In this release, we integrated more than 19.4 million Government, Supranational, Agency, and Corporate (GSAC) securities from Markit, enhancing our Pricing, Analytics and Reference data coverage. In addition, we refined certain reference data to be more granular and descriptive. This includes nomenclature adjustments for fields like Bond Type, Coupon Type, Coupon Interest Frequency, Green Bond Type, Ownership Type, and Default Type, as well as modifications to historical pricing for select securities. As these fields are integral to Search, Dashboard, Screener, S&P Capital IQ Pro Plug-in and page filters, users can experience changes in their result sets. Please note that as we update the database, you may notice differences between page views and Screener results.

Expanded coverage include:

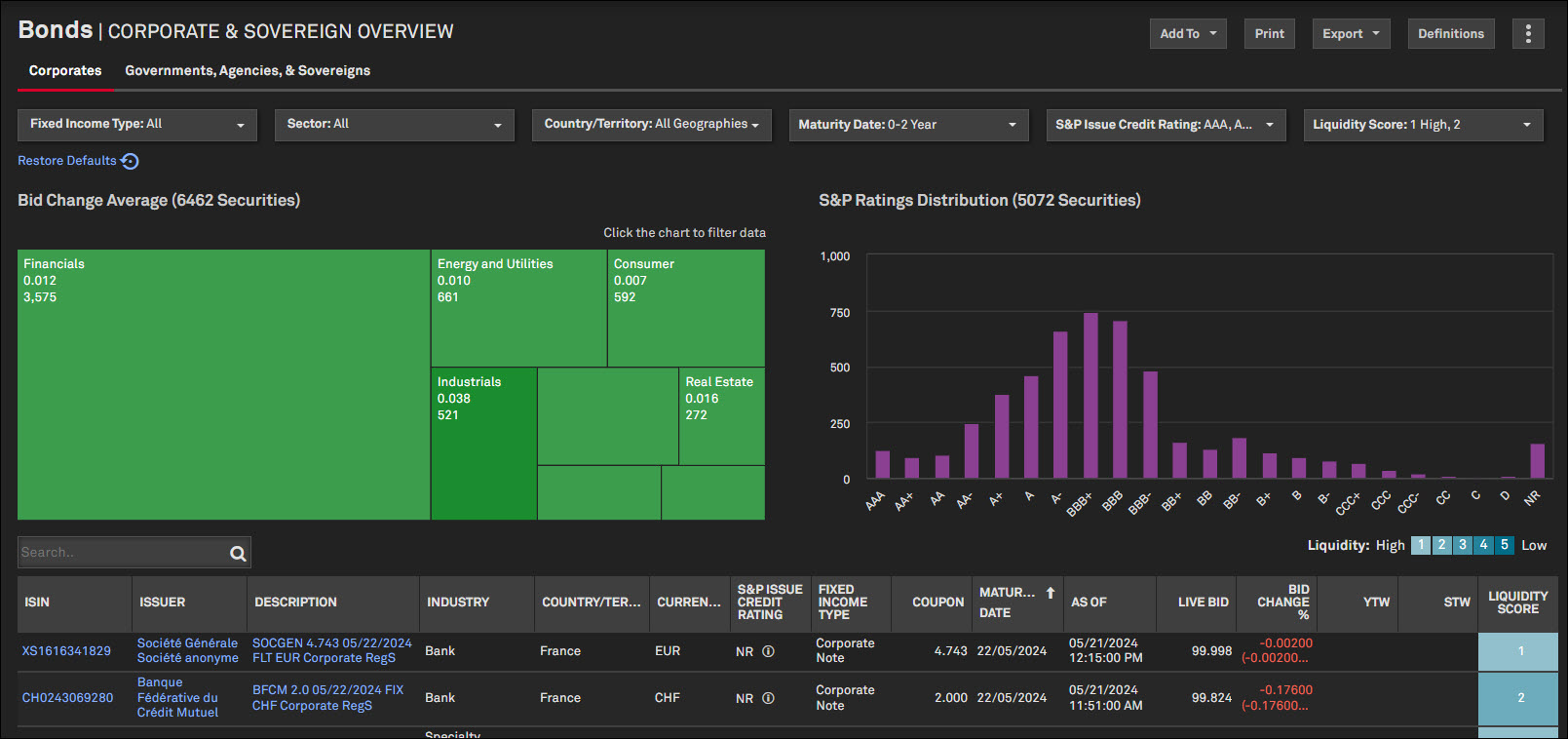

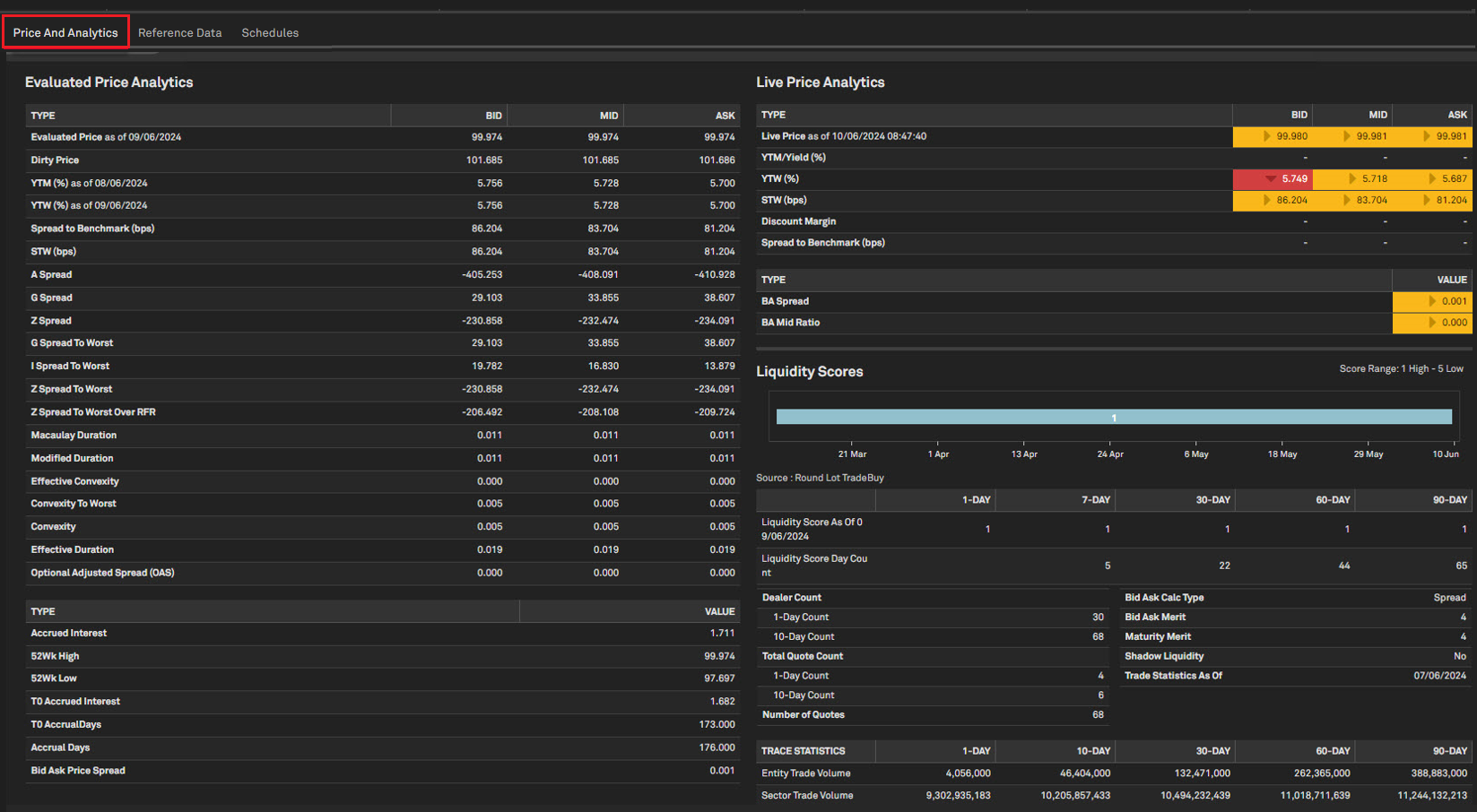

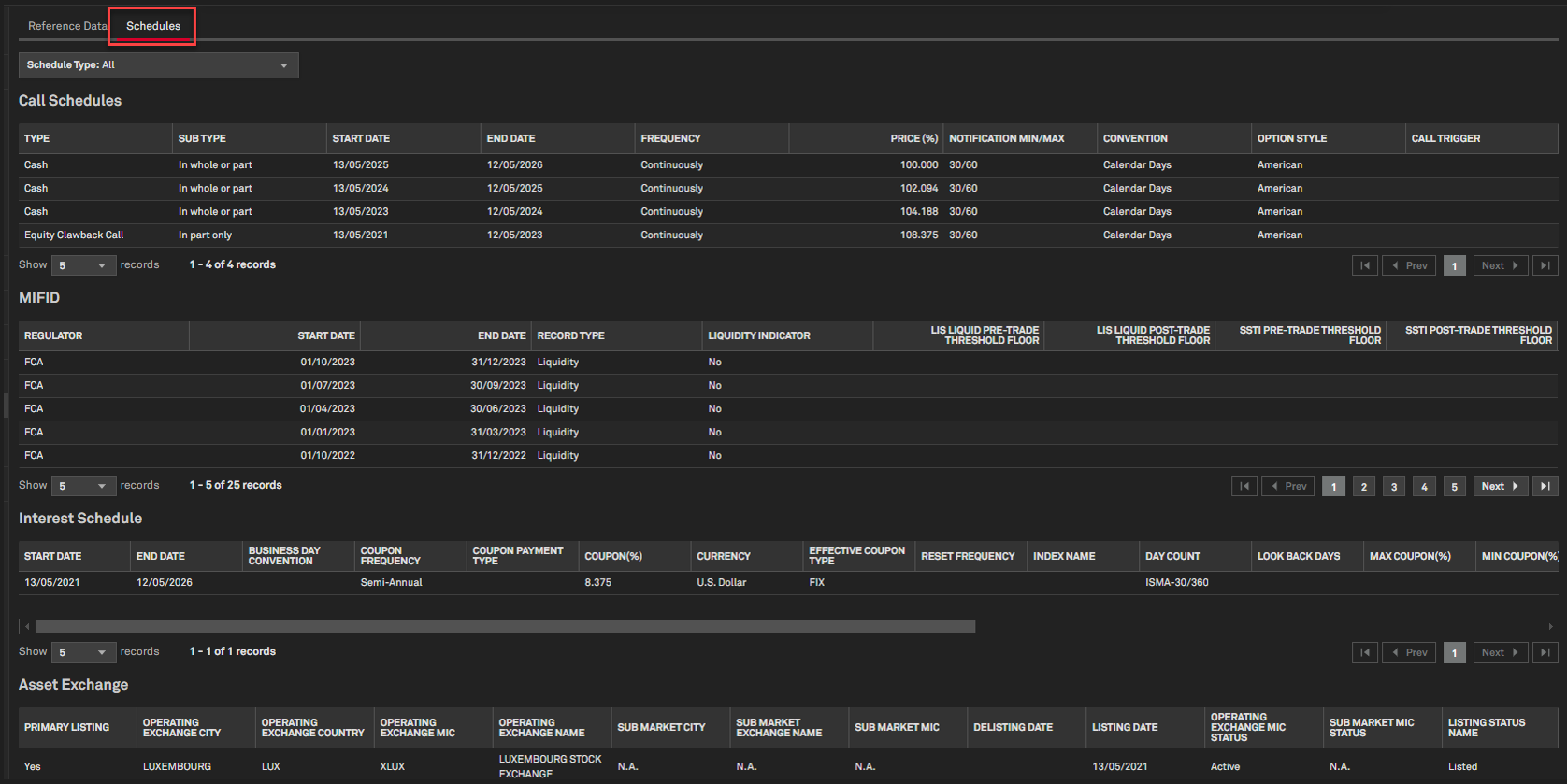

Users now have access to over 19.4 million Markit-covered securities with additional terms and conditions (T&C) data. Of these, around 60,000 have live prices and 1.6M will have end of day prices. This data is available on Corporate Issuance pages within the Corporate Profile, Securities Summary Screener and the S&P Capital IQ Pro Plug-in. With this release, we have also created new views such as Bond Sector Overview and Bond Security Detail with live pricing, improved charting and enhanced interactive visuals. The new Bond Security Detail page includes added bond reference data and a tab for relevant Schedule information. The expanded coverage is also included in Search, Dashboards and List Manager.

Find it in the platform:

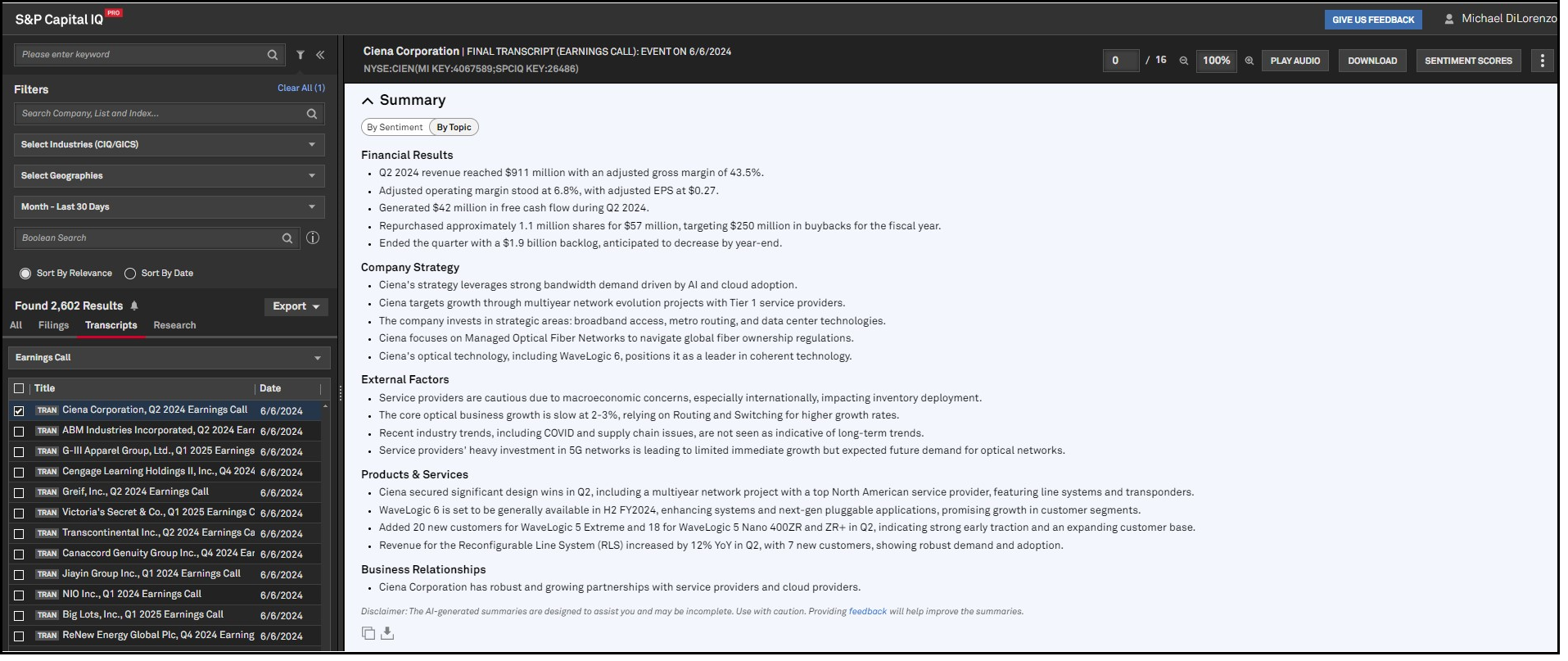

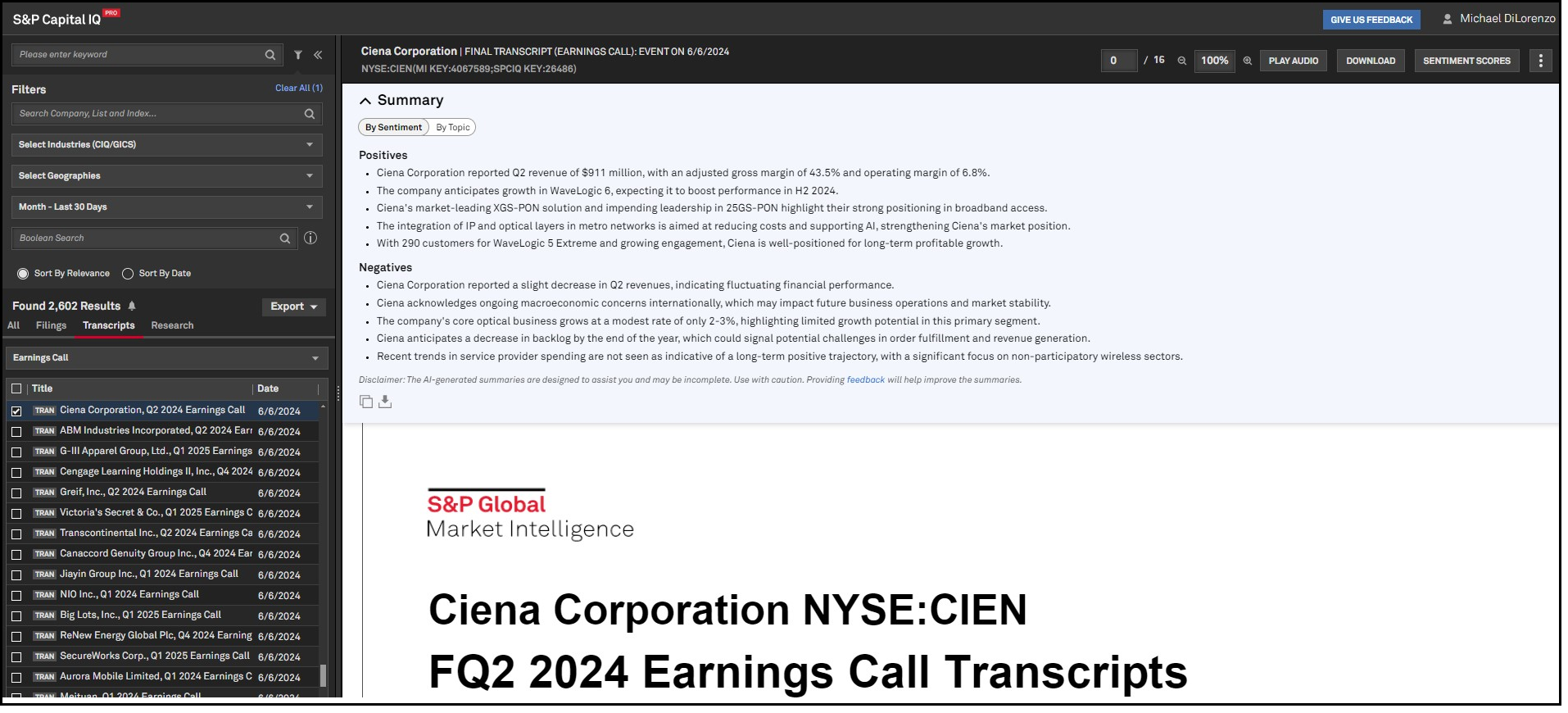

With the advent of Generative AI, we continue to build on our AI-driven enhancements across the platform in partnership with Kensho and our data science teams. In this release, we are introducing Generative AI Transcript Summarization, which provides a summary of earnings call transcripts that saves time for users and complements our NLP-derived sentiment scores within the AI-powered Document Viewer. These new transcript summaries are organized by Topics and Sentiment, offering users a comprehensive overview of the earnings call. Summaries are available for global earnings call transcripts from January 1, 2023 onward.

Users will have the option to select summaries organized by Topic or Sentiment. Topical summaries cover financial results, company strategy, products & services, external factors and partnerships, while Sentiment summaries are categorized as positives or negatives. With this new Generative AI Transcript Summarization, users can quickly glean the tone and mood of an earnings call, identify signals of management's optimism or challenges. As with any document within the Document Viewer, users can directly navigate to text related to the summaries, share with colleagues, and export all summaries to PDF or Word documents. Summaries are available for global earnings call transcripts from January 1, 2023.

Find it in the platform:

