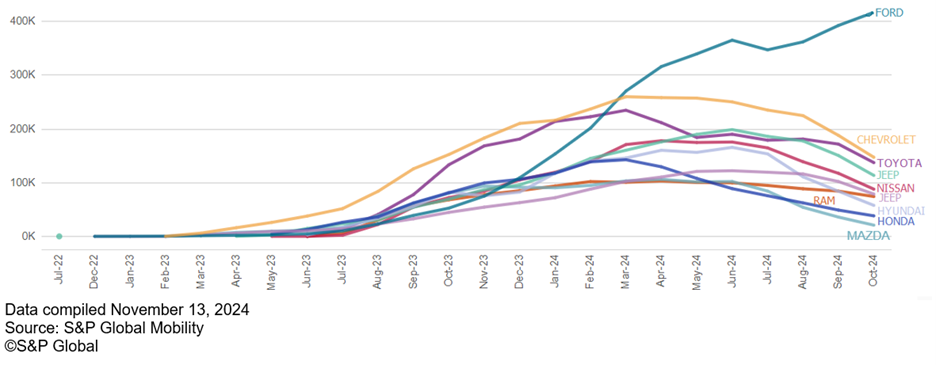

Among EV models, Ford Mustang Mach-E inventory increased 8.3% from September, but it is down 25.6% vs. October 2023. The Honda Prologue demonstrated the highest month-over-month growth in October, ending the month up 17.0% from September and at slightly more than 15,000 vehicles. Most of the other top EV models have continued to show lower decreasing inventory since this past spring.

Electric Vehicle Advertised Inventory by Model, June 2022 - October 2024

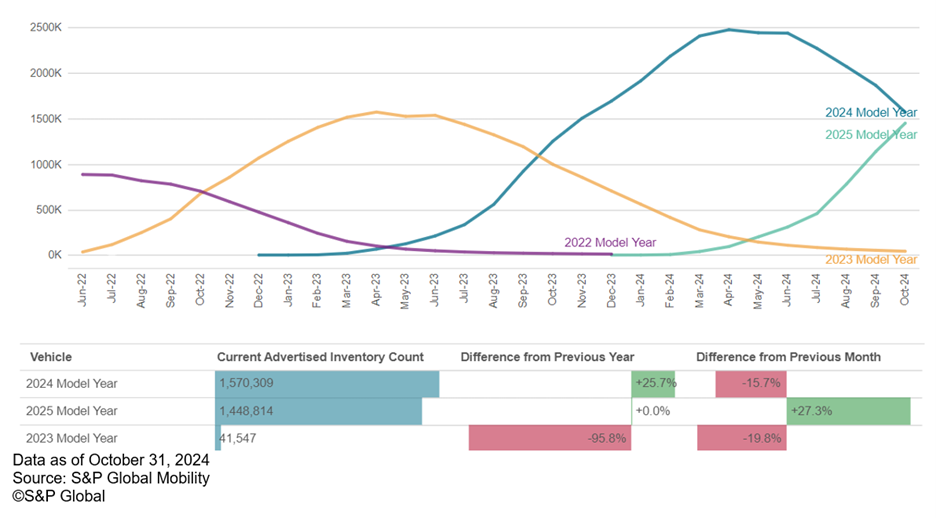

3. 2025 model years are gaining momentum even as 2024 inventory remains high

2025 model year vehicles continue their rollout, up 27.3% vs. last month and now close to the same level as 2024 model year inventory. 2023 model year has very few vehicles remaining now.

Advertised Inventory by Model Year, June 2022 - October 2024

Of 2024 model year vehicles, Ford has the most by far and is the only one of the top brands that has increased its 2024 inventory in the last three months.

2024 Model Year Inventory by Brand

4. Average days on dealer lots has increased for all top brands

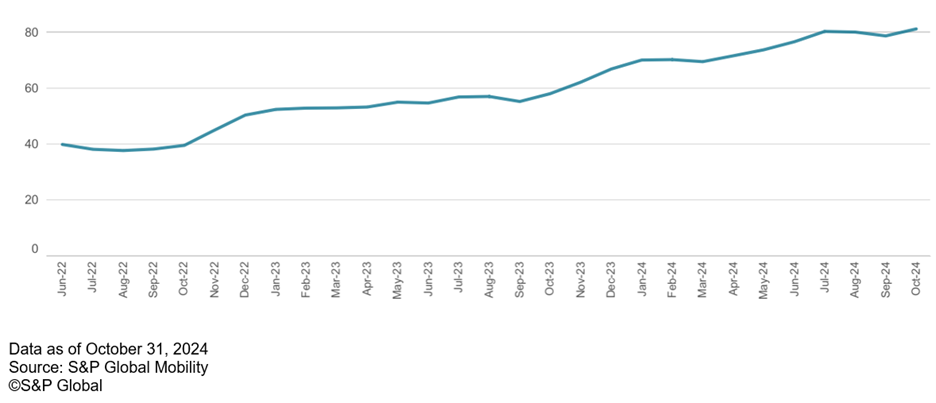

The average days on dealer lots increased slightly to 81 days at the end of October, continuing the steady increases seen over the past year.

Average Days on Dealer Lots

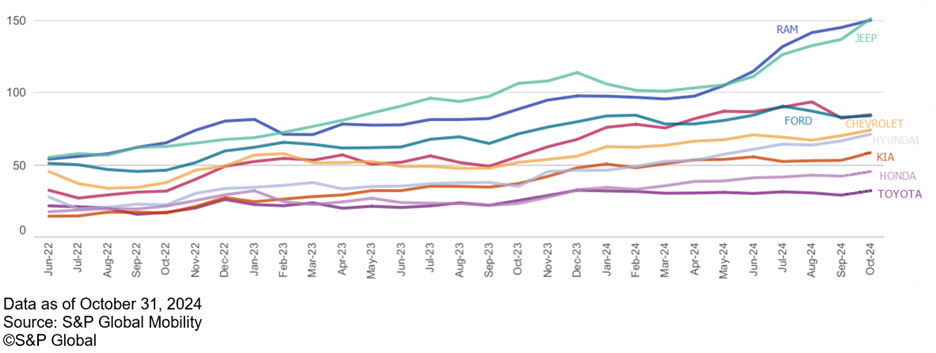

While all of the top brands have shown increases in the average length of their inventory in October, Ram and Jeep brands have shown the greatest increases over the past several months and now are both over 150 days.

Average Days on Dealer Lots, by Brand

Toyota, at 32 days, and Honda, at 46 days show the lowest average age of advertised inventory, in part due to the amount of pipeline that dealers show in their listings.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.