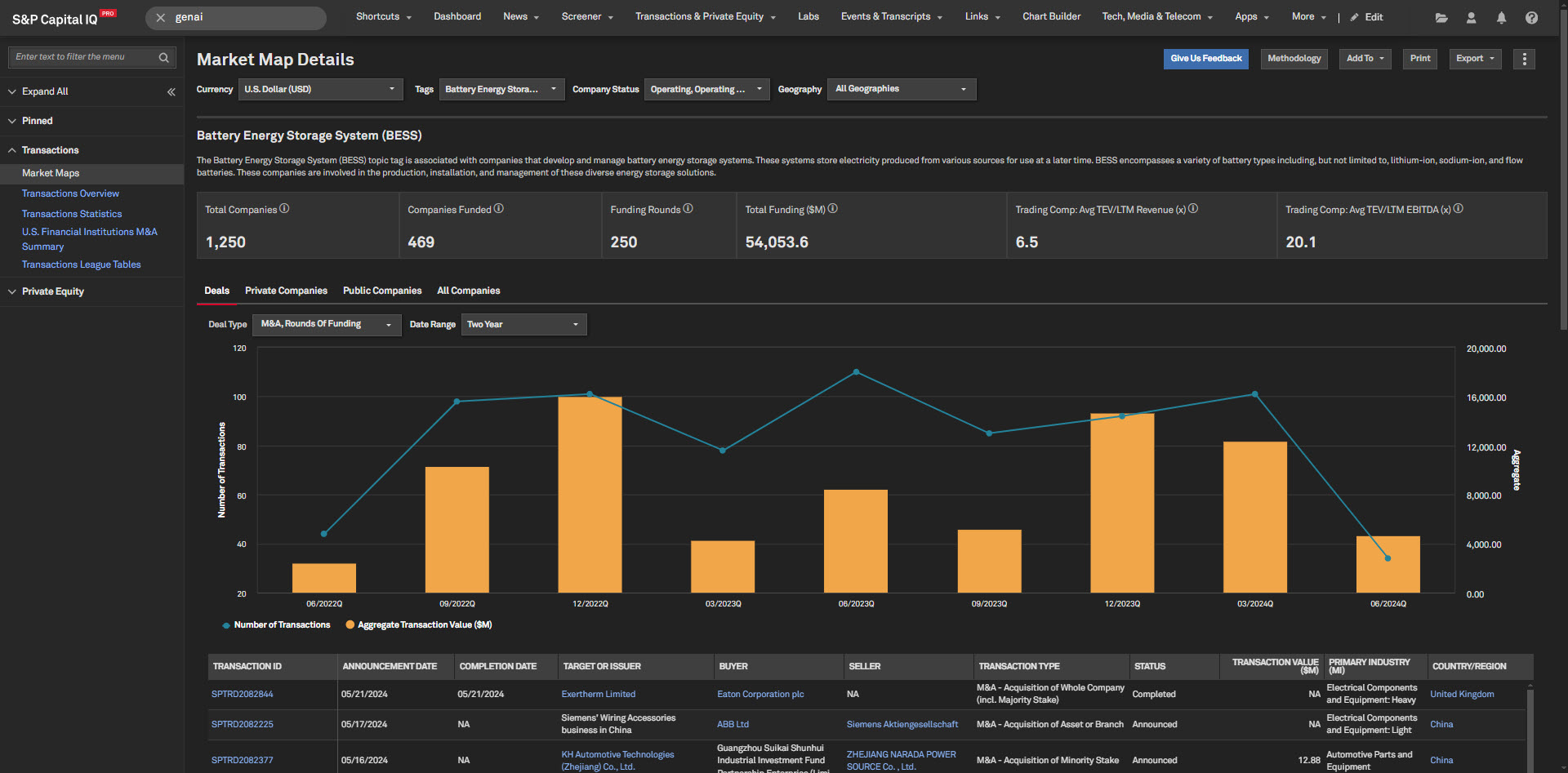

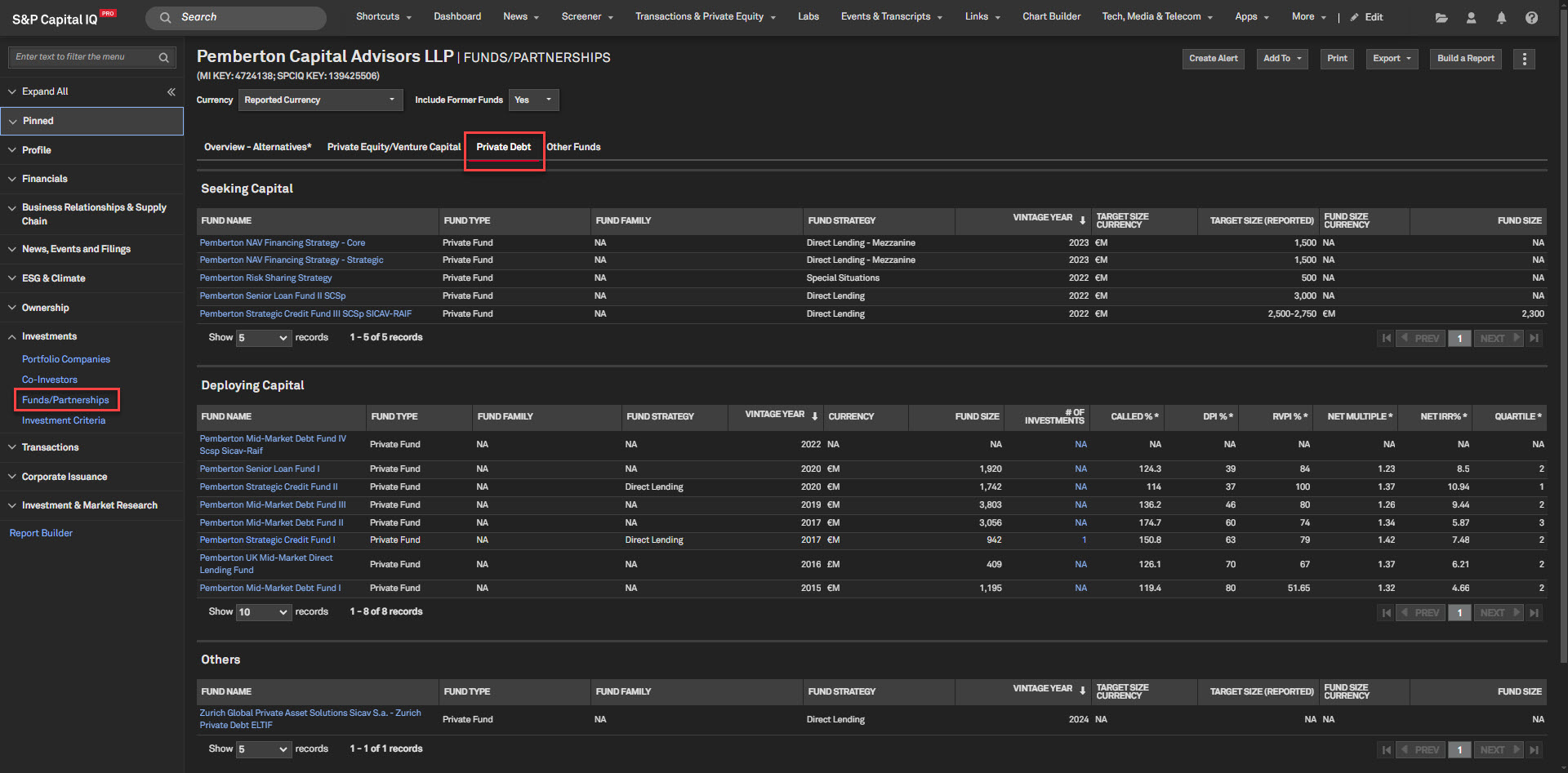

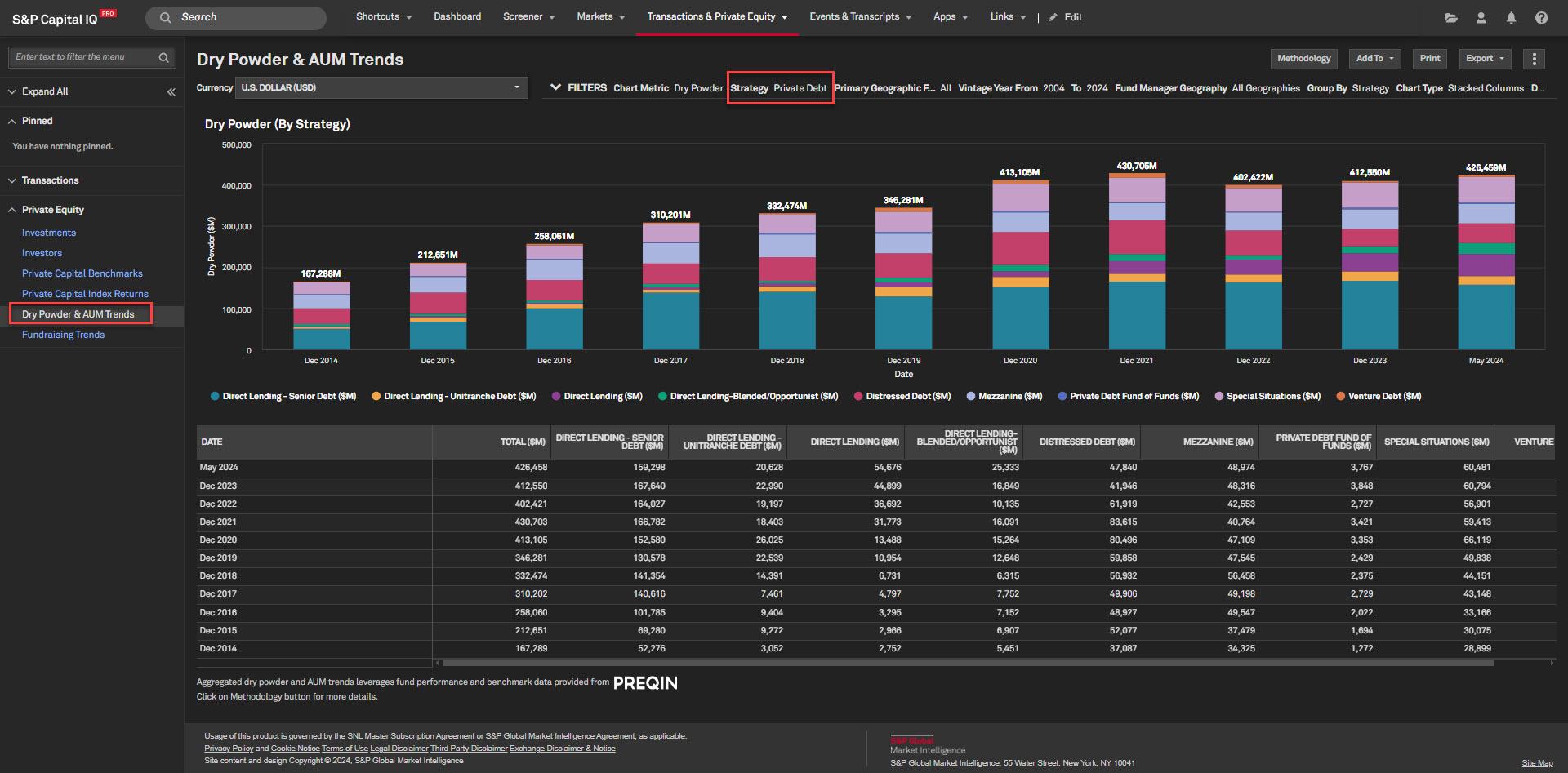

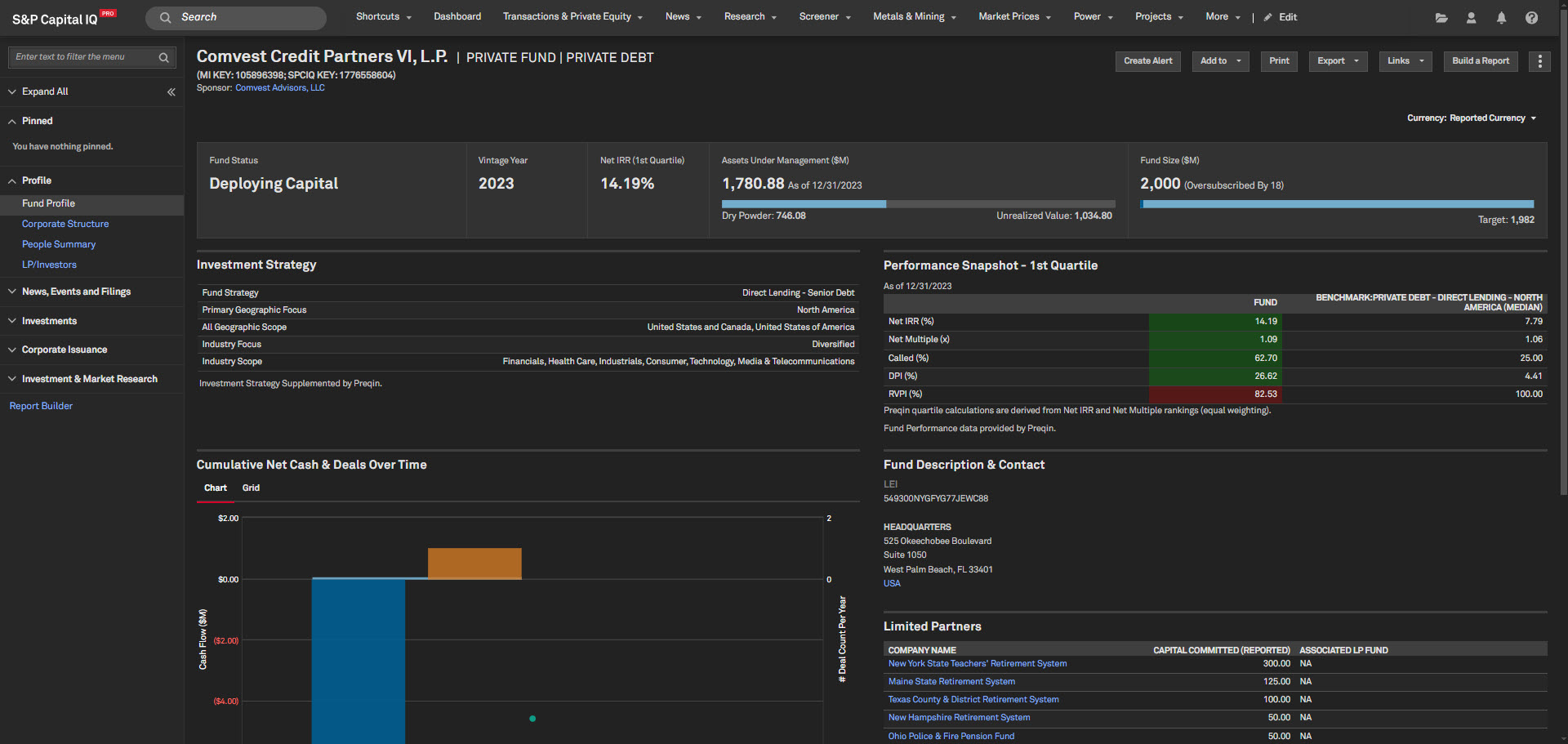

In this release, we expanded our private markets offering by adding 14 new energy-related topic tags and added Preqin's Private Debt asset class on S&P Capital IQ Pro. We enhanced the view of the Private Capital Benchmarks and aggregated Dry Powder & AUM trends, allowing users to gain insights into the private debt industry trends. In addition, for premium users, we expanded our private markets coverage by adding Preqin's Private Debt asset class across investors, fund managers, funds, fund performance and cashflow, benchmark constituent funds, investment criteria and preferences, as well as lender relationships and investor fund commitments.

Users can access 14 new Topic Tags available in Market Maps, Screener, and Corporate Profile, allowing users to identify companies that operate in these niche markets, supporting the deal sourcing workflow. The new topic tags are - Residential Solar; Utility-Scale Solar; Onshore and Offshore Wind; Advanced Nuclear; Battery Energy Storage System; Electric Vehicle Charging Infrastructure; Anaerobic Digestion; Hydrogen; Carbon Capture, Utilization and Sequestration; Direct Air Capture; Green Steel; Renewable Ammonia; Bio-based & Renewable Materials; and Sustainable Aviation Fuel. With these additions, users can now access over 290 market maps to get a top level view of the fundraising and deal activity and its participants in these niche industries.

Find it in the platform:

Coverage stats:

Users can now access Preqin's private debt data across firm, fund, and investor (LP) profiles on the S&P Capital IQ Pro Platform. This enhancement provides users with an expanded view of the private debt asset class within private markets.

Find it in the platform:

Coverage stats:

Note: Access only to users with Preqin Private Debt entitlements, please contact your account team for details on accessing Preqin Premium and Preqin Private Debt

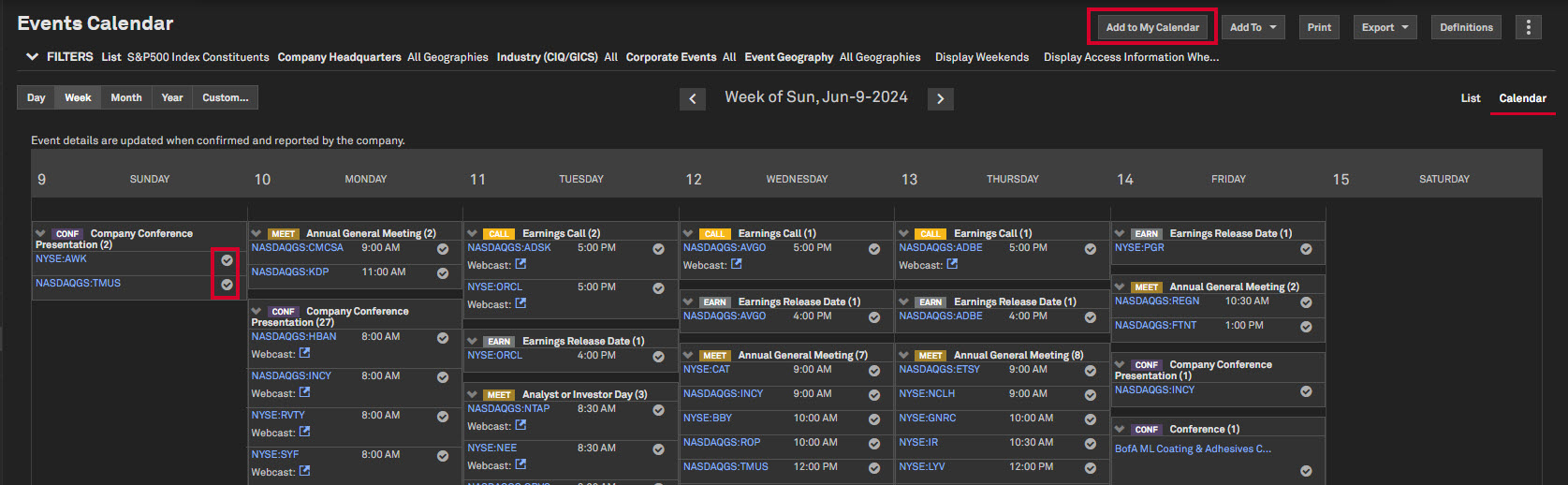

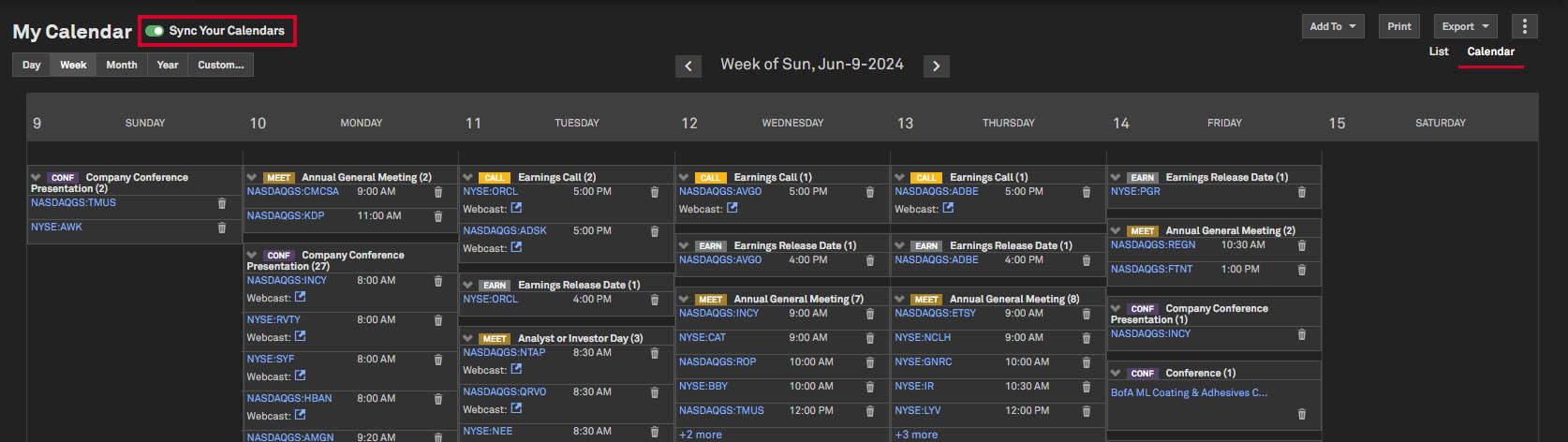

In this release, users can automatically sync corporate and industry events within the Events Calendar to their personal calendars. My Calendar auto sync allows users to subscribe to Capital IQ Pro Events calendar and receive all related updates in their personal calendar seamlessly.

S&P Capital IQ Pro users can seamlessly sync Events Calendar invites to their work and personal calendars by using the new My Calendar Auto Sync feature. This functionality allows users to subscribe to relevant corporate, industry, and economic events, and receive updates directly in their calendars without downloading invites from the Capital IQ Pro platform.

Filter level preferences, when added to My Calendar, are dynamic, and in the future, any events that match the filters will automatically synchronize without any manual intervention. In addition, users can also sync individual events by adding them to My Calendar from either Calendar or List view. The updated Events Calendar and My Calendar pages also simplify the process of identifying subscribed events and effortlessly remove any undesired ones.

Find it in the platform:

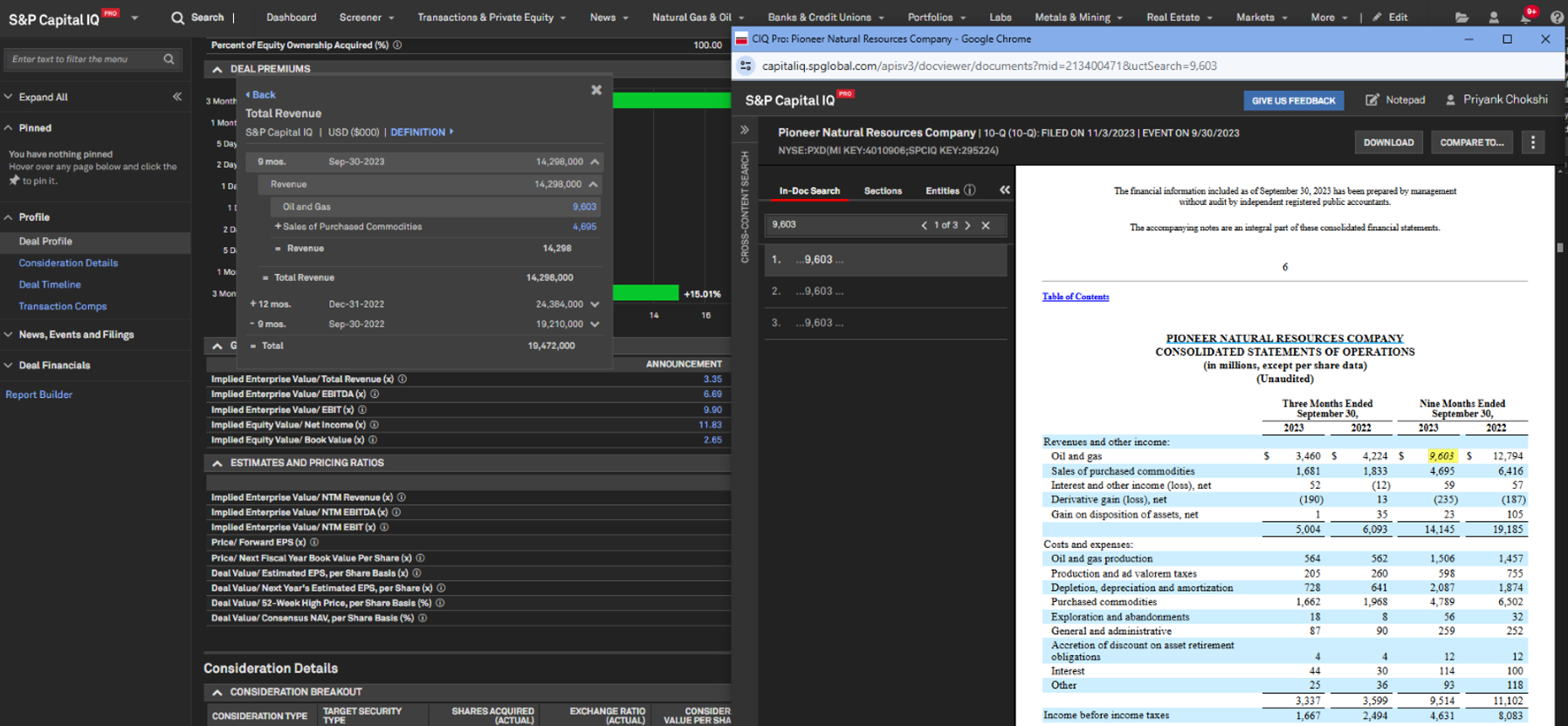

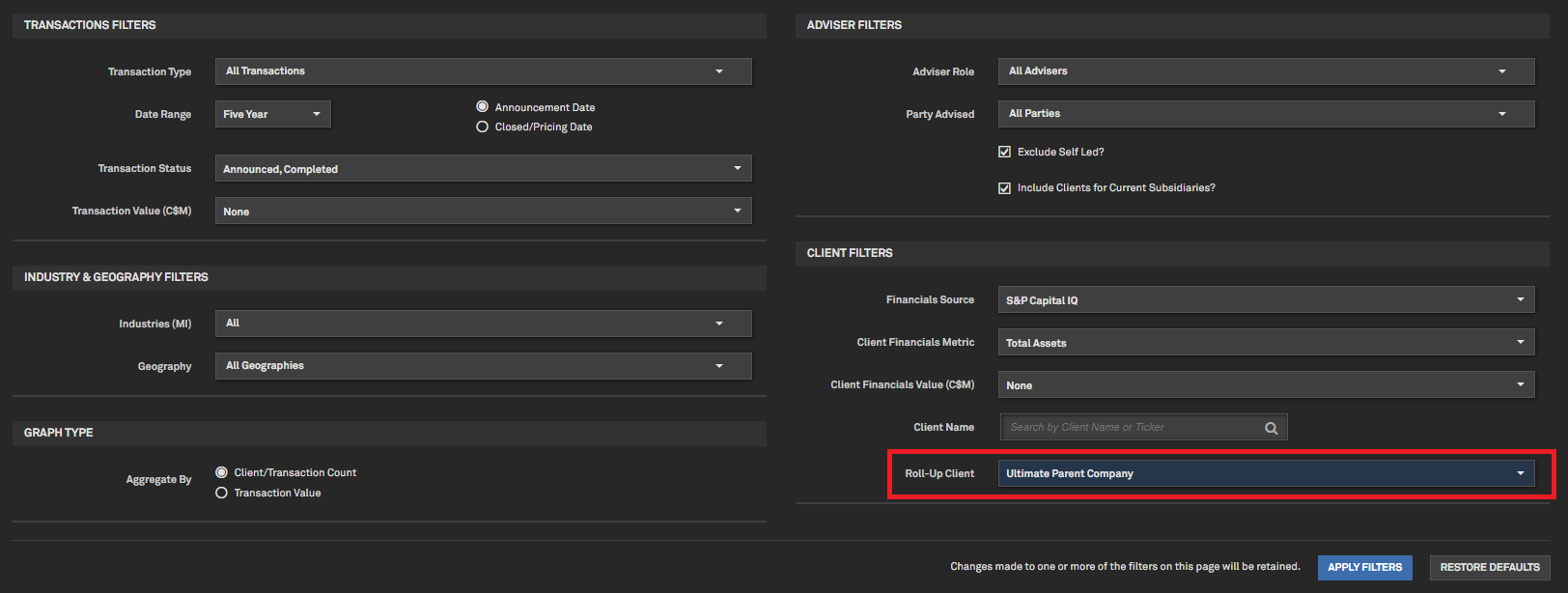

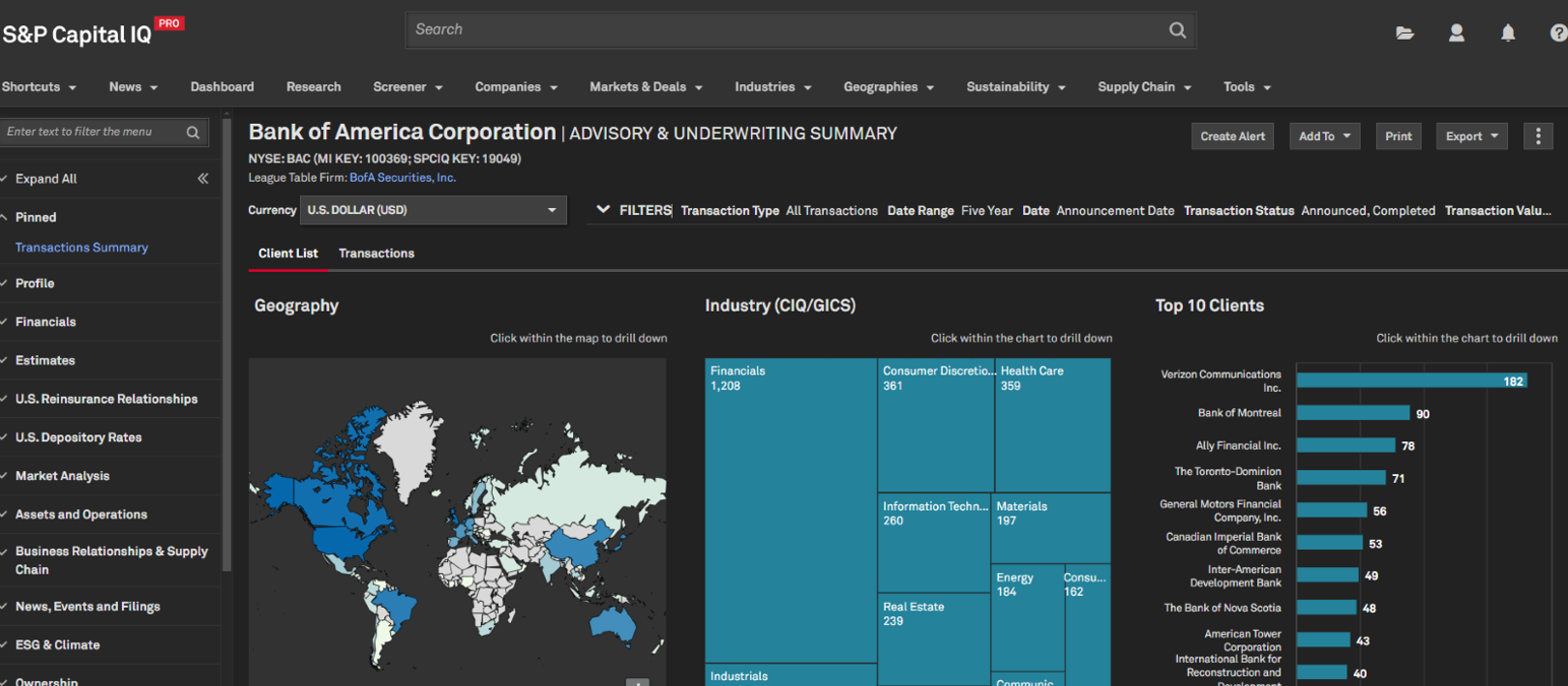

In this release, we added click-through functionality for S&P Capital IQ sourced financials used in M&A deal valuation and general ratios calculations. We also enhanced the client level filters on the clients’ tab of the Advisory & Underwriting summary page where users can now apply financial filters, including industry and geography, at the Ultimate Parent level, when filtering to roll up on Ultimate Parent company. Additionally, M&A league tables now feature reverse mergers, including the buyer's industry and geography.

Users can click through into S&P Capital IQ-sourced financial values used in M&A valuation and general ratios.

Find it in the platform:

Users can now filter for clients of an advisor/underwriter by Ultimate Parent using the Roll-up Client dropdown selection on the Advisory & Underwriting Summary page. This feature provides users with a view of an adviser-client relationship and client subsidiaries, and the ability to understand the depth of the existing relationship. Additionally, all the client level filters, including Industry and Geography filters on the clients’ tab, can now be applied at the Ultimate Parent level, enabling a top-level view of the clients of an advisor/underwriter.

Find it in the platform:

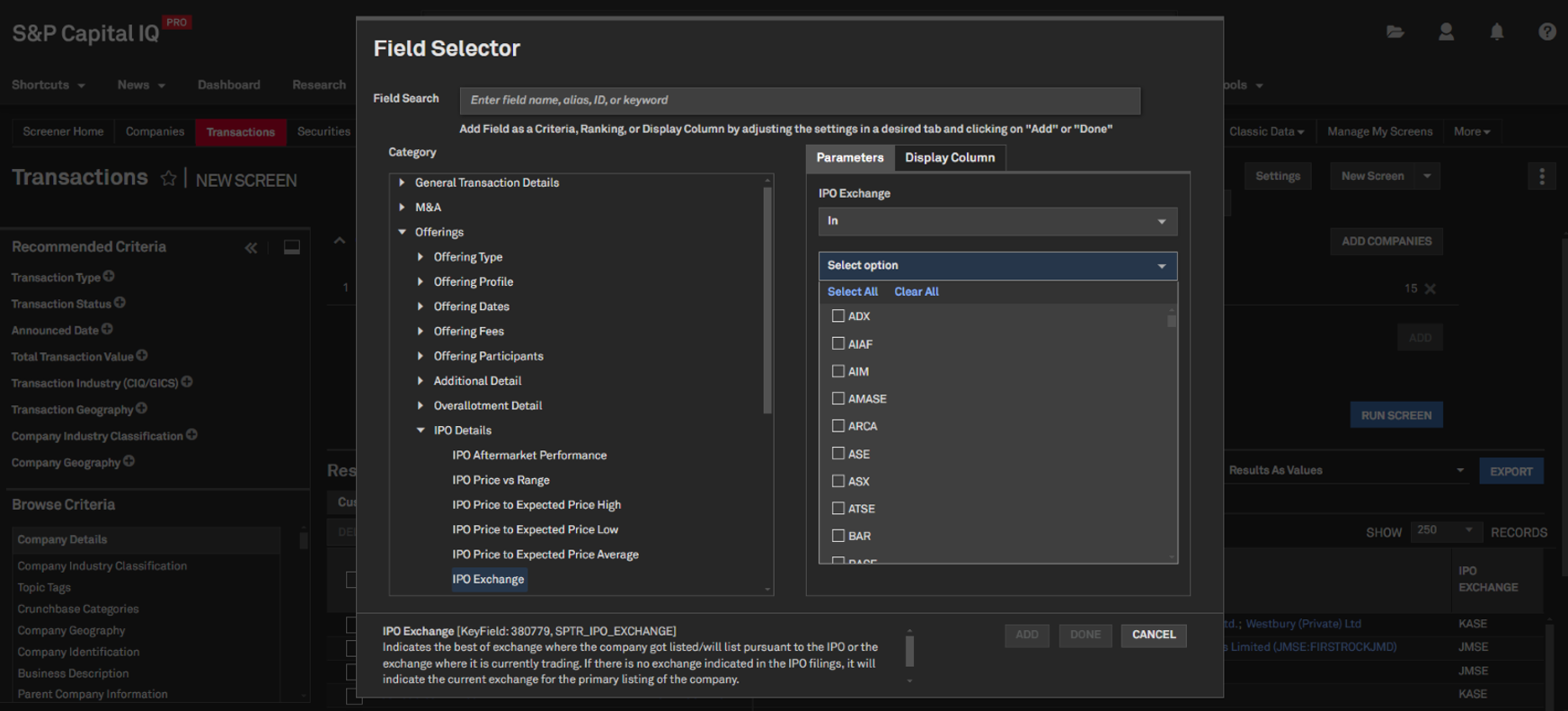

Users can now screen for companies and IPO transactions based on the exchange that the company is listed, following the IPO.

Find it in the platform:

Users can now create league table rankings whereby all reverse merger transactions, including SPAC backdoor IPO’s and reverse mergers, are classified using buyer’s industry and geography for ranking purposes.

Find it in the platform:

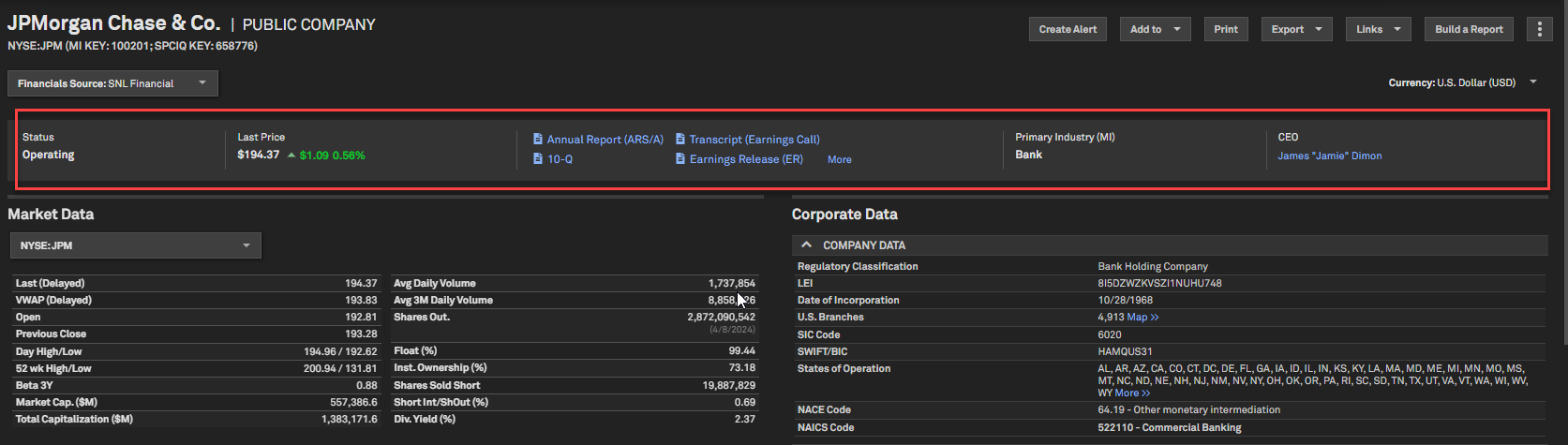

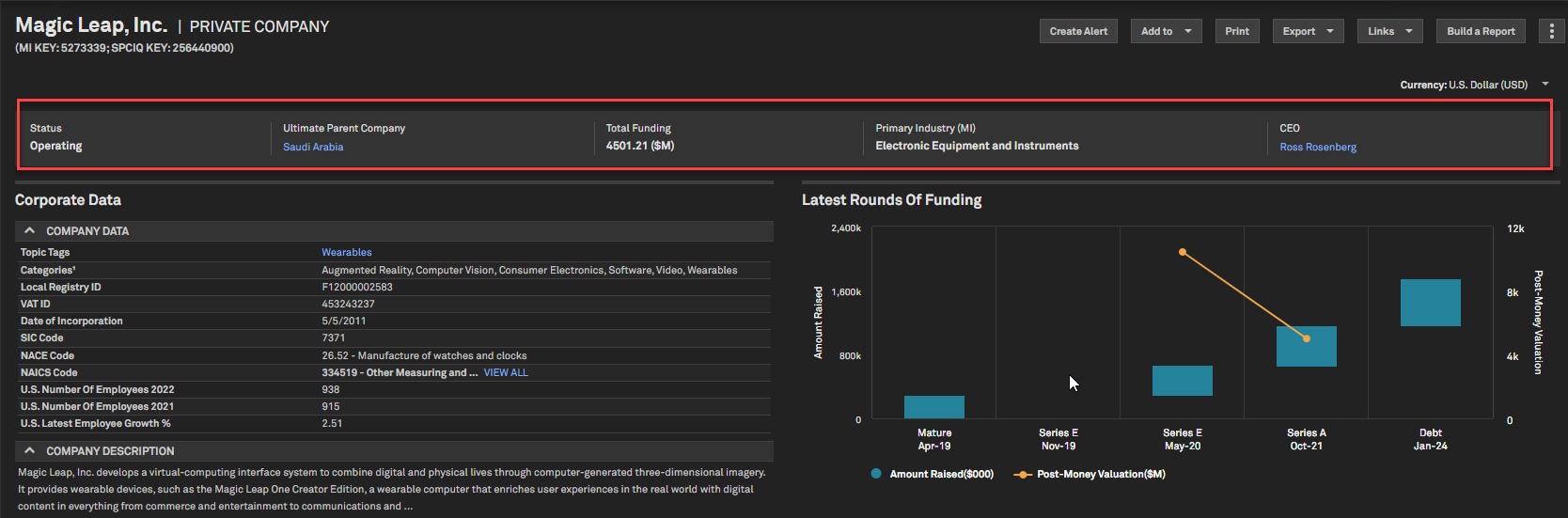

In this release, we enhanced the top ribbon of the Corporate Profile of public and private companies with the addition of commonly sought after information to provide our users with quicker access to the latest updates of a company.

Users can now get quick access to earnings call details, key documents, latest share price and other metrics in the top ribbon for public companies. Similarly, for private companies, users can view parent company information, total funding and other key metrics with this update.

Find it in the platform:

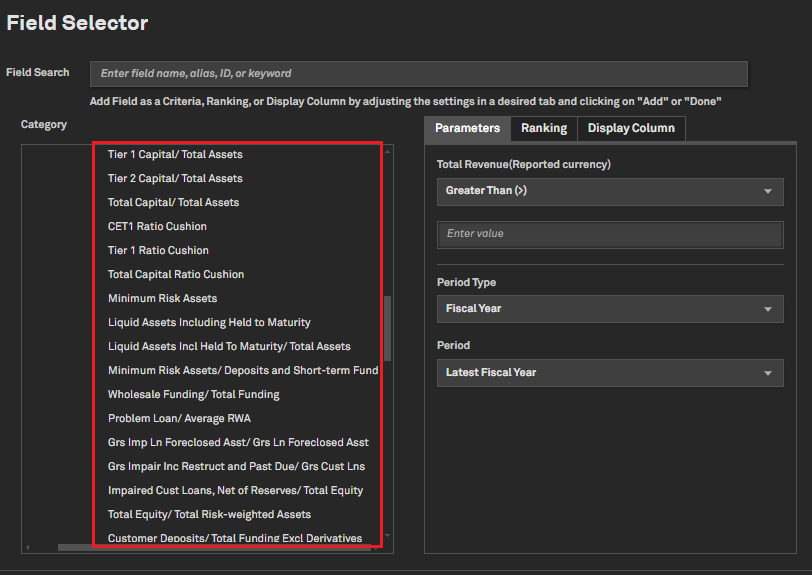

In this release, we added auto-derived ratios related to Balance Sheet, Income Statement, capital adequacy, and asset quality for both U.S. and global banks. We incorporated Form ADV data from Section 7.A & Section 7.B of Schedule D for all registered investment advisors and exempt filers. Additionally, we added new CDFI fields and updated Uniform Bank Performance Report (UBPR) fields. Finally, we updated & aligned the Herfindahl-Hirschman Index for Change in Market to 100 within the Branch Analytics Merger Planning/HHI Analysis Application.

Users can now access derived ratios related to Balance Sheet, Income Statement, capital adequacy, and asset quality for US and global banks.

Find it in the platform:

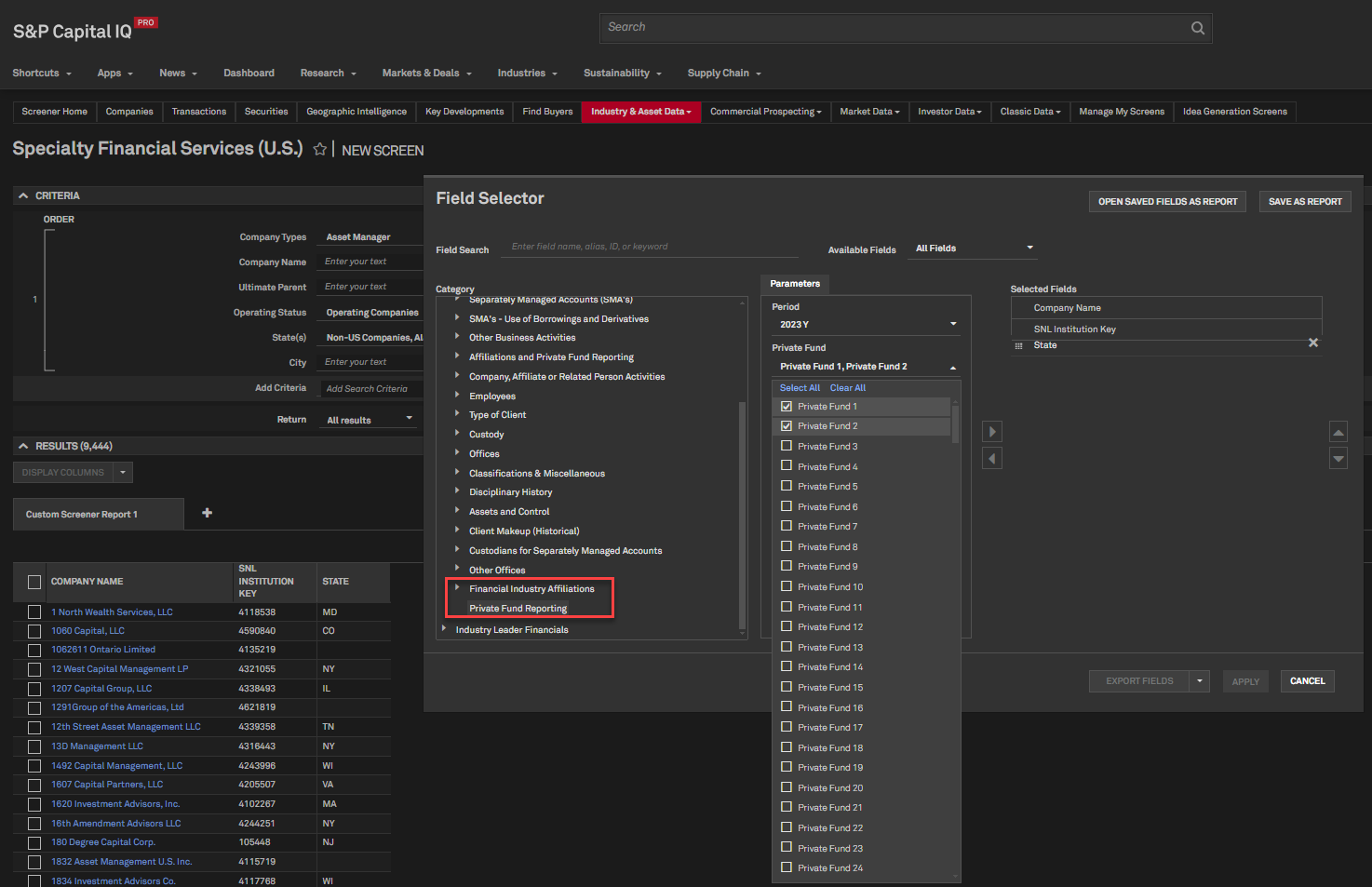

Users can now access additional disclosure details available from section 7.A of Schedule D where a U.S. asset manager is required to disclose their financial industry affiliations and any related person that provides certain financial services. Additionally, users can access section 7.B of Schedule D, which provides basic information on the size and organizational, operational, and investment characteristics of each private fund that it advises.

Find it in the platform:

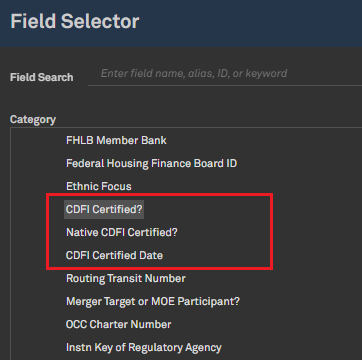

Users can now access newly introduced Community Development Financial Institutions (CDFI) fields in Screener.

Find it in the platform:

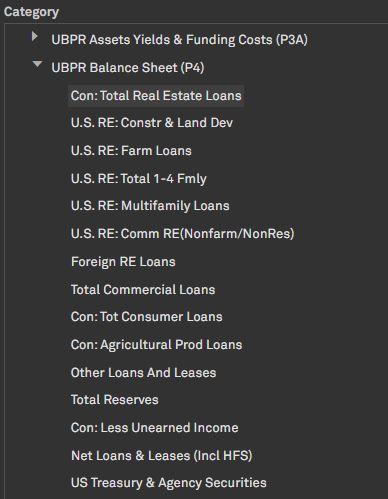

Users can now access updated fields within UBPR Balance Sheet (P4) sub-category on Screener.

Find it in the platform:

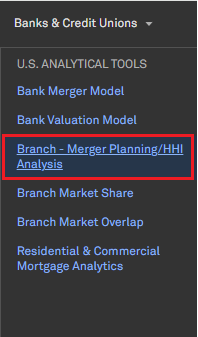

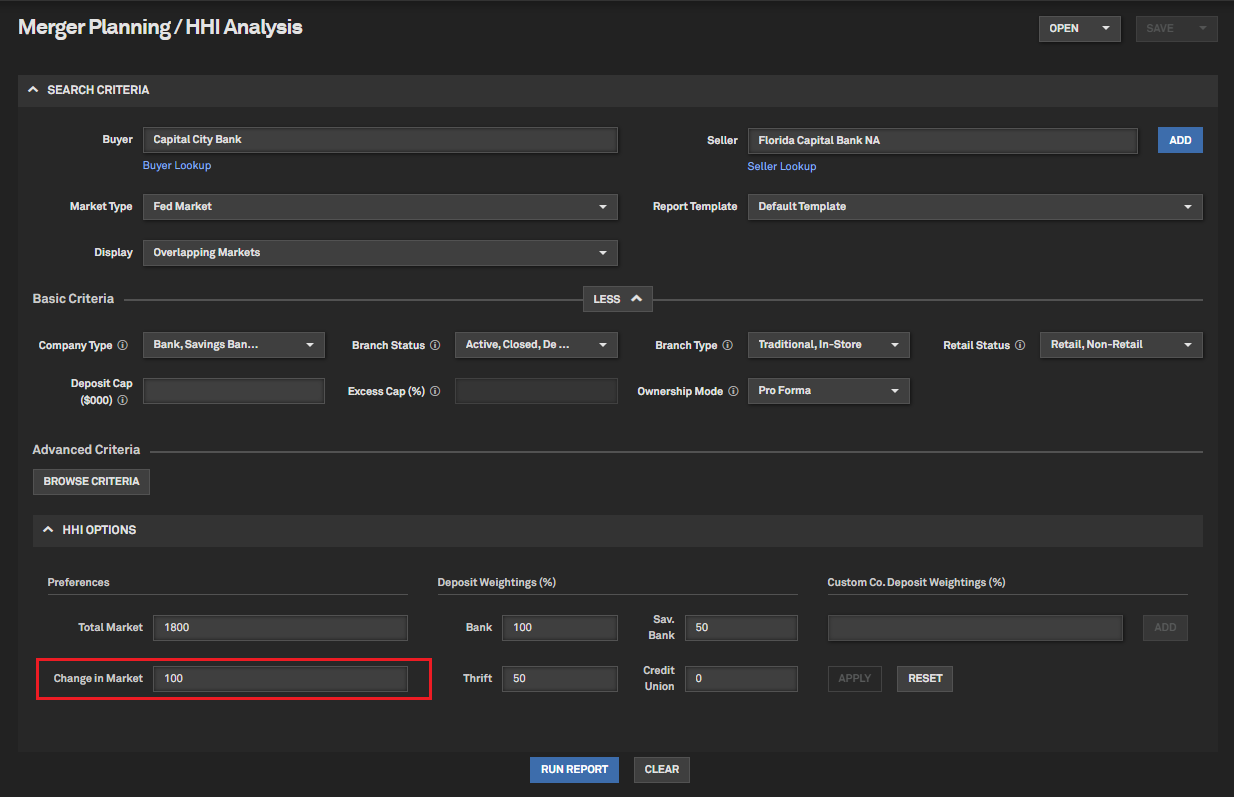

When assessing competition and potential monopolistic behavior within a market, the Change in Market default index is now set to 100 for proforma and current years. This update is in accordance with the new guidelines introduced by the Department of Justice.

Find it in the platform:

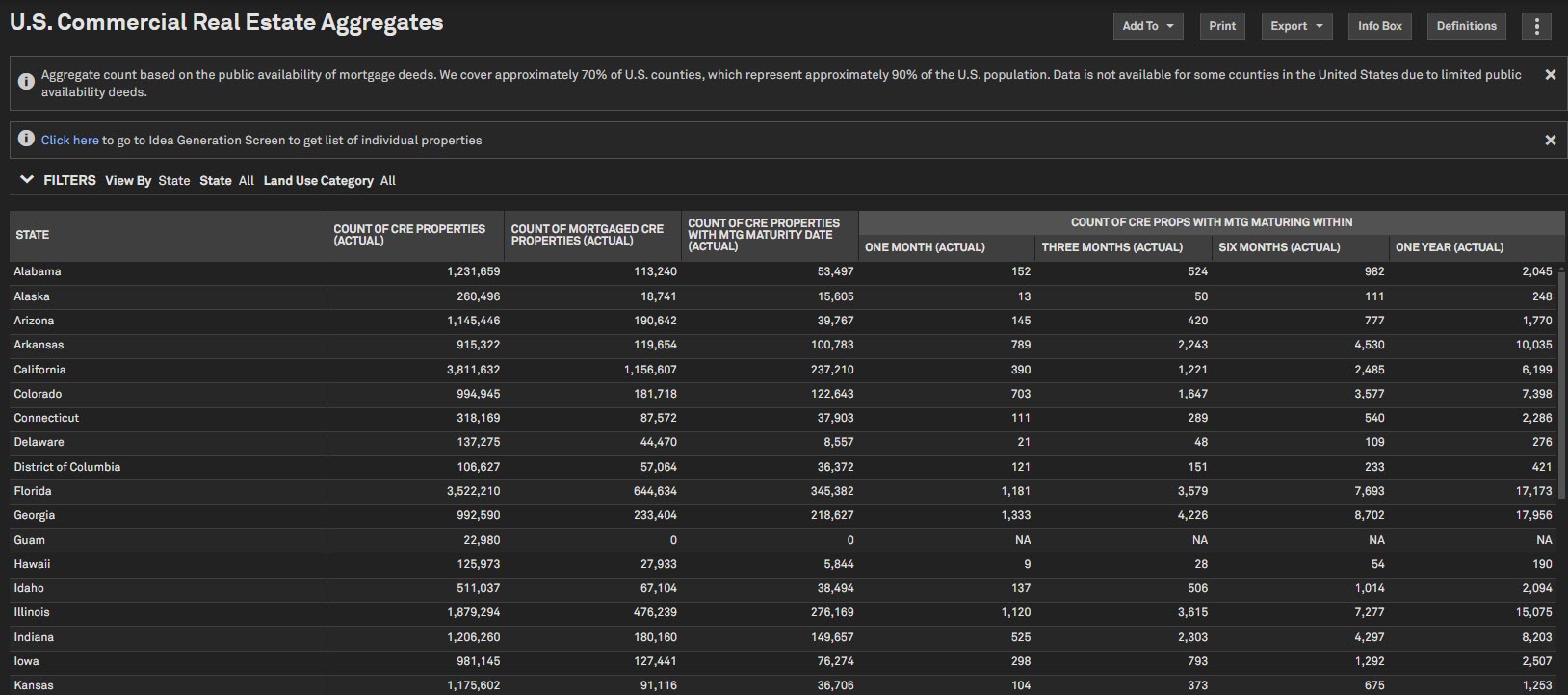

In this release, we introduced the U.S. Commercial Real Estate Aggregates page, providing users with access to a consolidated view of maturing CRE (Commercial Real Estate) mortgages by State, MSA, or County. Additionally, we enhanced integration between Companies data and Business Listings by adding MI Institution Keys to the Business Listings dataset. Lastly, we released new and improved Idea Generation screens, further enhancing Prospecting workflows.

Users can now access an aggregated view of Commercial Real Estate (CRE) mortgages by state, MSA, or county on a single page with an option to filter further by Land Use category, making it easier to track and analyze trends in the CRE mortgage market.

Find it in the platform:

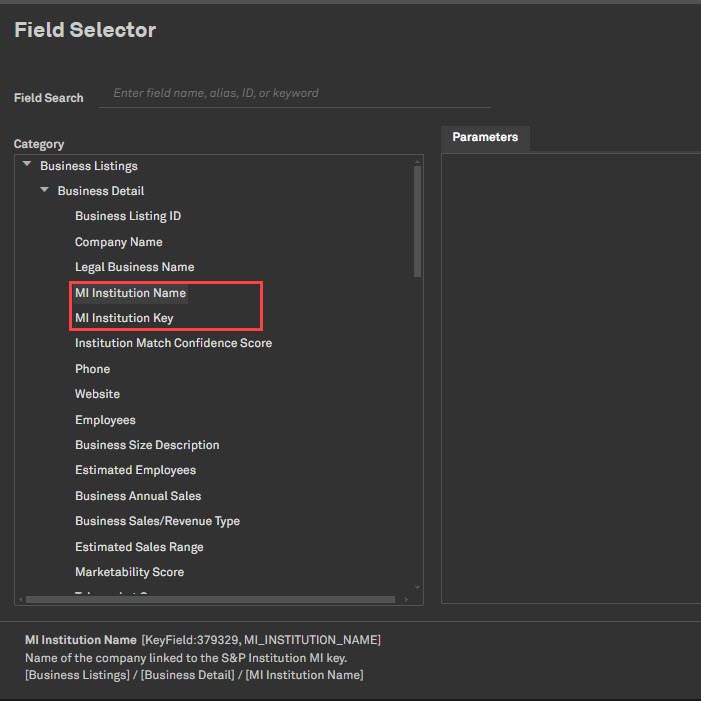

Users can now pull in MI Institution Key within Business Listings data. This data integration will help establish stronger connections between company profiles and business listings, allowing for more effective prospecting.

Find it in the platform:

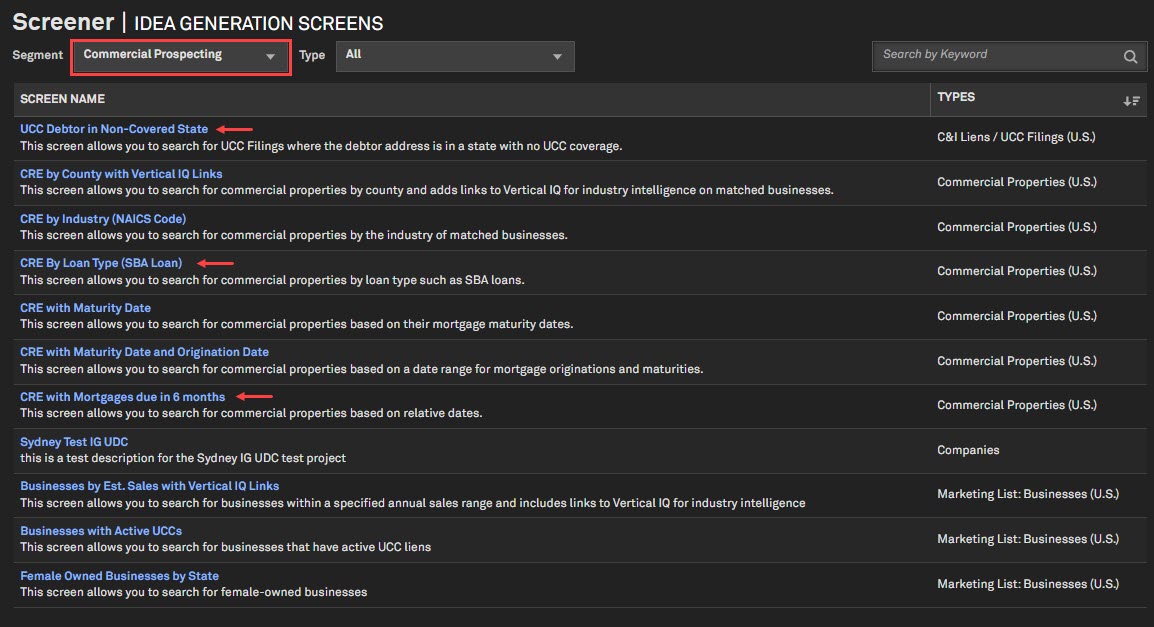

Users can access both new and enhanced Idea Generation screens for Commercial Prospecting workflows.

Find it in the platform:

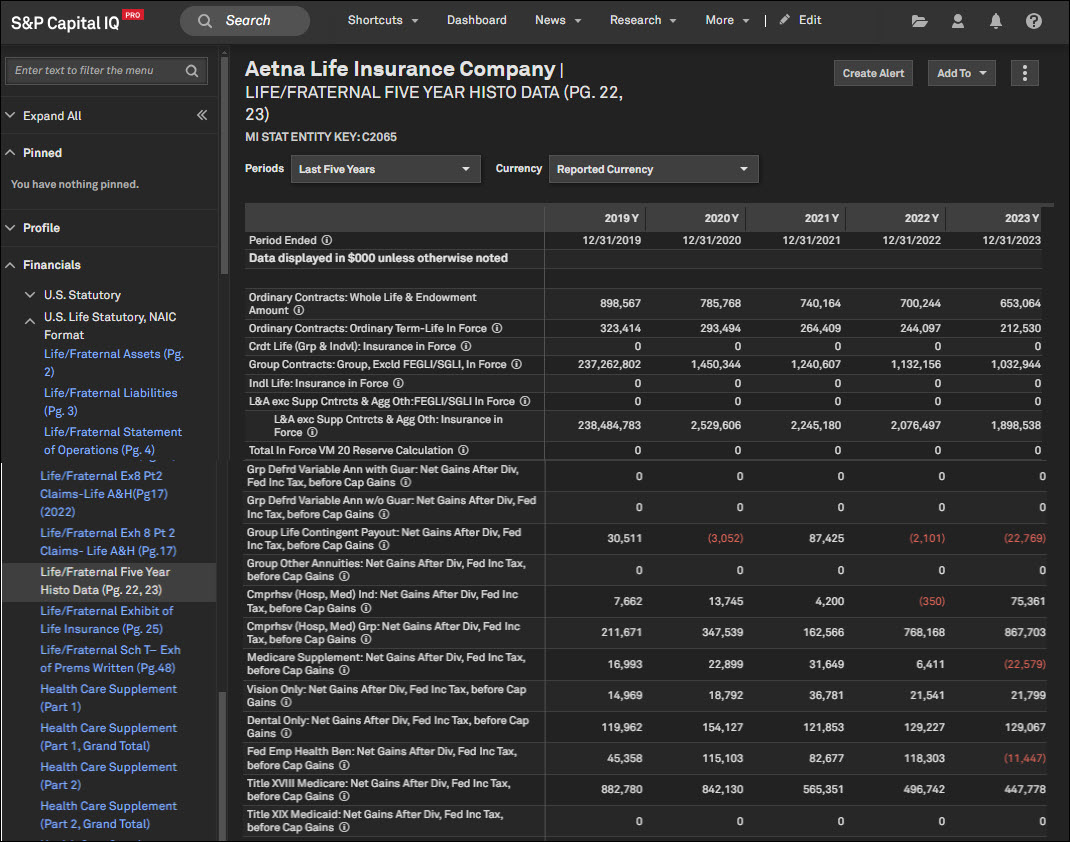

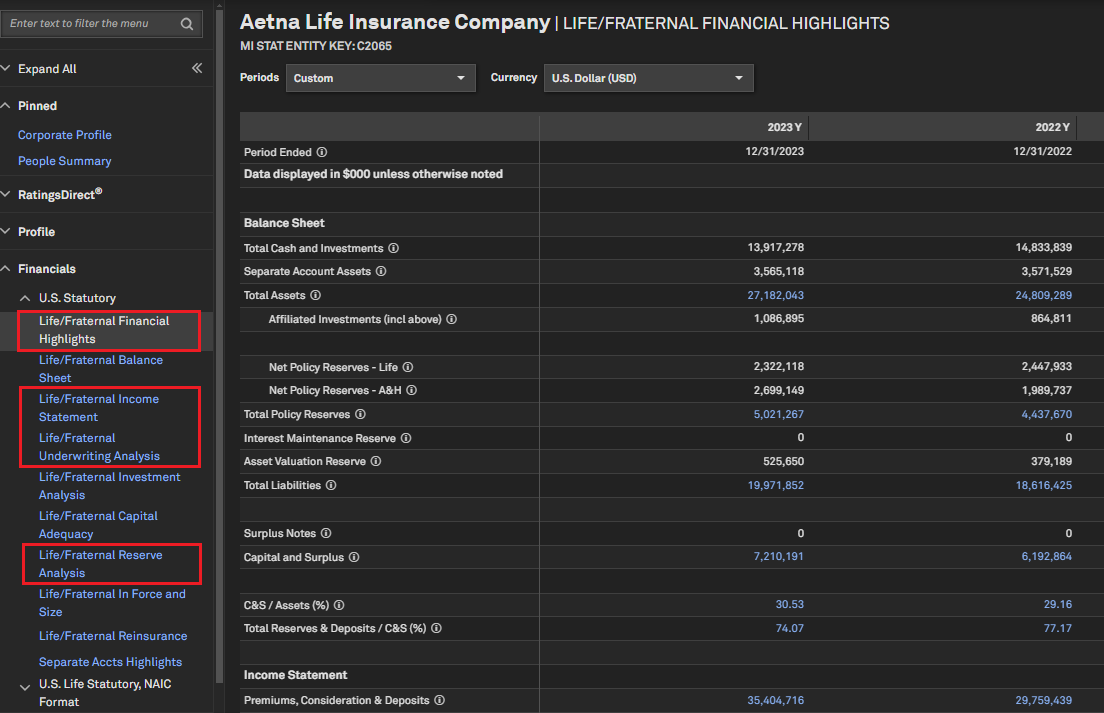

In this release, we enhanced the U.S. Insurance Statutory offering by adding the most relevant line items on the U.S. Statutory financials, providing comprehensive coverage through our relationship with the NAIC (National Association of Insurance Commissioners), the U.S. regulator for insurance companies. Additionally, we expanded our insurance coverage in North America to include financial data for Canadian insurance companies within Screener. This data is directly sourced from the Canadian regulator OSFI (Office of the Superintendent of Financial Institutions), including the newly adopted IFRS 17 regulatory disclosures by Canadian insurance companies.

Users can access updates to Lines of Business which are reflected in the following pages to ensure consistency across Life/Fraternal filings.

Find it in the platform:

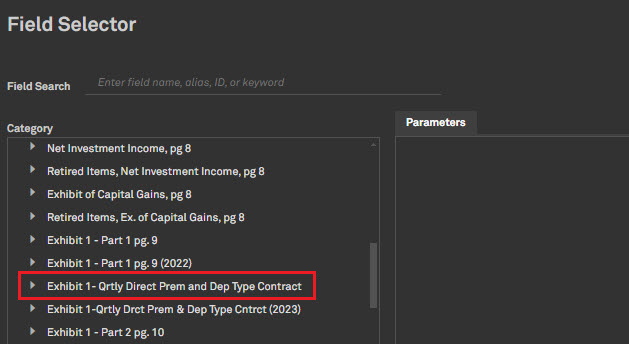

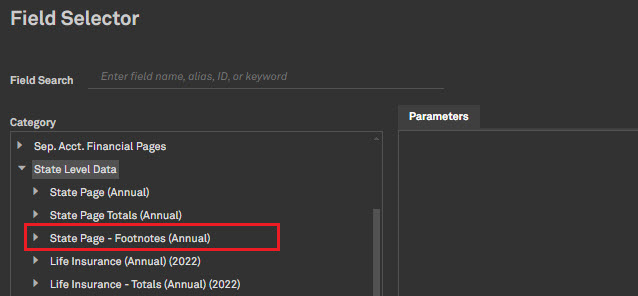

Users can access two new subcategories in Life/Fraternal exhibits in Screener for State Page Footnotes and Exhibit 1 – Quarterly data points.

Find it in the platform:

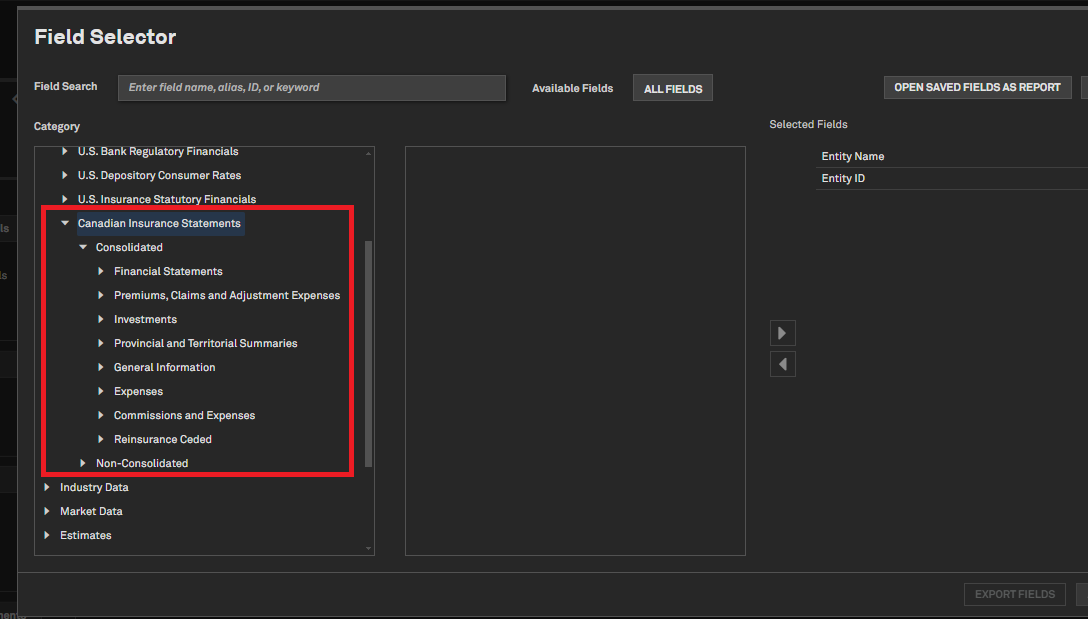

Users can access consolidated and non-consolidated financial data for Canadian insurance companies in Screener. We added new categories and subcategories of fields reported by Canadian P&C and Life insurance companies spanning across core financial statements, premiums, claims and adjustment expenses, investments, provincial and territorial summaries, commissions and reinsurance in the companies dataset in Screener. We also added Canadian Insurance corporate fields to allow users to filter and identify Canadian insurance companies by sector.

Find it in the platform:

Coverage stats:

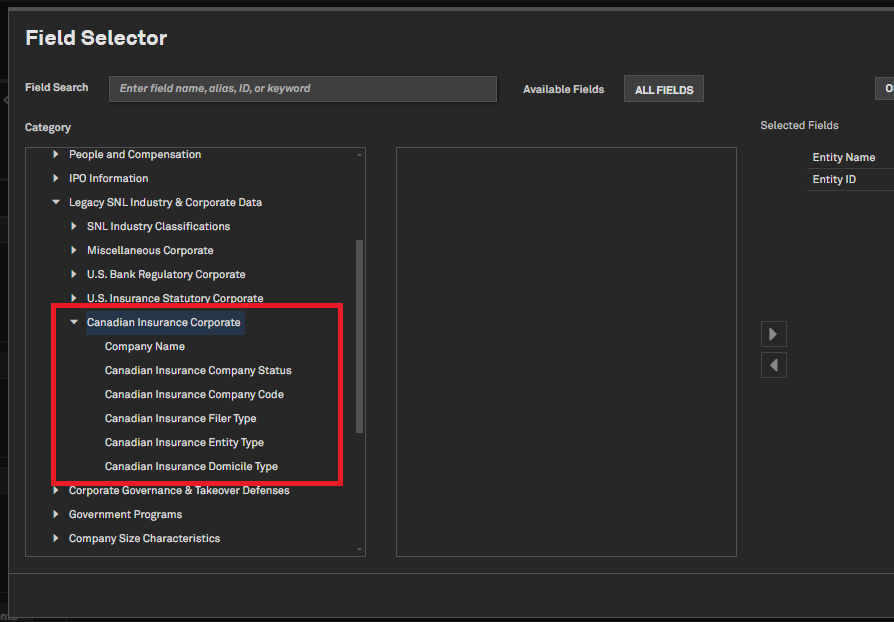

Users can access all the required insurance corporate fields for Canadian insurance companies in the Screener companies dataset. These fields allow users to filter relevant Canadian insurance companies, identify their status, pull the official company code, identify filer and entity type, and view additional details on Canadian insurance domicile type.

Find it in the platform:

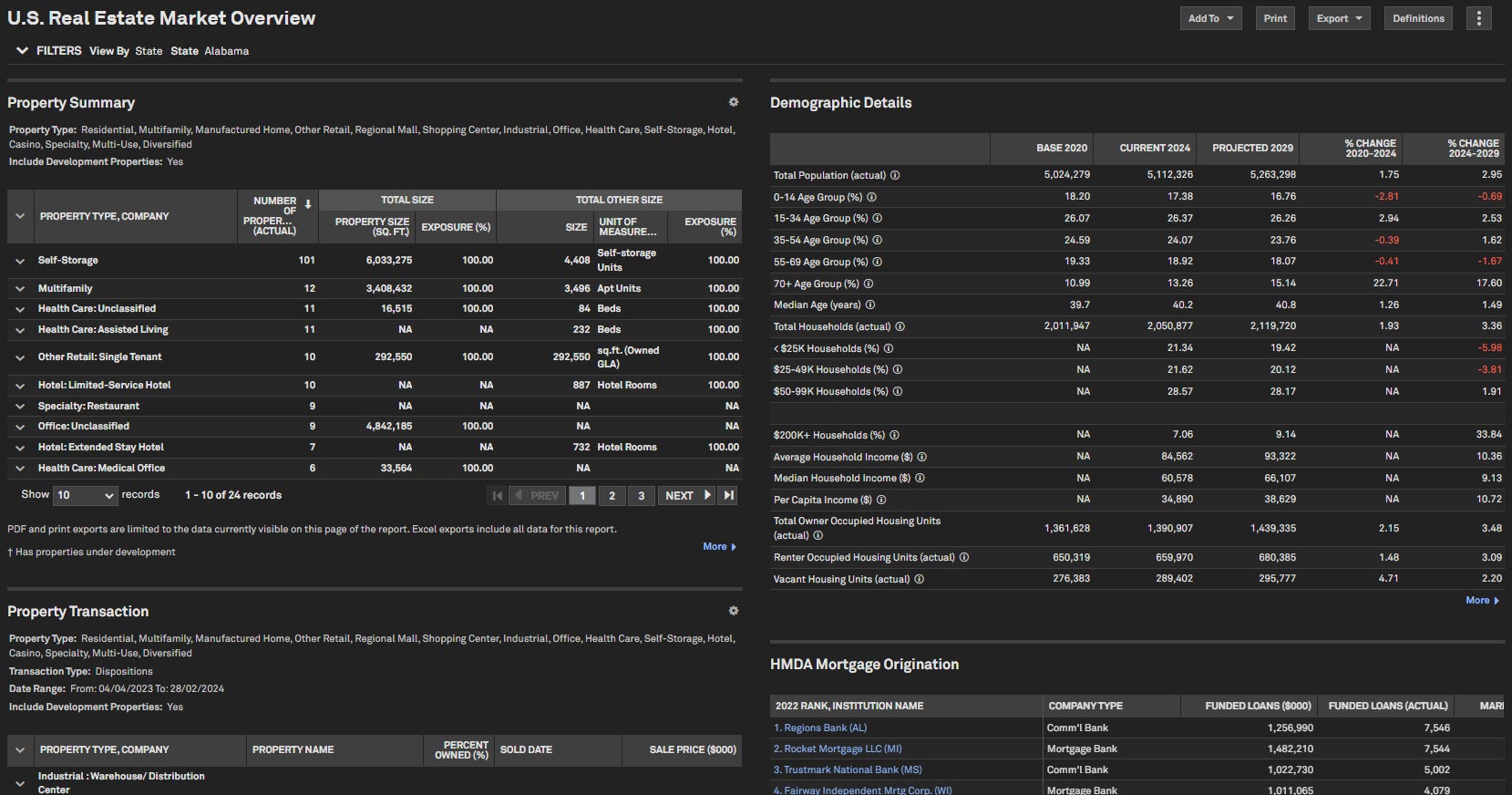

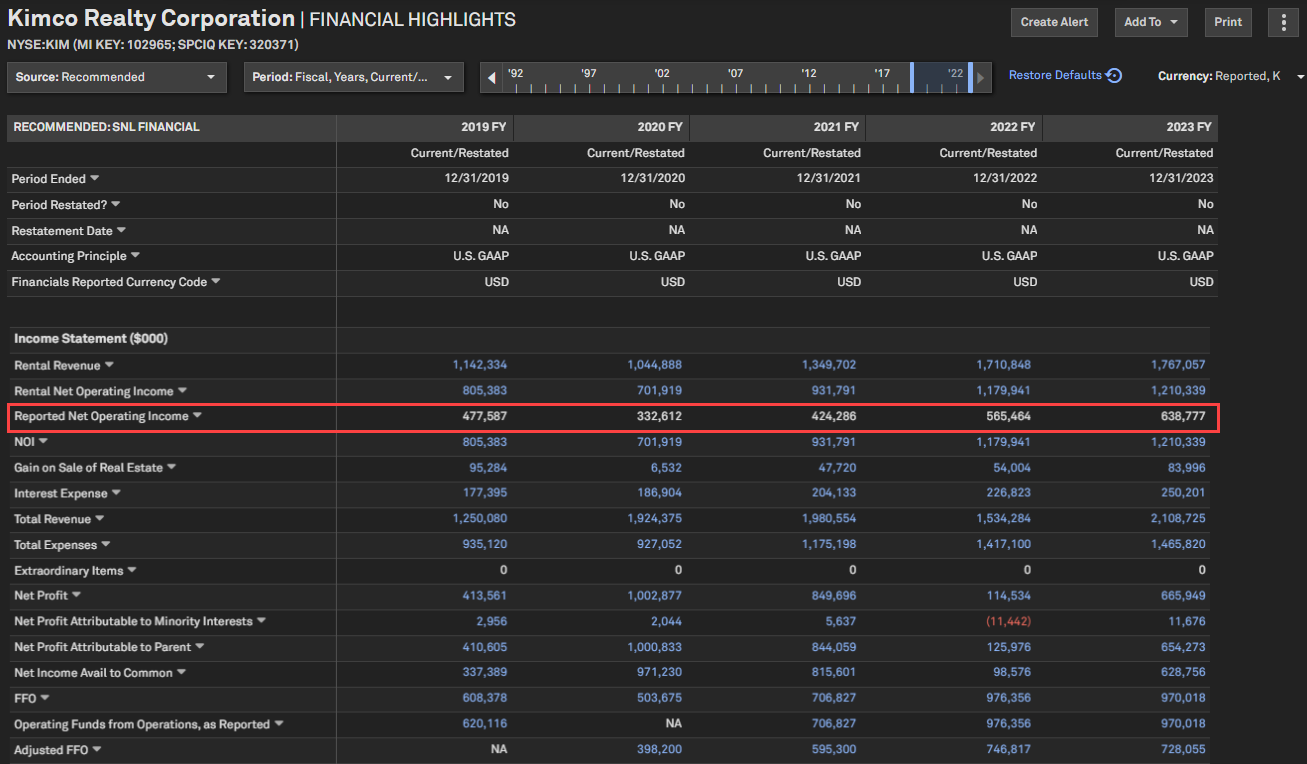

In this release, we introduced Real Estate Market Overview page providing users with a streamlined view of Real Estate data to seamlessly access critical market insights. We also added Net Operating Income (NOI) financial data, specifically for US REITs, empowering users to make more informed decisions.

Users can now access real estate and related datasets at a glance with the addition of the Real Estate Market Overview page.

Find it in the platform:

Users can view net operating income (NOI) for U.S. REITs on the financial highlights page in Capital IQ Pro platform.

Find it in the platform:

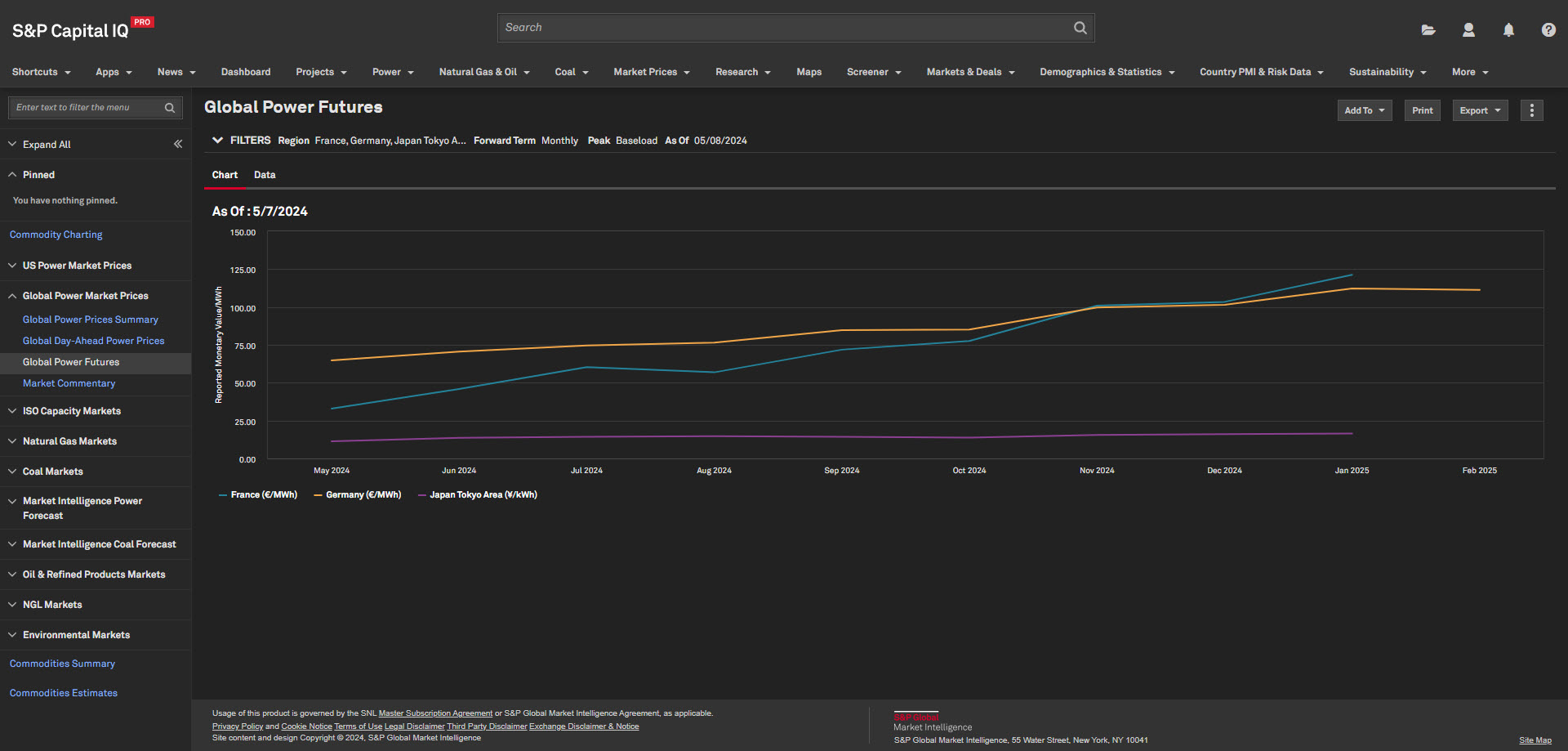

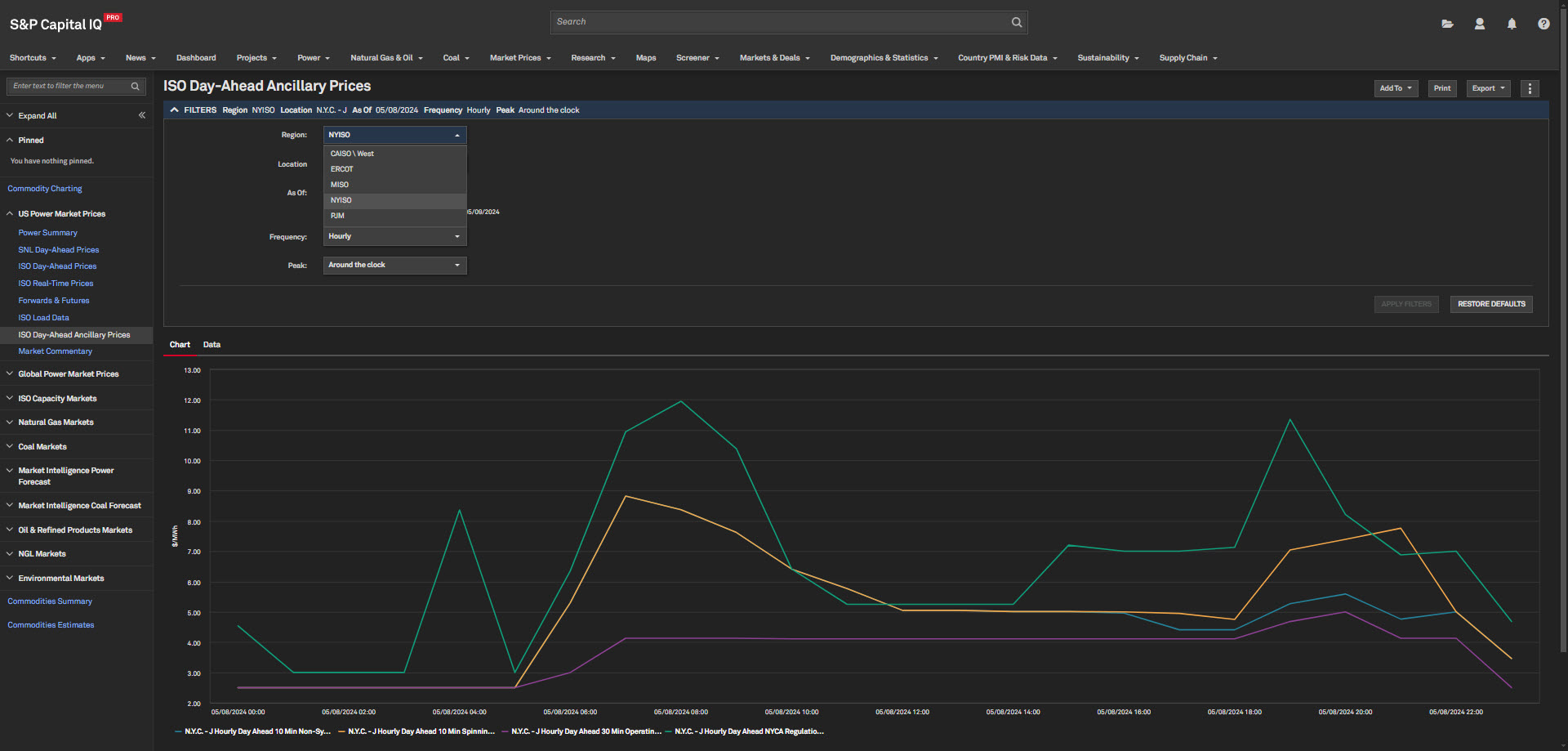

In this release, we enhanced coverage of power pricing with the introduction of Global Power Pricing data, accessible on the Global Power Prices Summary page, the Global Day-Ahead Power Prices page, and the Global Power Futures page. Additionally, we expanded our Ancillary Pricing Data coverage to include two new regions, NYISO (New York ISO) and MISO (Midcontinent ISO).

Users can access Day-Ahead Power Pricing for United Kingdom and Power Futures for select countries in Europe and Asia. This feature enables users to value generating assets and portfolios and track impact of renewable integration in these regions.

Find it in the platform:

Coverage stats:

Users can access Ancillary Pricing data for ISO regions throughout the United States, including the NYISO and MISO regions. This enhancement empowers users with deeper insights into ancillary markets and helps with decisions around grid optimization and generating resource procurement.

Find it in the platform:

Coverage stats:

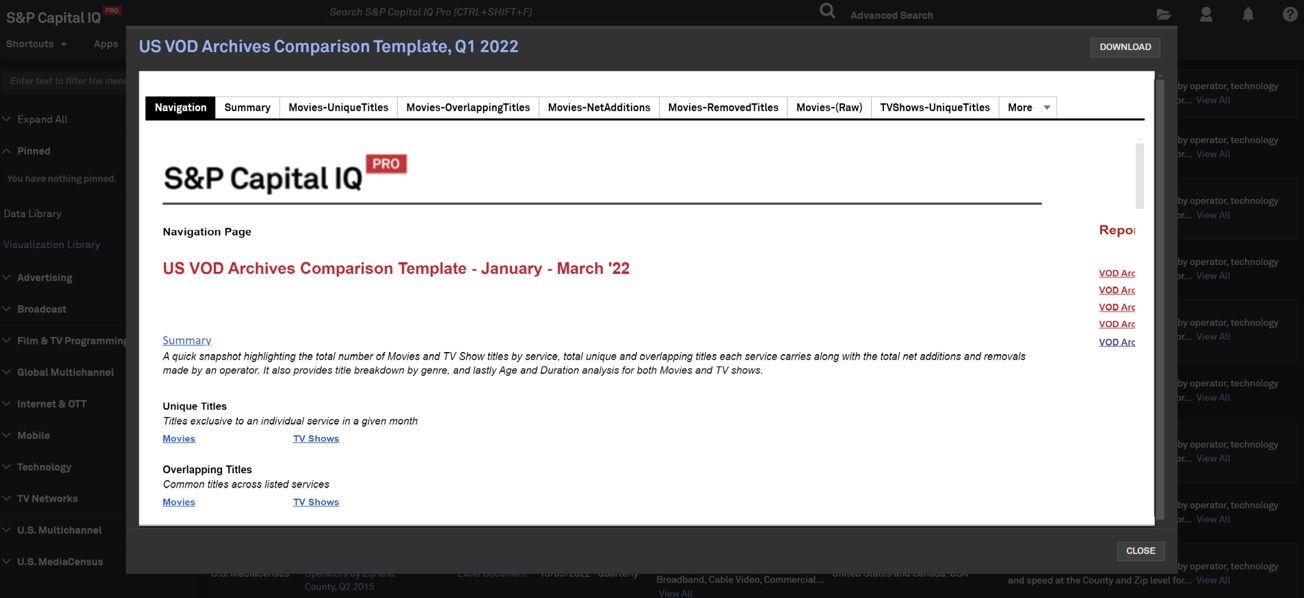

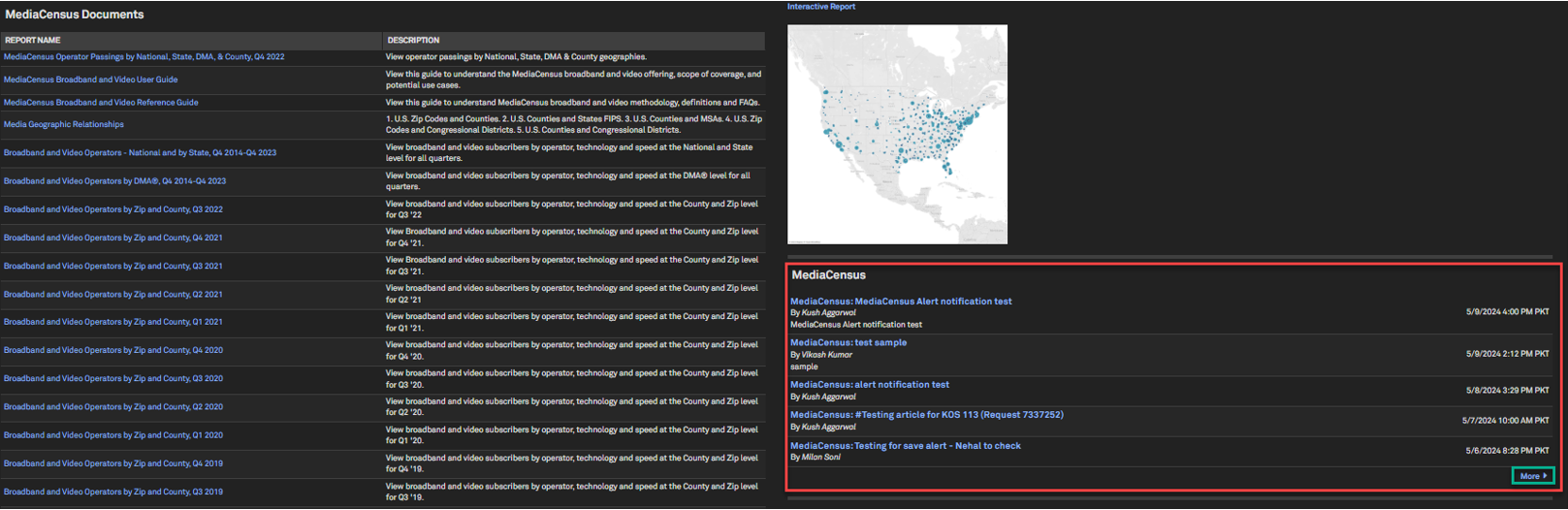

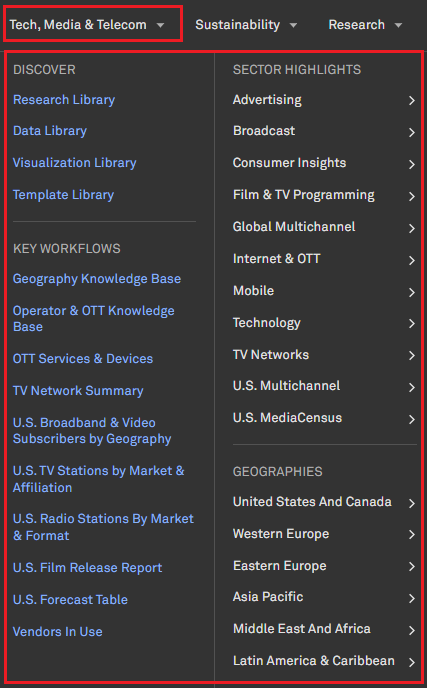

In this release, we introduced a new preview functionality on the Data Library page. This feature allows users to open a preview window within the existing screen, providing a glimpse of available interactive pages, visualization reports, or Excel file previews without redirecting from the page. Additionally, we added two new pages on the Corporate Profile, to provide a comprehensive and centralized view of a company's asset and operations portfolio. We also introduced a new MediaCensus research widget and added alerts to keep users updated on the latest developments within our MediaCensus offering. Finally, we expanded TMT (Tech, Media & Telecom) menu on the top navigation panel to include additional links for improved content discoverability.

Users can now preview multiple report types available in the Data Library directly within a pop-up window, including interactive pages, Excel spreadsheets, and visualization reports.

Find it in the platform:

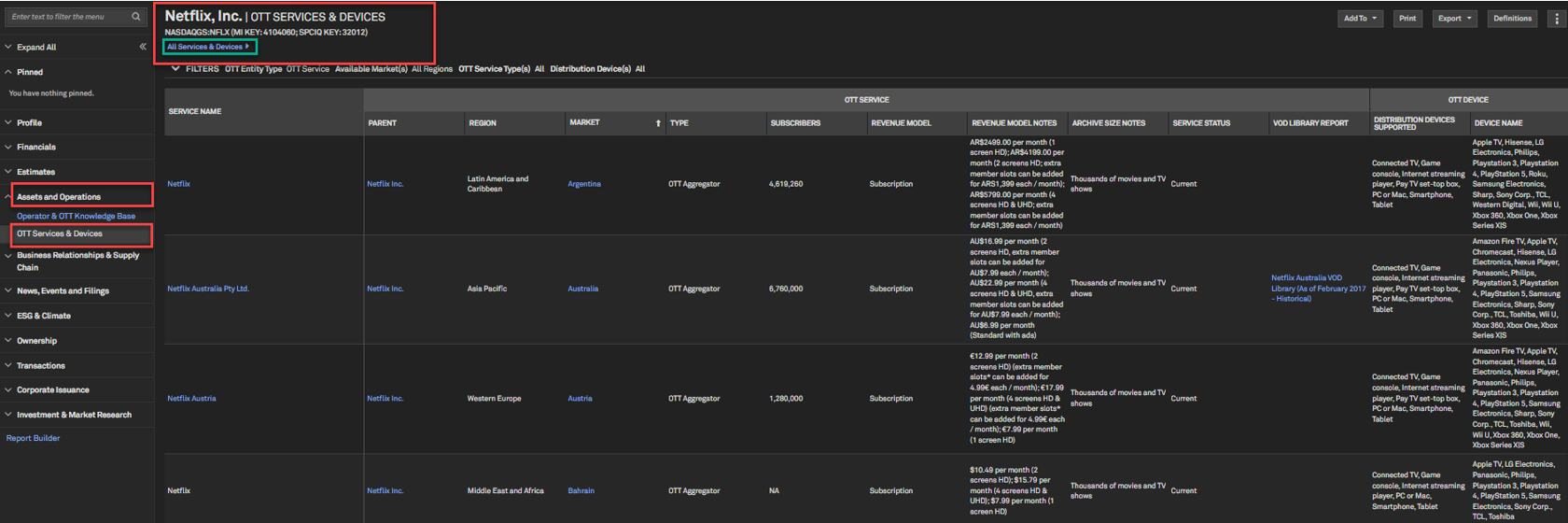

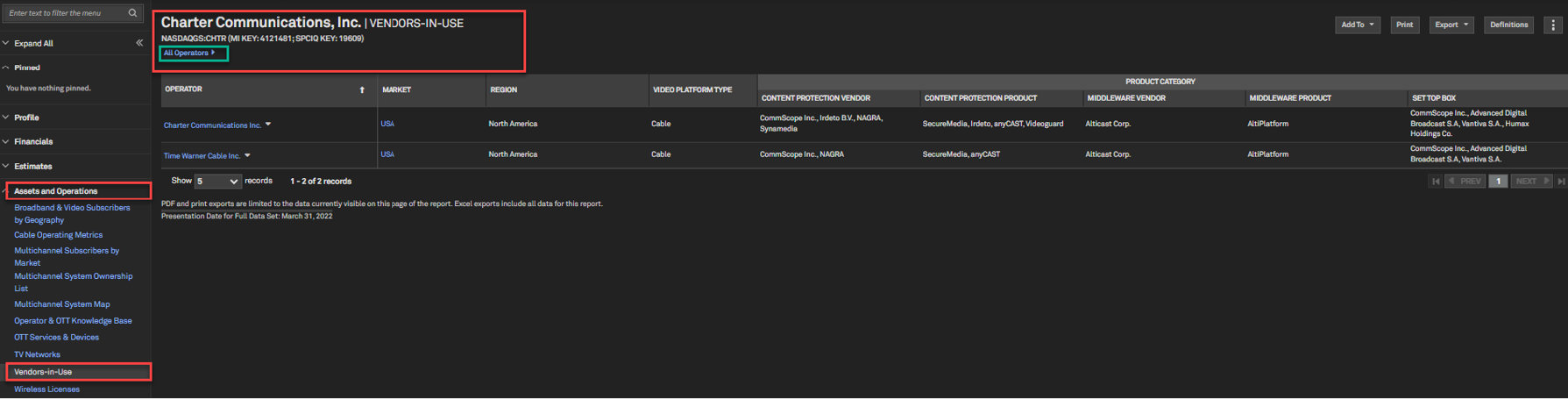

Users can access OTT Services & Devices dataset along with subscribers’ metrics by service type and Vendors-in-use dataset under the Assets and Operations section of a company's Corporate Profile page.

Find it in the platform:

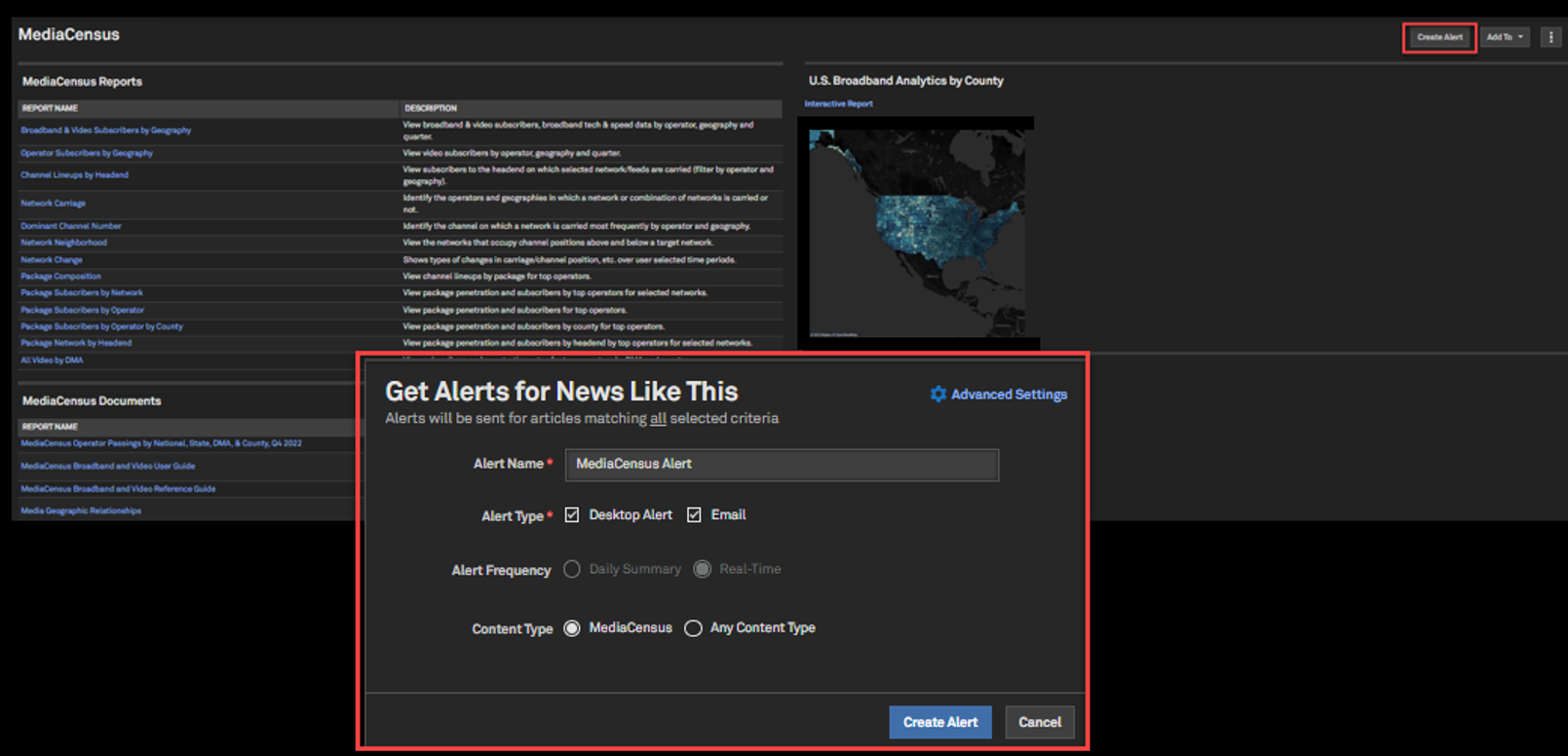

Users can access a new feature on the MediaCensus Homepage, enabling them to set up alerts and receive notifications on upcoming release dates, data updates and key insights.

Find it in the platform:

Users can access a new widget on the MediaCensus Homepage designed for our proprietary U.S. Broadband and Video data within the MediaCensus offering. This enhancement will allow users to efficiently find all related research articles, alerts, and notifications in one centralized location.

Find it in the platform:

Users can view a streamlined Tech, Media & Telecom (TMT) menu which consolidates all our coverage into a unified location. Additionally, we introduced two new sections under the TMT menu that features all Kagan research, proprietary datasets, visualizations, templates, and key workflow pages. This centralization enhances discoverability and simplifies access to TMT's proprietary data and research for users.

Find it in the platform:

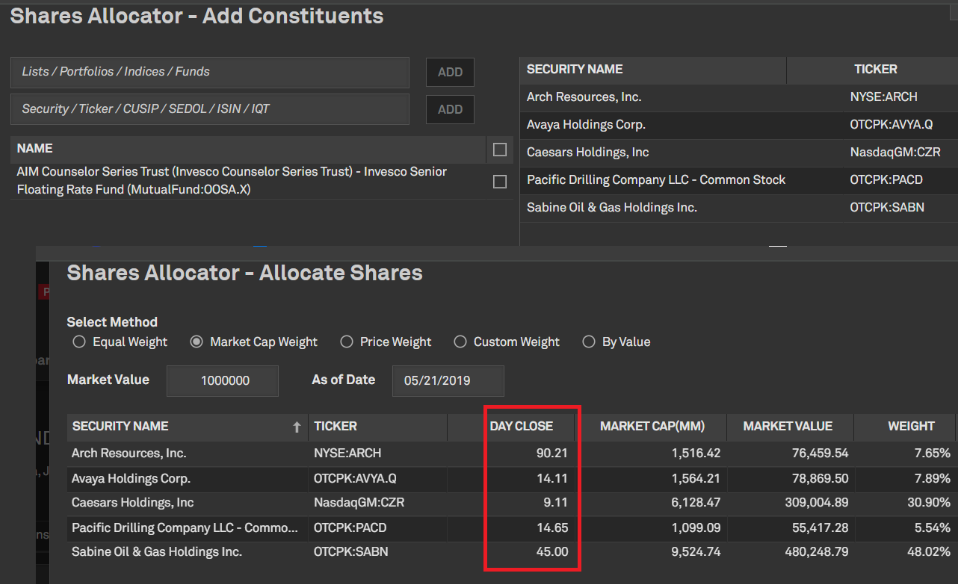

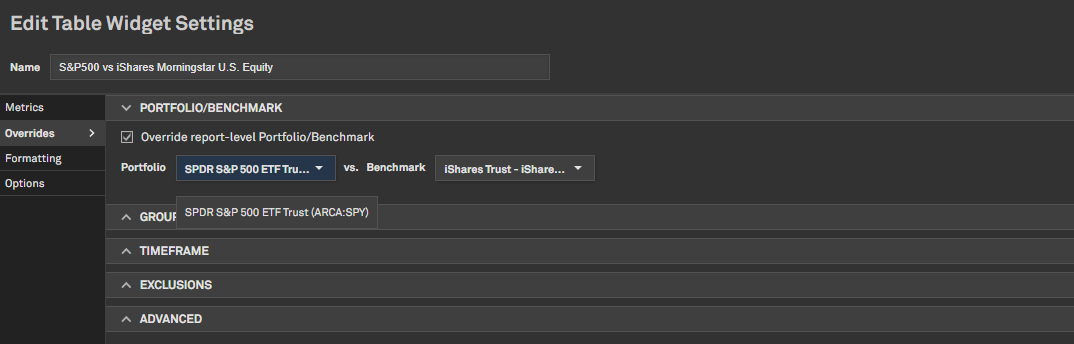

In this release, we expanded coverage for closed end mutual funds by offering Net Asset Value alongside day close price. We also expanded scenario analysis by including multiple portfolio and benchmark combinations within a single report for various 'What If' scenarios and made usability enhancements for portfolio creation and upload by providing a visual interactive guide in Portfolio Management section.

Users can view extended coverage for closed-end funds by using Net Asset Value (NAV) as pricing in their portfolios.

Find it in the platform:

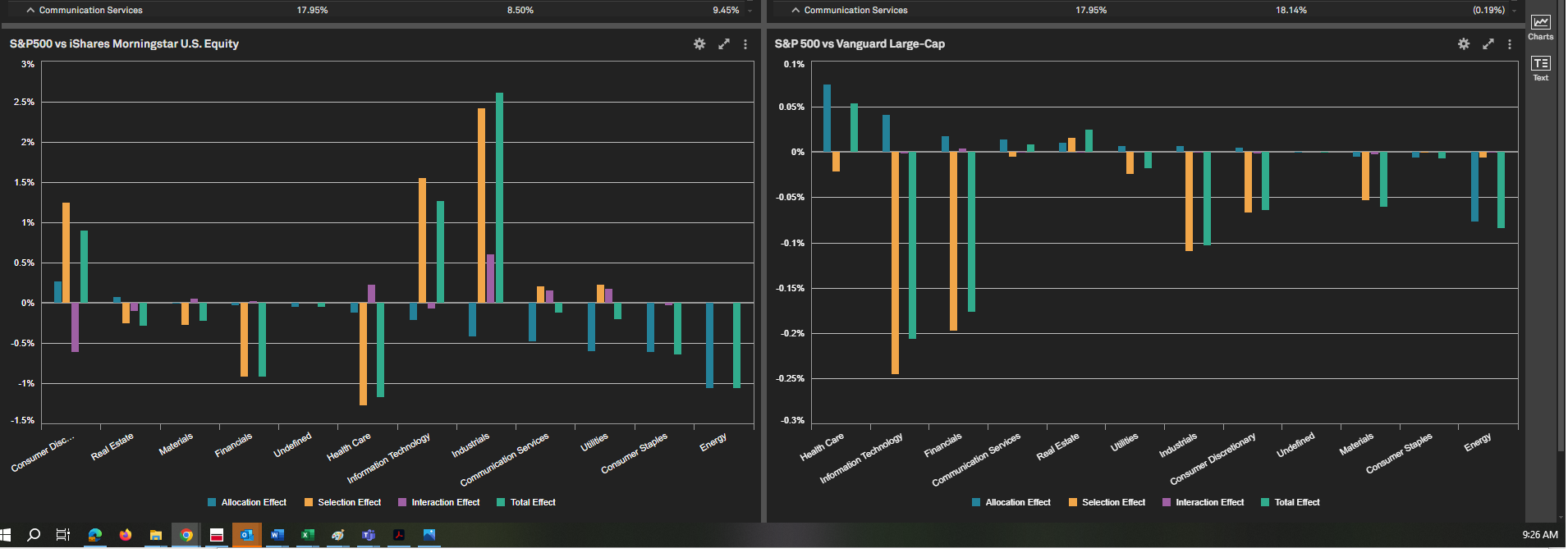

Users can conduct comprehensive comparisons with multiple portfolio and benchmark combinations, under different market conditions, in a single report. Portfolio Analytics enhances the depth of scenario analysis by testing against different indices, peer groups, exploring alternative asset allocation and attribution analysis.

Find it in the platform:

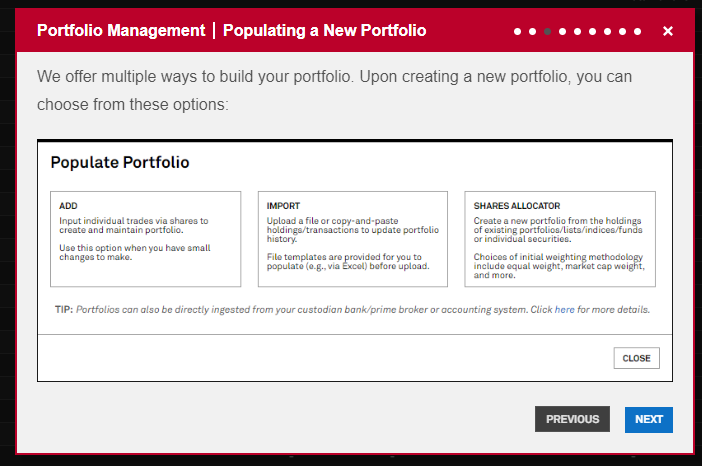

Users can access a new in-platform tour to learn how to populate portfolios via file uploads, copy, paste or use an existing list, portfolio, index, or fund.

Find it in the platform:

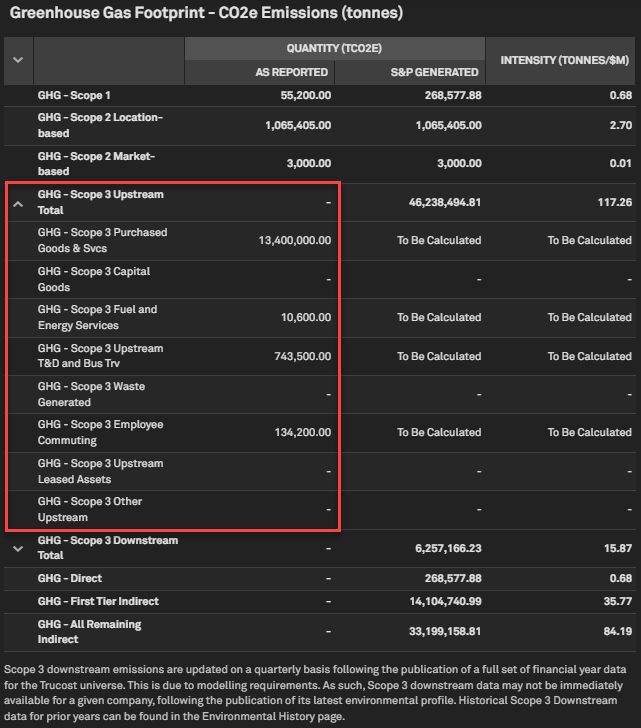

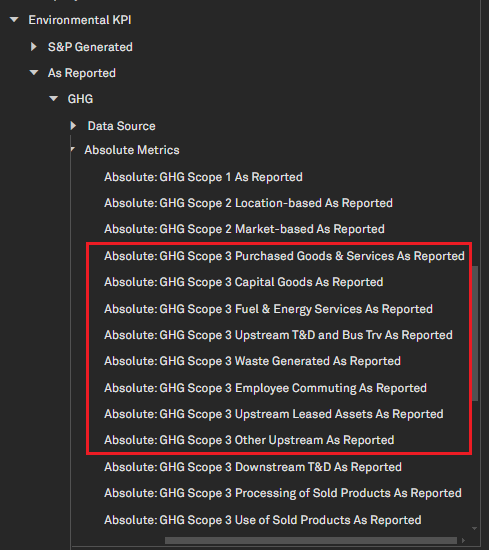

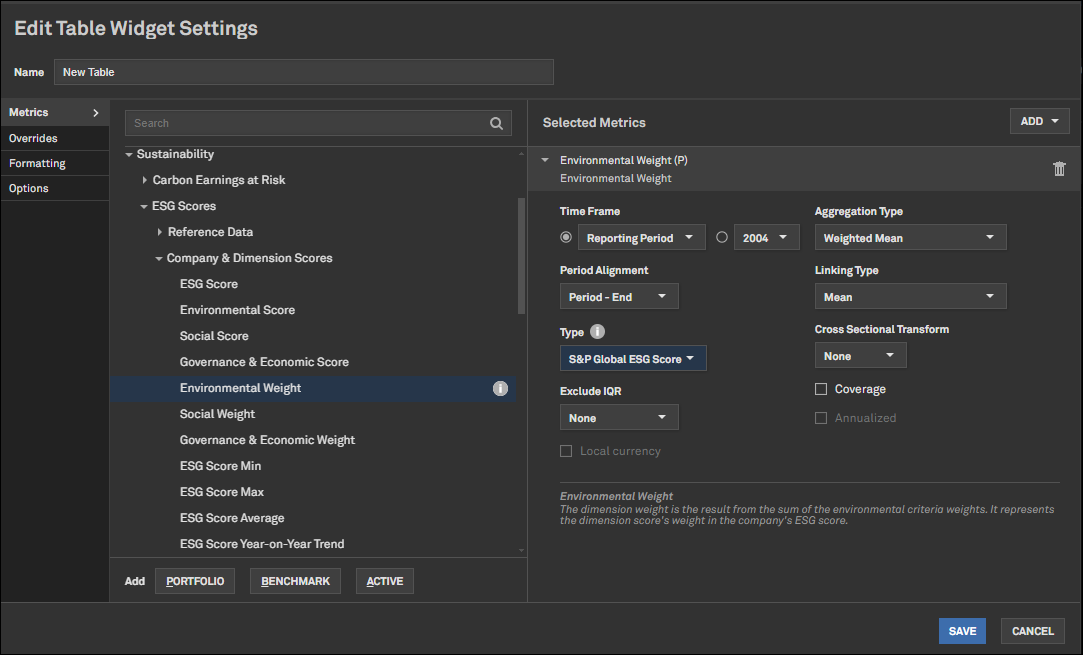

In this release, we introduced as-reported Scope 3 Upstream categories, offering granular insights into a company's Scope 3 emissions. We also added Year and Effective date dropdowns in the Net Zero Commitments tracker, and improved user experience on Nature Risk & Biodiversity and Sustainability Overview pages. We added new data points including as-reported Scope 3 Upstream categories, Nature & Biodiversity data, and Physical Risk Financial Impact fields in Screener, Capital IQ Pro Plug-in, and Dashboard. Within Portfolio Analytics, we added new Nature & Biodiversity metrics and Sustainable Investing metrics. Finally, we replaced the terminology ‘ESG’ with Sustainability to align with S&P Global's sustainability messaging and updated terminology used to describe assets within our Physical Risk product, ensuring the data remains current and valuable.

Users can access as-reported greenhouse gas (GHG) Scope 3 upstream categories in a company's Environmental pages, Screener, S&P Capital IQ Pro Plug-in, and Dashboard providing detailed Scope 3 emissions data and its concentration.

Find it in the platform:

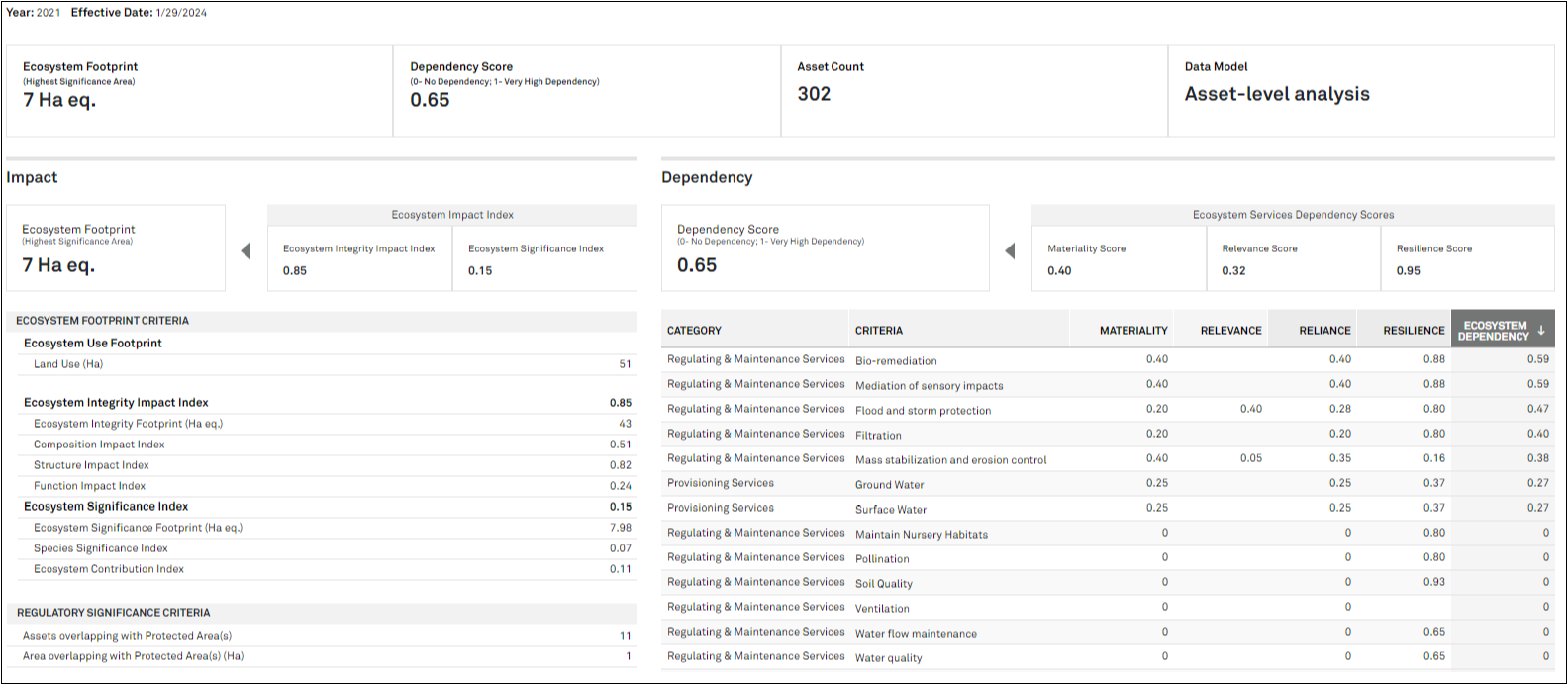

Users can now access the expanded fields on Nature & Biodiversity Risk company page, including Year and Effective Date dropdown for point-in-time analysis and global GICS sector averages for interpretation of headline impact, dependency metrics and peer comparison. Users can also view an asset’s latitude, longitude, overlap with Key Biodiversity Area flag, area overlapping with Key Biodiversity Area, overlap with Protected Area flag, and area overlapping with Protected Area. Additionally, users can view all assets associated with a company on a map, and can see metric definitions in tooltips.

Find it in the platform:

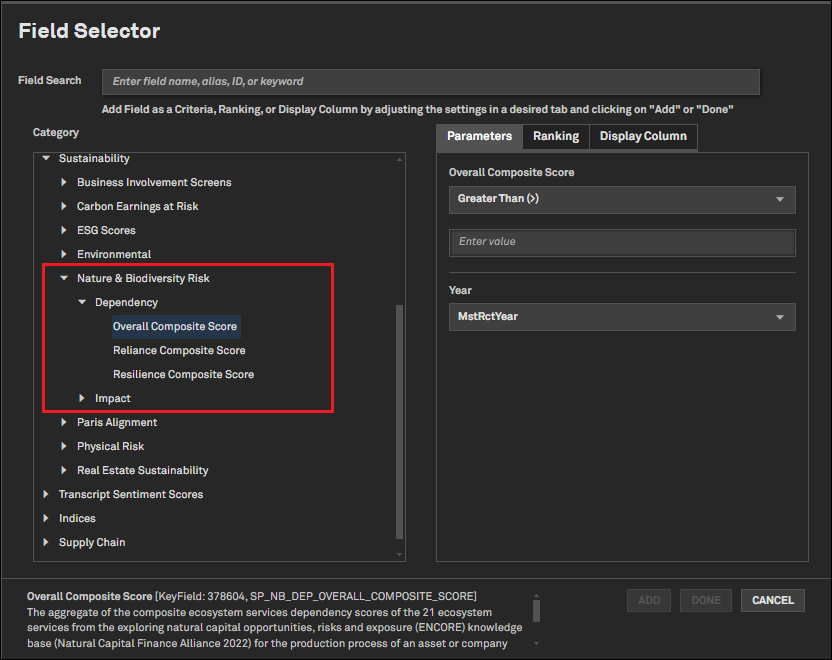

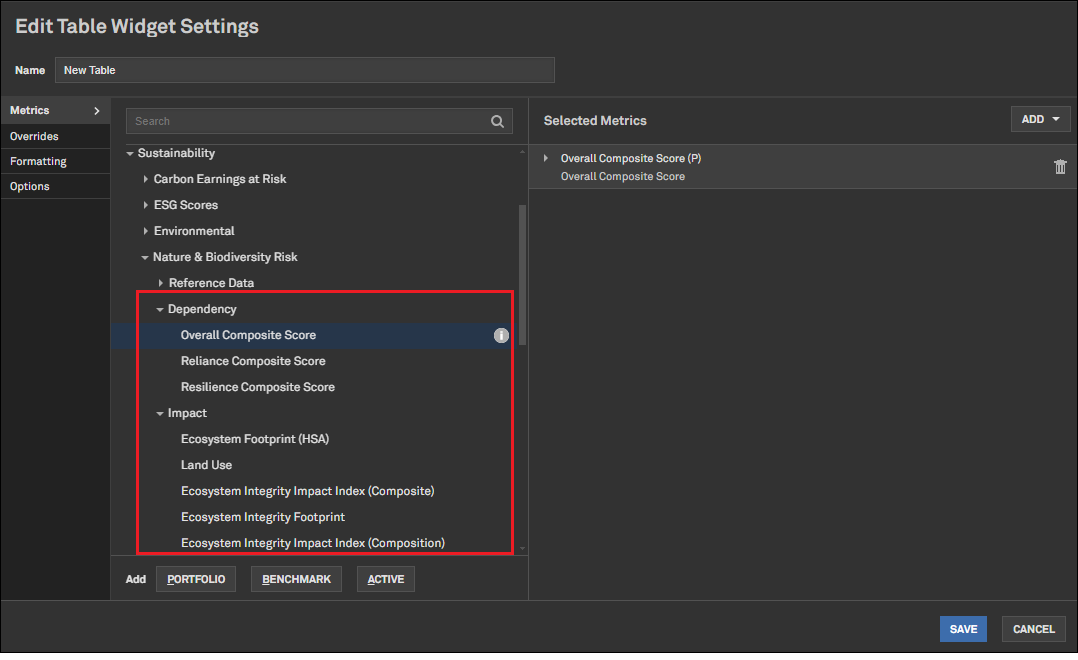

Users can access Nature & Biodiversity related metrics to understand, manage, and mitigate exposure of a list of companies or companies in your saved portfolios to nature-related risks and impacts within Screener, S&P Capital IQ Pro Plug-in and Portfolio Analytics. Users can access a set of core Ecosystem Footprint metrics to measure impact and use dependency scores to measure aggregated dependencies across a company’s direct operations. This dataset is aligned with the Taskforce on Nature-related Financial Disclosures (TNFD) LEAP approach, enabling users to leverage these metrics to measure alignment of companies of interest with TNFD recommendations.

Find it in the platform:

Note: Access to Nature & Biodiversity metrics in Portfolio Analytics requires an additional subscription , please contact your account team for details.

Users can access Year and Effective Date dropdowns in Net Zero Commitments Tracker, providing a point-in-time view for Net Zero data and an easy way to identify when the dataset was last updated for a company.

Find it in the platform:

Users can now screen for companies with targets or commitments for the longest term that meet their criteria with the addition of Net Zero Commitments Tracker. This will help them with target setting and comparing commitments across companies for their portfolio optimization.

Find it in the platform:

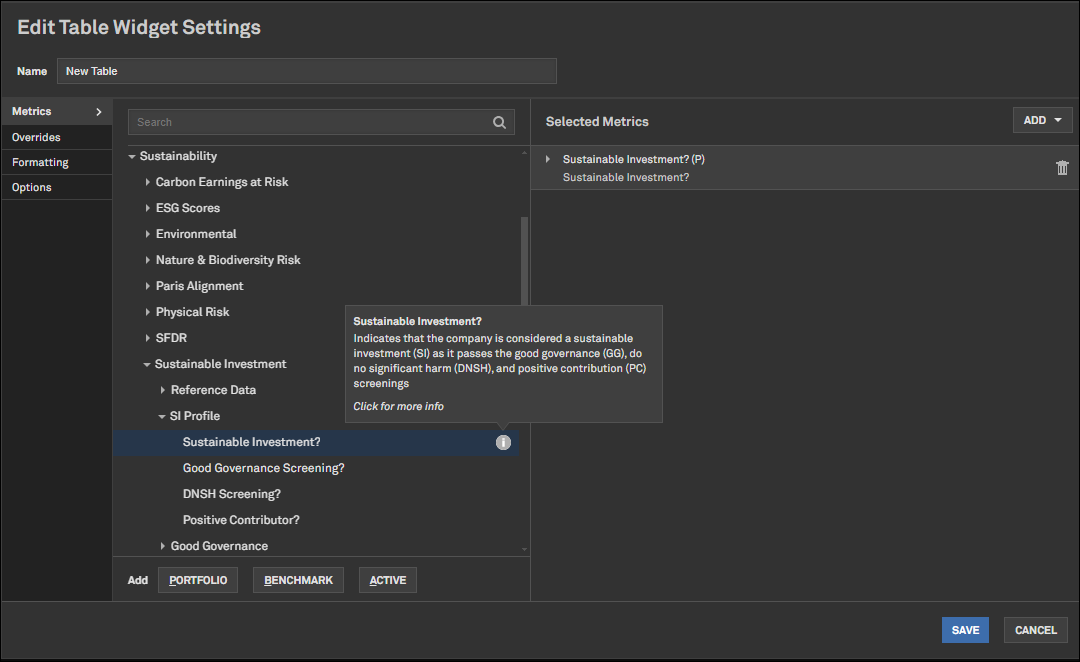

Users can assess sustainability of their portfolios according to the Sustainable Finance Disclosure Regulation (SFDR) definition of Sustainable Investment. With the introduction of Sustainable Investment Framework solution on Portfolio Analytics, users can conduct portfolio-level assessments and align their products with Markets in Financial Instruments Directive (MiFID II) and the SFDR regulations, incorporating sustainability considerations into investment decision-making. This empowers investors to make informed choices based on the sustainability profile of the products they invest in.

Find it in the platform:

Note: Access to Sustainable Investment Framework metrics in Portfolio Analytics requires entitlements, please contact your account team for details.

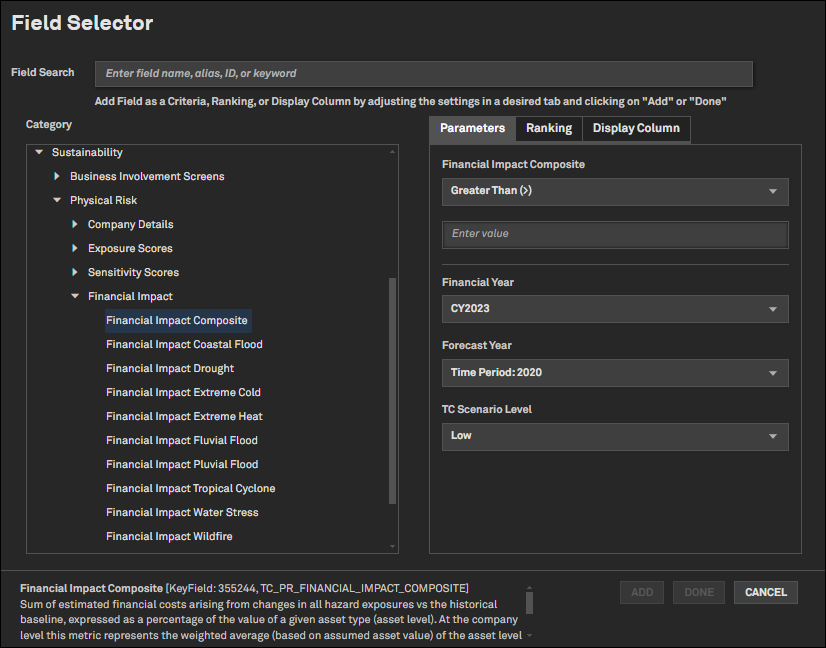

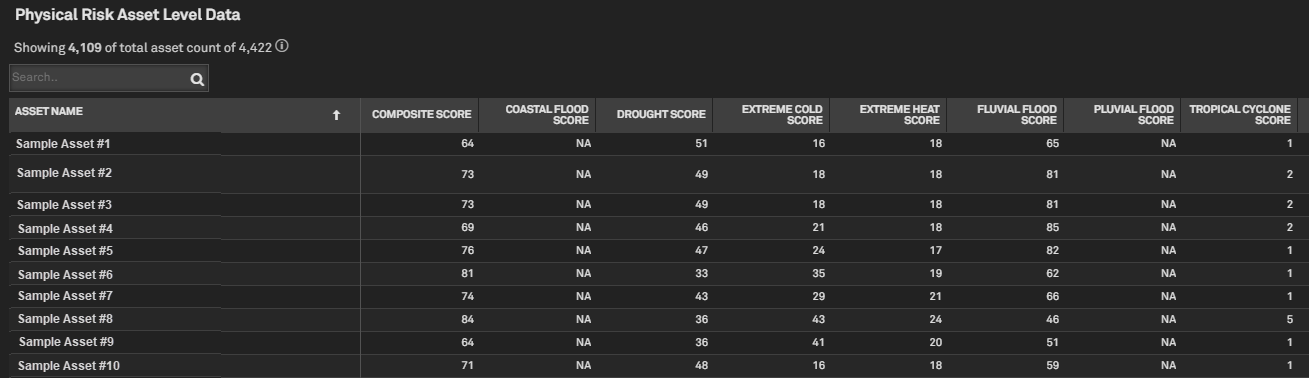

Users can screen for companies and access information related to financial losses from exposure to climate-related physical hazards across various climate change scenarios and multiple time horizons within Screener, S&P Capital IQ Pro Plug-in and Dashboard. These metrics continue to expand on our harmonized Physical Risk offering, providing users deeper granularity into a company’s exposure to physical risks that are related to climate change.

Find it in the platform:

Users can now access recalculated sensitivity scores based on 2023 data. Additionally, we refreshed existing assets to reflect new data, including ownership changes, and integrated additional assets sourced from both internal and external sources.

Find it in the platform:

Coverage stats:

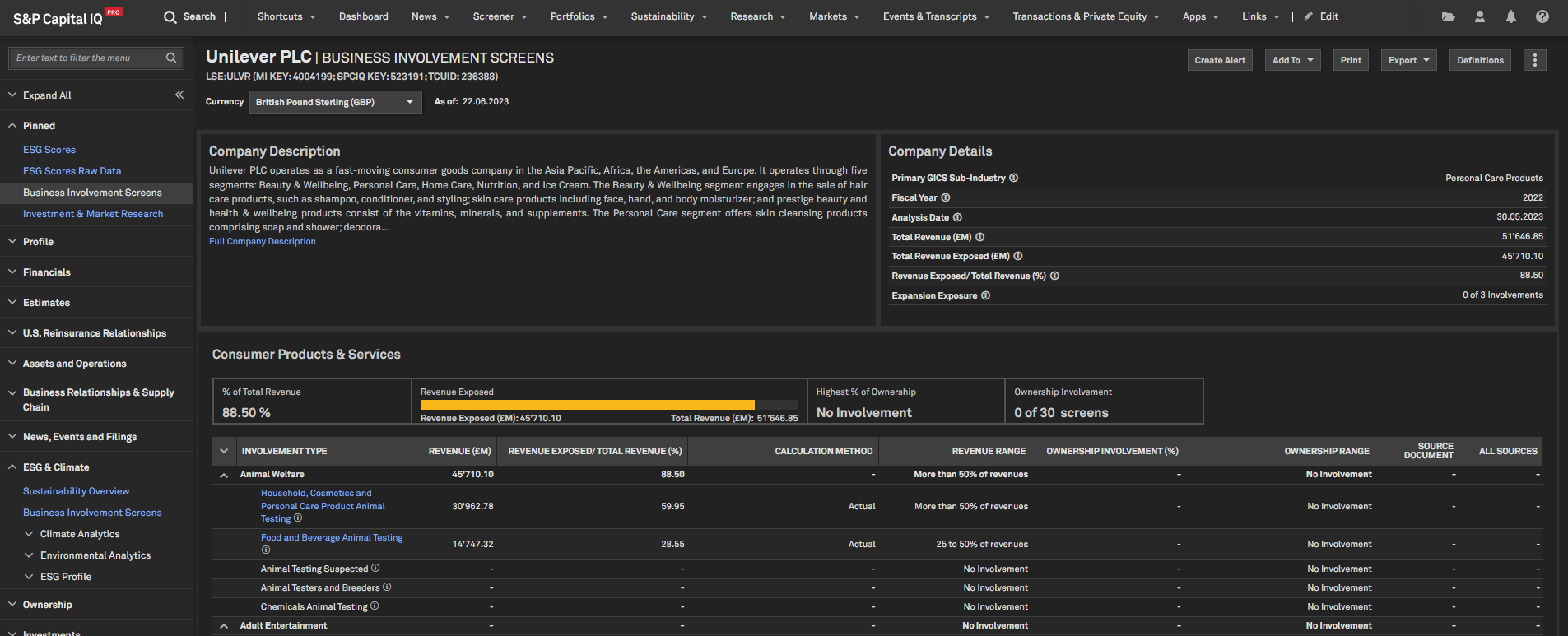

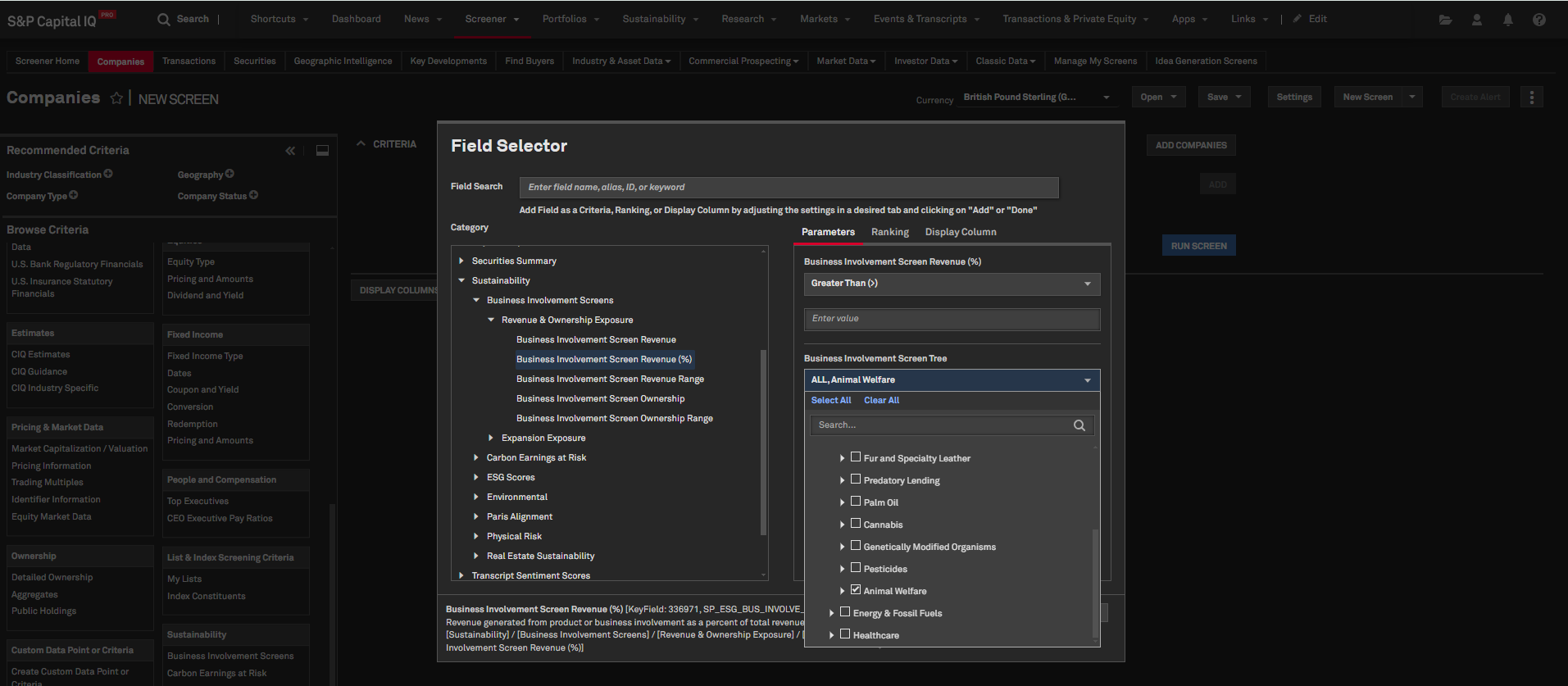

Users can access two new options for Business Involvement screens which relates to animal welfare and uranium mining. Users can review a company’s involvement in Animal Welfare, which is measured under the sub-categories of Animal Testers and Breeders, Chemicals Animal Testing, Food and Beverage Animal Testing, Household, Cosmetics and Personal Care, and Product Animal Testing.

A business involvement screen for uranium mining is measured for nuclear power generation.

Find it in the platform:

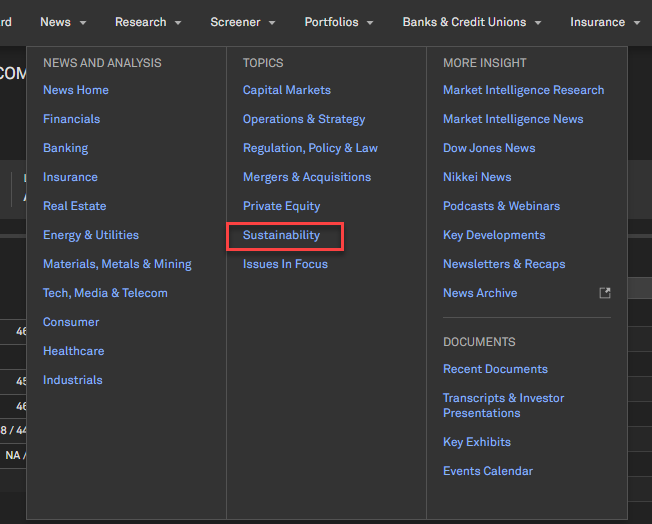

To align product & service taxonomy to S&P Global's sustainability messaging, we updated page navigation labels and drop-down options from ‘ESG’ to ‘Sustainability’ within News and updated ESG Score metric names and score type labels within Portfolio Analytics.

Find it in the platform:

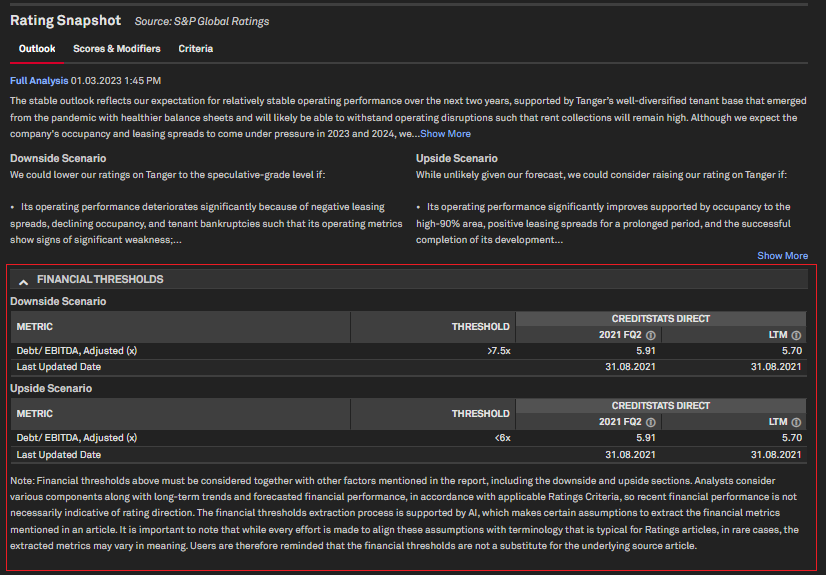

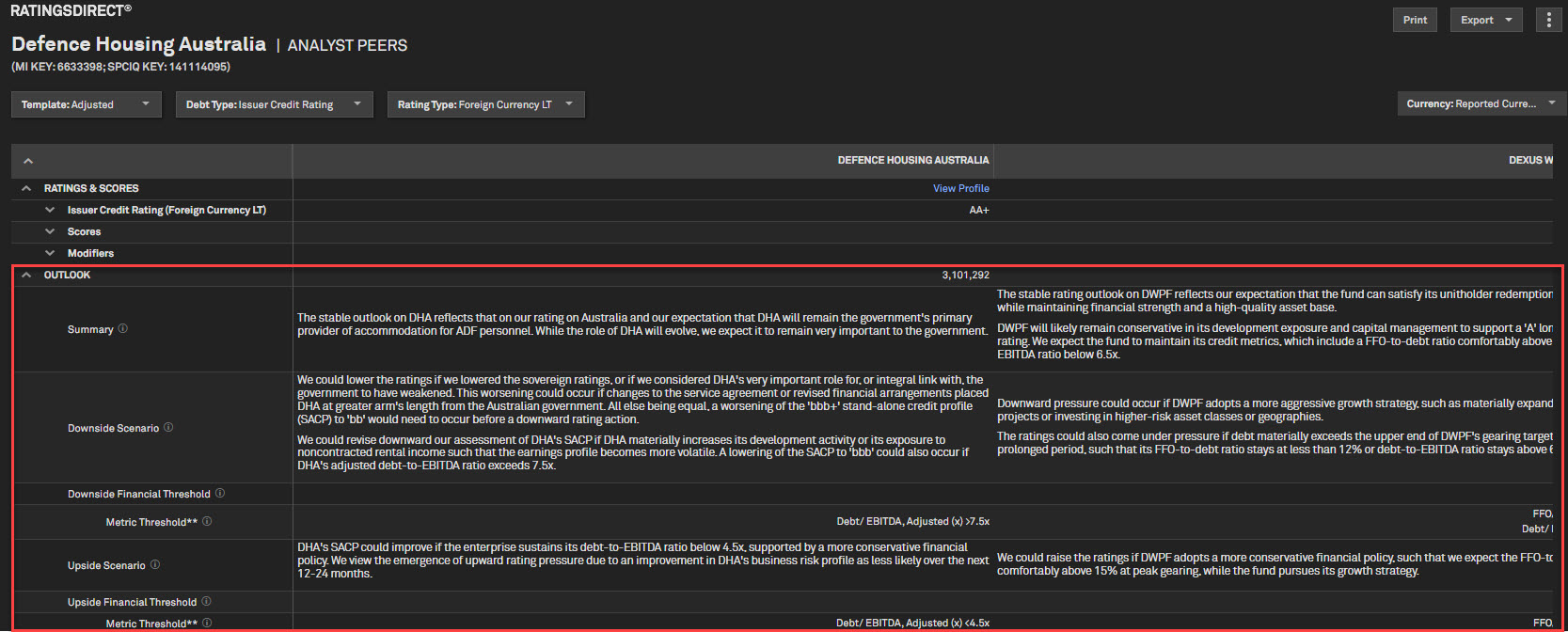

With this release, users of RatingsDirect® focused on Corporates, will benefit from the integration of Outlook Financial Thresholds, a concise one-page credit memo, and the Credit Default Swap source update to S&P Market Intelligence. U.S. Public Finance users can leverage the new U.S. State Ratings page, while Structured Finance users can access the full collateral universe with the complete list of collateralized issues.

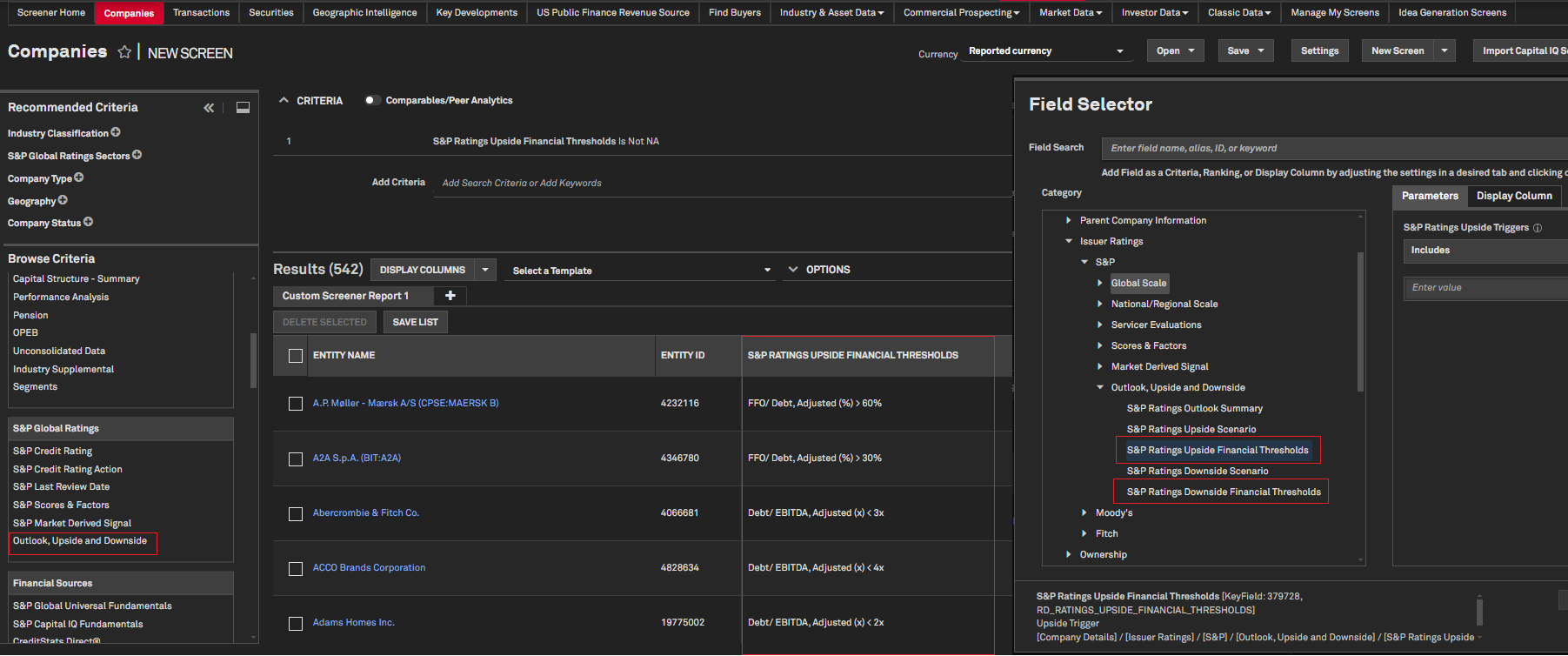

RatingsDirect® users can access Outlook Financial Thresholds on Corporate Profile, Analyst Peers page, Screener, and the S&P Capital IQ Pro Plug-in. Outlook Financial Thresholds are the key metrics and thresholds that can potentially lead to rating actions. With the help of Generative AI, the Outlook Financial Thresholds are extracted from the upside and downside scenarios of research articles for entities in the Corporate sector. Users no longer need to navigate through research reports to find these critical data points, but can leverage these triggers to effectively monitor the credit risk of one or more entities, for quicker informed decision-making.

Find it in the platform:

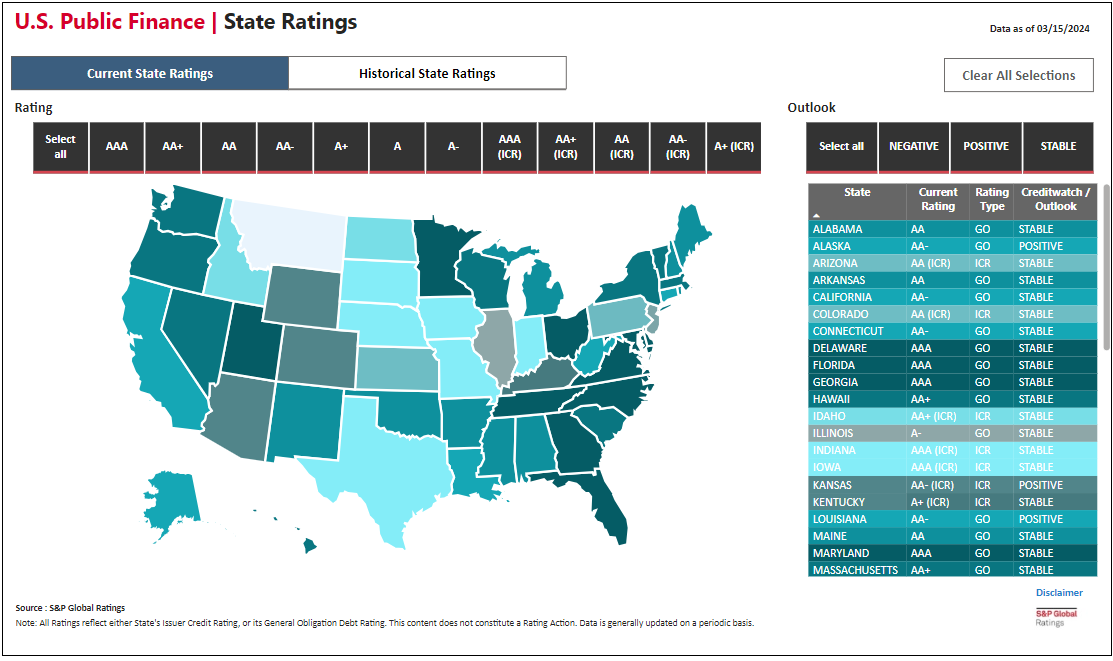

RatingsDirect® users interested in U.S. Public Finance can access a new page featuring an interactive map of the United States, displaying credit ratings of each state. The ratings are based on either the state's issuer credit rating or its general obligation debt rating. Users can interact with the map and filter by rating and outlook to gain valuable insights into the current ratings of U.S. states, across different regions of the country.

Find it in the platform:

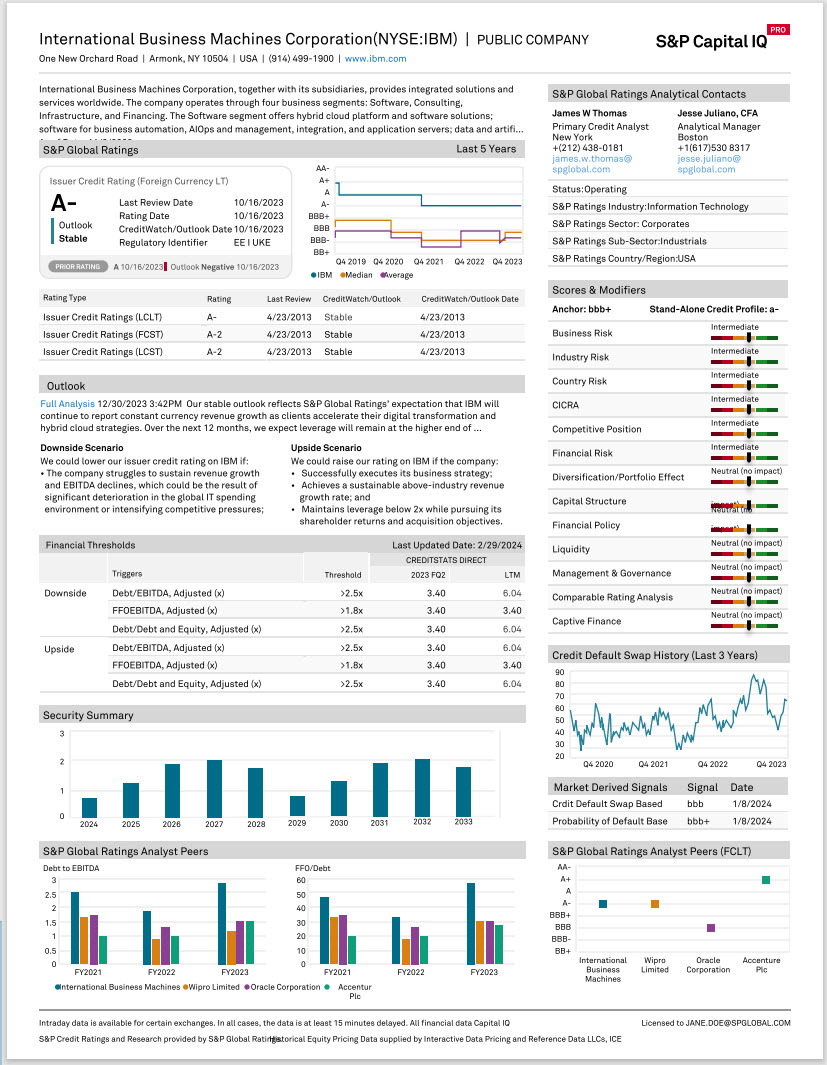

RatingsDirect® users can export a one-page credit tearsheet for Corporates, Financial Institutions, and Insurance entities directly from the Corporate Profile to get a quick snapshot of an entity's credit health. The credit memo provides an overview of key credit metrics for an entity, such as issuer credit ratings, outlook/upside/downside scenarios, scores & modifiers, outlook financial thresholds, analyst peers, and more.

Find it in the platform:

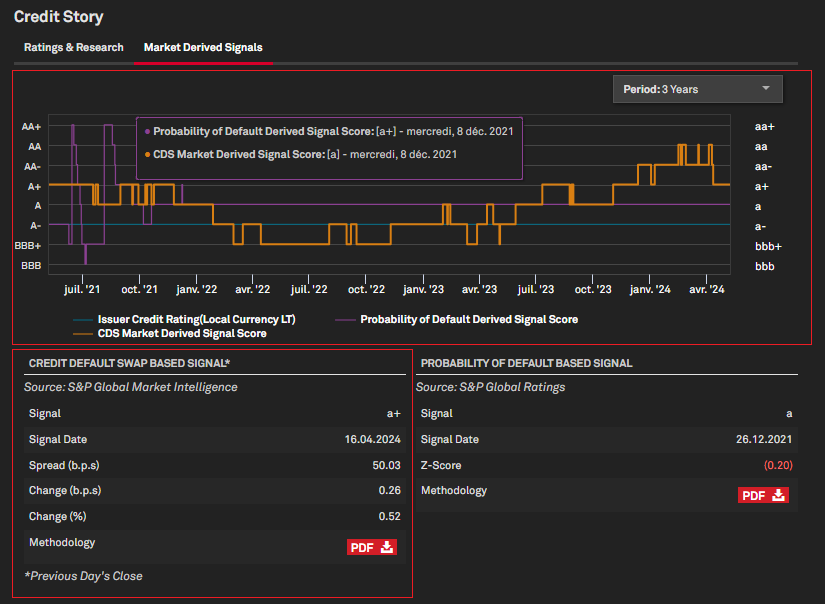

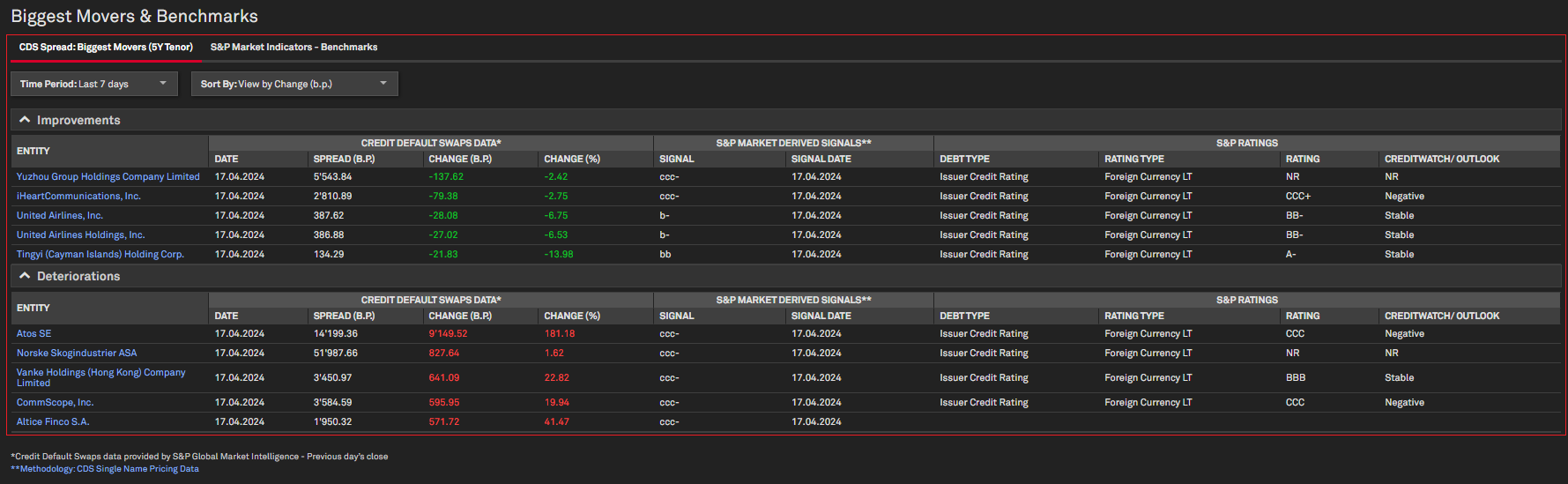

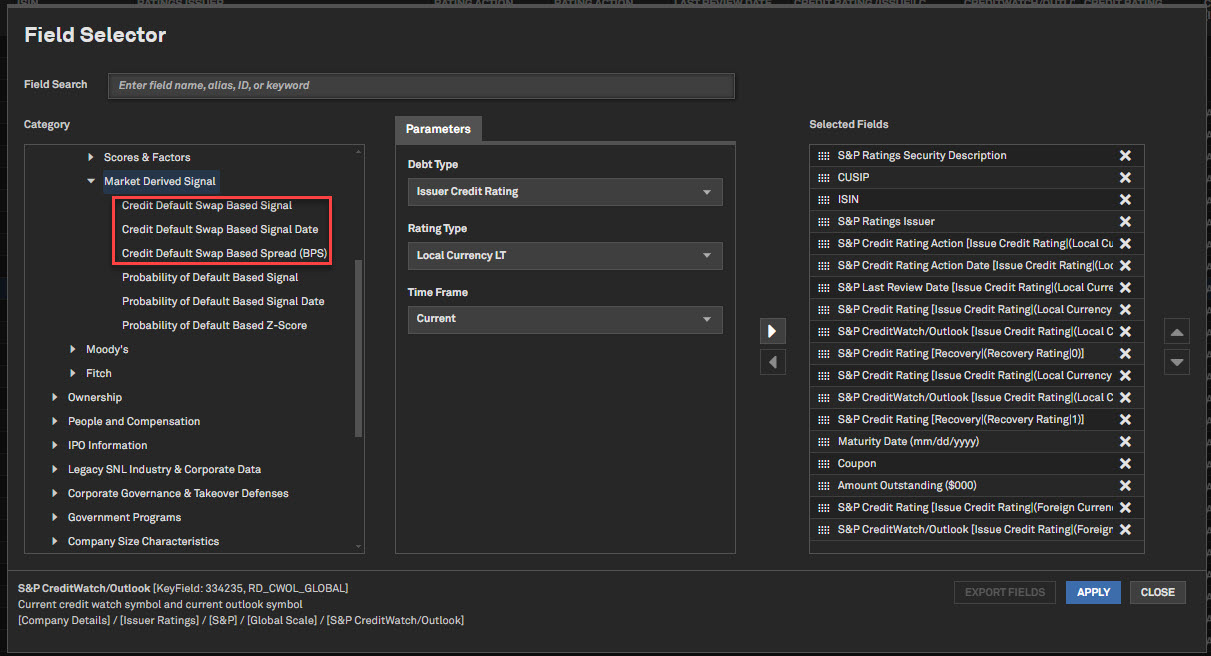

RatingsDirect® on Capital IQ Pro is updating the source of Credit Default Swaps (CDS) and market-derived signals to S&P Market Intelligence (Markit) pricing, valuation & reference data from ICE. This update will be reflected on the Corporate Profile, Sector Profile pages, Screener, Dashboard, and the S&P Capital IQ Pro Plug-in. The Corporate Profile now includes a chart that overlays Issuer Credit Ratings, CDS Market-Derived Signal Scores, and Probability of Default Derived Signal Score in one view.

The migration to S&P Market Intelligence (Markit) sourced CDS and market-derived signal data offers key benefits, including a larger universe of entities with a history dating back to 2010. Additionally, it leverages more composite pricing based on actual CDS pricing, as opposed to evaluated pricing derived from bond spreads. This enhancement ensures users have access to comprehensive and reliable CDS and market-derived signals data for informed decision-making.

Find it in the platform:

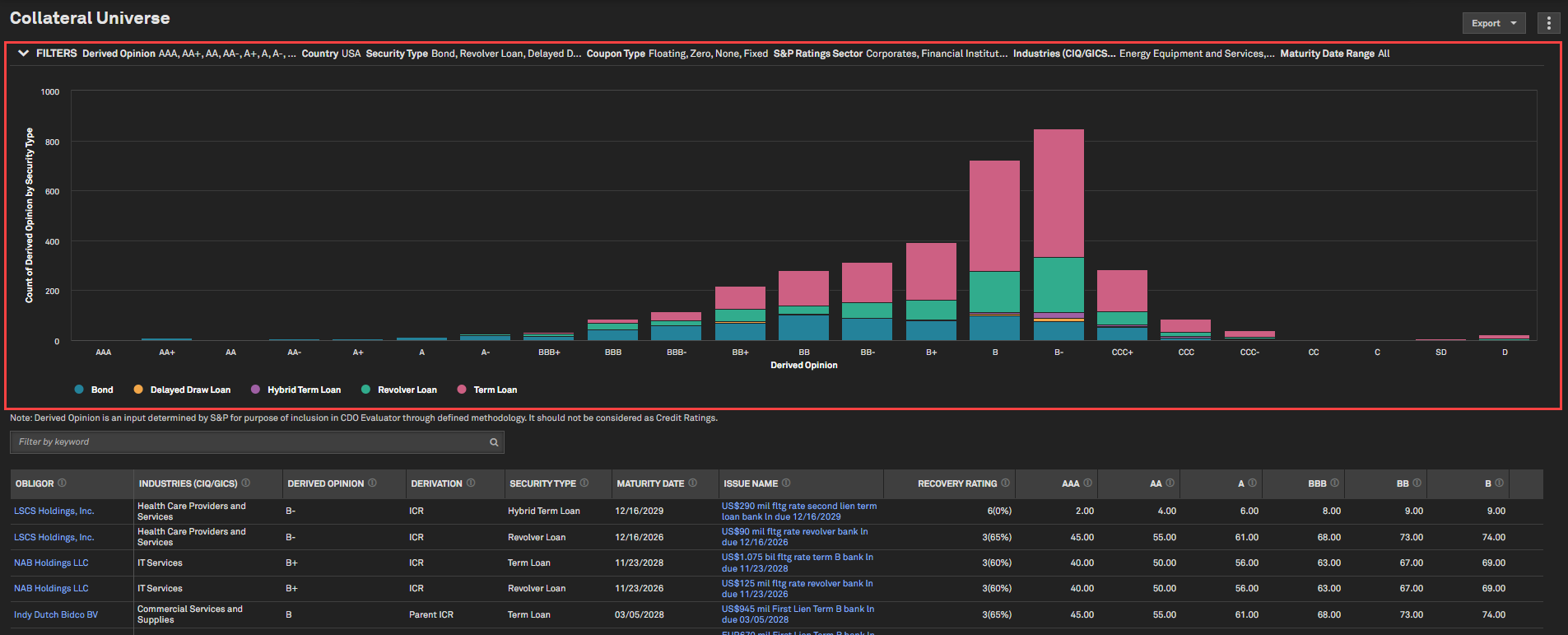

RatingsDirect® users with Structured Finance capabilities can access the universe of collateralized and uncollateralized S&P-rated corporate loans & bonds to gain visibility into the outstanding loans & bonds market that can be included in existing and future CLOs.

Find it in the platform:

Coverage stats:

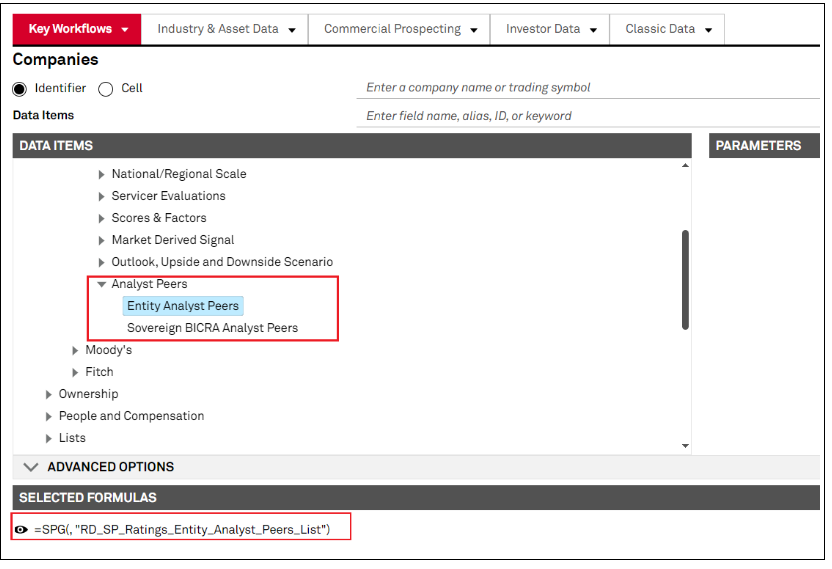

RatingsDirect® users can utilize S&P Capital IQ Pro plugin to import a list of S&P Ratings analyst peers for entities and Sovereign BICRA analyst peers for sovereigns to seamlessly compare entities and sovereigns against their peers in customized excel views.

Find it in the S&P Capital IQ Pro Plug-in:

Coverage stats:

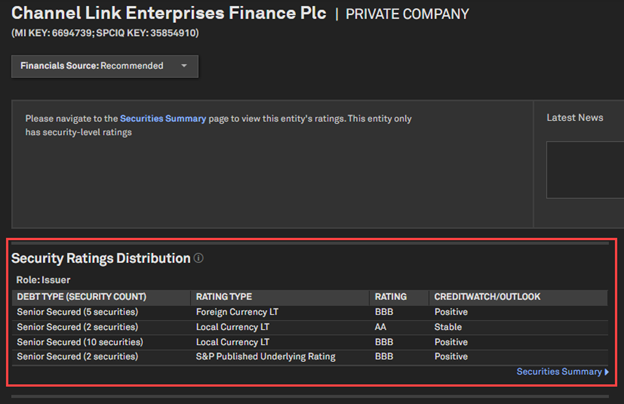

RatingsDirect® users can access Security Ratings Distribution for unrated entities with rated securities. Even if an entity does not have an issuer level rating, users can easily access the underlying rated debt from the entity profile. Security Ratings Distribution is a calculated aggregate count of securities by Debt Type, Rating Type, Rating, and CreditWatch/Outlook when the available ratings are only at the security level.

Find it in the platform:

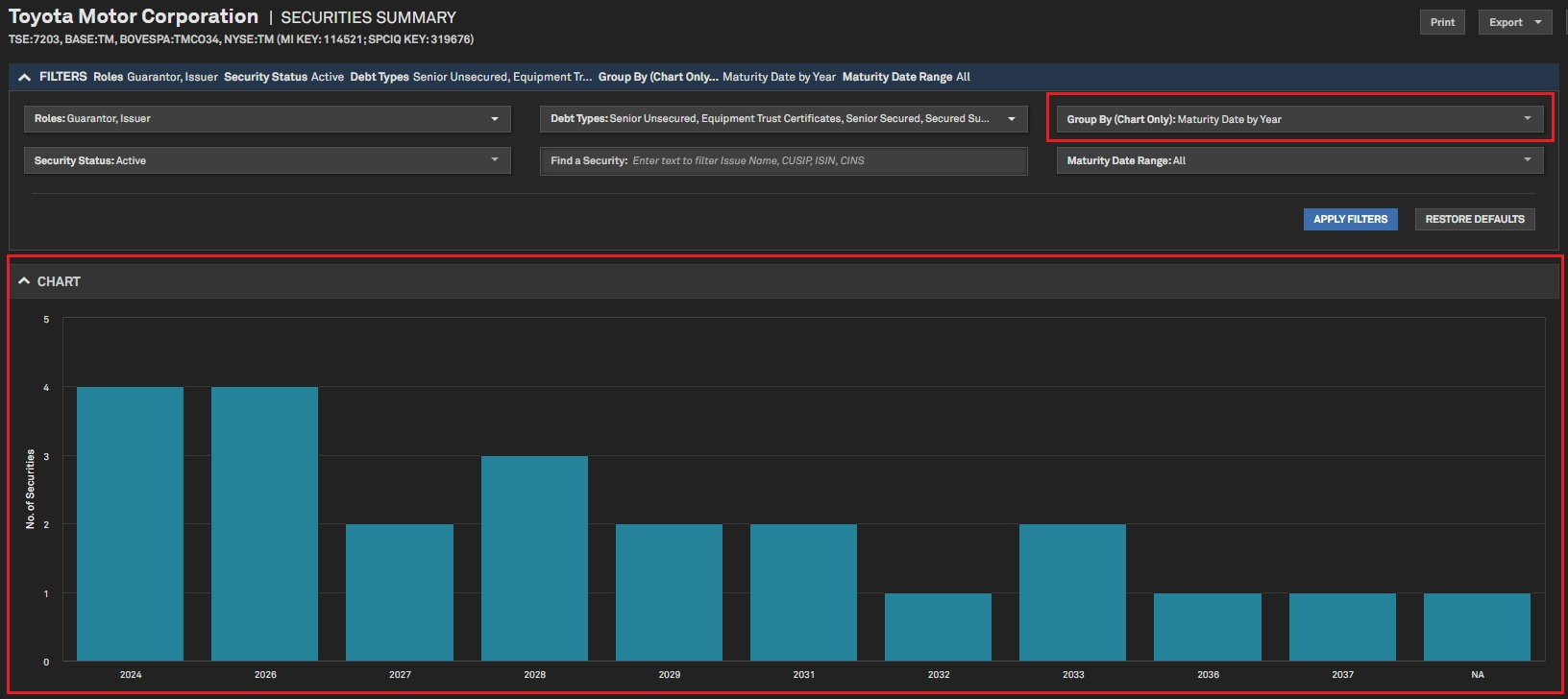

RatingsDirect® users can access an interactive security distribution chart on the Securities Summary page for an entity. This allows users to visualize how an entity’s debt is distributed by maturity date or debt type. The chart is interactive and updates the detailed security summary grid when clicked.

Find it in the platform:

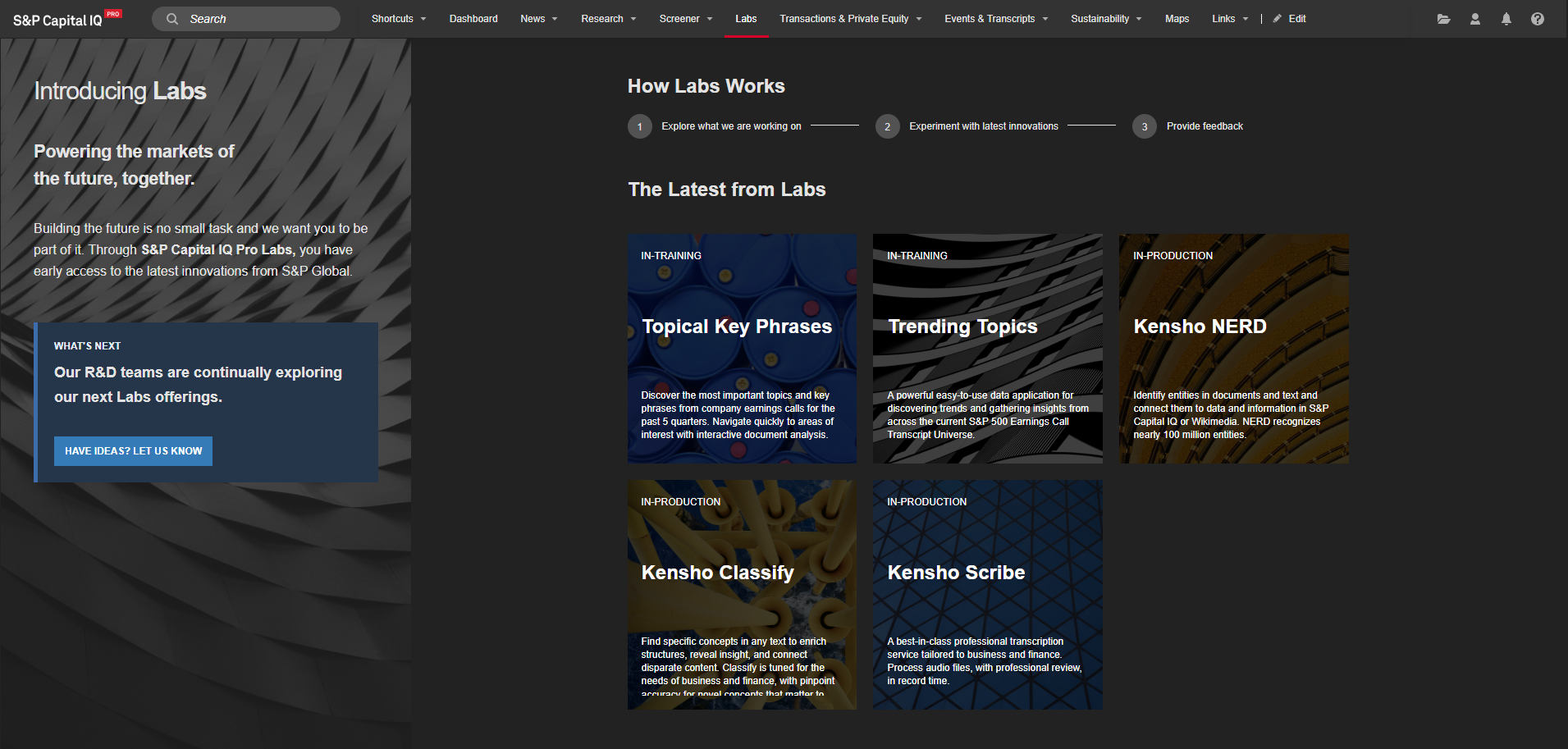

S&P Capital IQ Pro Labs is the new home of innovation within S&P Capital IQ Pro.

S&P Capital IQ Pro Labs enables collaboration with users on innovation initiatives for Capital IQ Pro and showcases beta applications and solutions allowing clients to explore, experiment, and provide feedback.

Find it in the platform:

In this release, we integrated more than 19.4 million Government, Supranational, Agency and Corporates (GSAC) securities from Markit across all fixed income pages and improved reference data granularity. Portfolio Analytics now includes sustainability analysis for private companies using proprietary data, expanded closed-end mutual funds coverage with NAV, and enhanced scenario analysis. Credit Analytics features streamlined workflows and enhanced data sets for better responsiveness and robust company credit assessments, including the updated RiskGauge Report.

Read June 2024 S&P Capital IQ Release Notes. Visit S&P Capital IQ for access.

Should you have any questions, please Contact Us.

The Marketplace Data & Solutions Communiqué reflects developments in the S&P Global Marketplace, your discovery tool for differentiated data and robust solutions with an integrated support site.

Data: Leverage premium fundamental and alternative datasets available seamlessly, along with expert analysis, to accelerate your journey from data to insight.

Solutions: Gain maximum value from your big data with technology solutions designed to enhance your workflow, increase your insights, and complement your datasets. Our solutions, including Snowflake, Kensho NERD, Xpressfeed, Xpressfeed Loader, and API Solutions, help you make the most of all your data.

If you wish to subscribe, sign up on the Communiqué Marketplace site.

In this release, we introduced a new personalized top menu for easier navigation, a new and reimagined Chart Builder with improved presentation creation and analytical capabilities, and enhanced our Investor Activism offering by launching a new market-level Activist Investor Ownership page and integrating the data in Screener. Additionally, we introduced a new Advisory & Underwriting Summary page to view the clients of financial and legal advisors in M&A and capital raising deals, integrated Nikkei News into alerts, enhanced our Search capabilities, expanded our APAC private companies coverage, and added industry-level content for Banks, Insurance, Real Estate, Energy, Metals & Mining, and TMT. Plus, so much more.